- United States

- /

- Metals and Mining

- /

- NYSE:CMC

Commercial Metals (CMC): Evaluating Valuation as Shares Quietly Gain 3%

Reviewed by Simply Wall St

See our latest analysis for Commercial Metals.

Commercial Metals’ share price has quietly rallied over 20% so far this year, even as its one-year total shareholder return still lags slightly in negative territory. That mix of recent gains alongside a modest longer-term setback suggests momentum could be picking up, as investors weigh the company’s growth potential against earlier headwinds.

If this shift in sentiment has you curious about what else could be gaining traction, now is a great moment to broaden your focus and discover fast growing stocks with high insider ownership

With shares trading at a notable discount to analyst targets and a rebound underway, the question remains: is Commercial Metals undervalued, or is the market already reflecting all of its future growth potential?

Most Popular Narrative: 11.3% Undervalued

The most widely followed narrative points to Commercial Metals’ fair value at $66.85, notably above the latest close of $59.32. This sets the stage for a deeper look at ambitious growth plans and potential catalysts that might reshape market expectations.

CMC's strategic initiatives, particularly the Transform, Advance, and Grow (TAG) program, are projected to generate an additional $25 million in benefits over the rest of fiscal 2025 and promise further enhancements in the coming years. These improvements are likely to permanently improve margins and increase earnings.

Want to know what powers this bullish view? The forecast leans on bold assumptions about expansion projects and margin transformation, backed by analyst conviction. The real surprise? It is not just about sales growth. Unpack the strategy behind the price jump and see what unique financial levers set this narrative apart.

Result: Fair Value of $66.85 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, economic uncertainty and setbacks in new project awards could challenge Commercial Metals’ earnings outlook. These factors could potentially reverse some of the recent optimism.

Find out about the key risks to this Commercial Metals narrative.

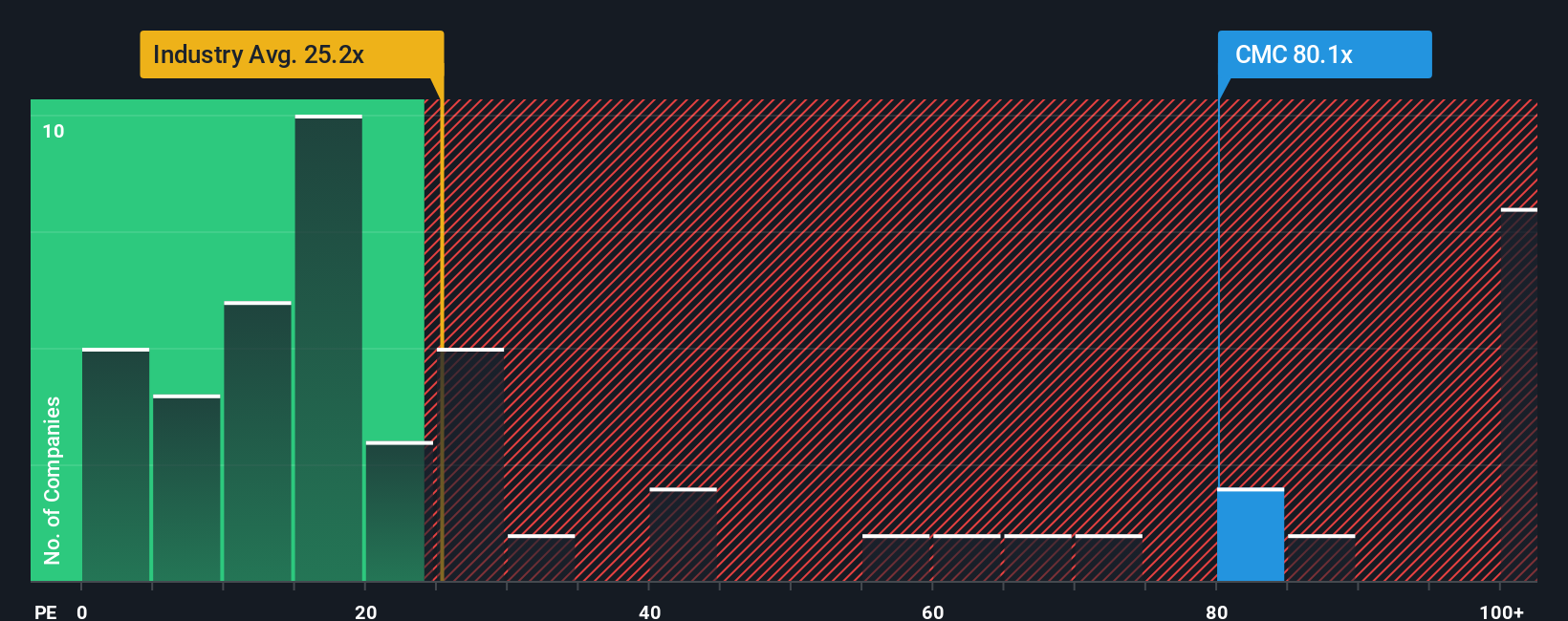

Another View: Multiples Tell a Different Story

Looking at Commercial Metals through a price-to-earnings lens, a different picture emerges. The company is trading at 77.8 times earnings, which is much higher than both the US Metals and Mining industry average of 21.2x and the peer group average of 43.7x. The fair ratio, based on market trends, is estimated at 31.4x. This sizable gap suggests investors may be paying a hefty premium right now compared to what fundamentals alone would support. Is this justified by future prospects, or is the risk of a valuation reset rising?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Commercial Metals Narrative

If you see things differently, or want to dive deeper into the numbers yourself, it only takes a few minutes to build your own perspective. Do it your way

A great starting point for your Commercial Metals research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Make the most of today’s market by acting now. Hundreds of other investors are gaining an edge by researching unique opportunities you might be overlooking.

- Start earning more passive income and grow your portfolio with these 16 dividend stocks with yields > 3% delivering yields above 3%.

- Capitalize on next-generation breakthroughs shaping tomorrow’s industries by reviewing these 26 AI penny stocks which are set to reshape how we live and work.

- Take advantage of undervalued gems right now through these 926 undervalued stocks based on cash flows before the wider market catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CMC

Commercial Metals

Manufactures, recycles, and fabricates steel and metal products, and related materials and services in the United States, Poland, China, and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives