- United States

- /

- Basic Materials

- /

- NYSE:CRH

A Look at CRH (NYSE:CRH) Valuation After $300 Million Buyback and Board Appointment

Reviewed by Simply Wall St

If you’re keeping an eye on CRH (NYSE:CRH), the latest sequence of moves may have you rethinking your next step. The company has just announced a hefty share buyback program aiming to purchase as much as $300 million in stock by November 2025. In addition, CRH named Patrick Decker, an executive with a track record in industrial and water technology leadership, to its Board of Directors. Both actions indicate a focus on shareholder value and corporate oversight, leaving investors to consider what these decisions suggest about the company’s direction.

This news follows a series of positive signals for CRH throughout the past year. The stock has rallied 23% year-to-date and is sitting about 29% higher over the past year, with noticeable momentum over the past three months. Recent developments also include CRH raising its EBITDA and EPS outlook and reaching a new all-time high. Taken together, the combination of buybacks, board appointments, and sustained earnings growth has drawn market attention as CRH continues to generate strong returns.

This raises the question: Is CRH delivering real value for investors, or are markets already pricing in all of the positive news and future growth potential?

Most Popular Narrative: 5.8% Undervalued

According to the most widely followed valuation narrative, CRH's current share price is undervalued by nearly 6% based on consensus analyst expectations.

"Acceleration in sustainable construction and decarbonization is catalyzing large investments into eco-friendly materials, exemplified by the Eco Material Technologies acquisition. This uniquely positions CRH to capture higher-margin business from the rapidly expanding supplementary cementitious materials market, benefiting both top-line growth and net margins amid market shifts toward green building."

Want to know what’s fueling this premium outlook? Hidden behind the narrative are aggressive assumptions on how much CRH’s profits and revenues could expand, along with expectations for a future earnings multiple that might surprise you. Eager to discover which bold financial levers analysts are betting on to justify this higher price? Take a closer look at the numbers that are setting this target beyond current trading levels.

Result: Fair Value of $120.37 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, shifts in federal infrastructure funding or setbacks in CRH’s major acquisitions could quickly change this growth outlook for investors.

Find out about the key risks to this CRH narrative.Another View: Market Multiples Tell a Different Story

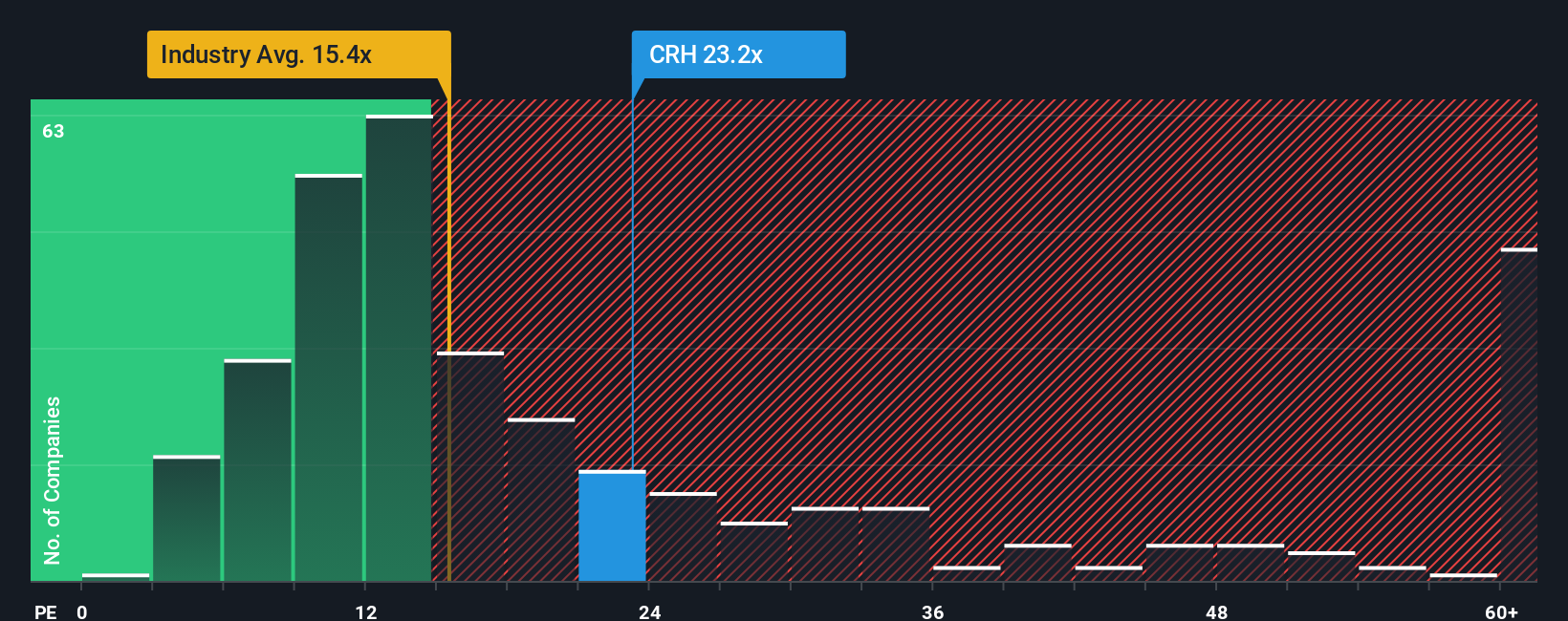

Looking at CRH from a different angle, market valuation ratios suggest the shares may actually be priced above the global industry average. This is the case even when considering what longer-term growth projections indicate. Which perspective should investors trust?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding CRH to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own CRH Narrative

If the existing narratives do not fully align with your outlook or you prefer a hands-on approach, you can easily craft your own analysis in just a few minutes, Do it your way.

A great starting point for your CRH research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors continually expand their horizons. Miss out and you could overlook the next big winner. Use the Simply Wall Street Screener to pinpoint stocks shaping tomorrow’s market.

- Uncover tomorrow’s tech leaders by tapping into AI penny stocks for standout opportunities in artificial intelligence innovation.

- Strengthen your portfolio with steady earners using dividend stocks with yields > 3% for companies paying attractive dividends above current market yields.

- Spot undervalued gems poised for a rebound by leveraging undervalued stocks based on cash flows and stay ahead of the pack.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CRH

CRH

Provides building materials solutions in Ireland, the United States, the United Kingdom, rest of Europe, and internationally.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives