- United States

- /

- Metals and Mining

- /

- NYSE:CLF

Cleveland-Cliffs (CLF): Analyzing Valuation After Supply Deal Extension and Board Appointment

Reviewed by Simply Wall St

Cleveland-Cliffs recently announced a three-year supply extension deal with SunCoke Energy, along with the addition of Edilson Camara to its Board of Directors. These moves highlight a focus on operational stability and leadership strength.

See our latest analysis for Cleveland-Cliffs.

Steel stocks have been volatile this year, but Cleveland-Cliffs has rallied after news of its renewed supply deal and new board appointment. This signals that investors see potential for improved stability. The company’s share price is up 32.5% year-to-date, though its 1-year total shareholder return of 4.1% lags the broader market. Long-term gains remain muted, suggesting momentum has picked up recently but uncertainty remains.

If you’re curious where else positive momentum or operational shifts are fueling opportunity, now’s the ideal moment to discover fast growing stocks with high insider ownership

With shares surging yet analysts growing more cautious, the key question for investors is whether Cleveland-Cliffs is trading below its intrinsic value or if the market is already factoring in any upside. Could this be a real buying opportunity?

Most Popular Narrative: Fairly Valued

Cleveland-Cliffs closed at $12.64, while the narrative’s fair value estimate is $12.58. This creates a razor-thin gap, setting the stage for debate on which catalysts might tip the balance in the coming quarters.

Strategic footprint optimization, internal coke and feedstock integration, and direct moves to lower fixed costs and SG&A have already resulted in unit cost reductions. Ongoing initiatives are expected to deliver further cost savings. These efforts may help enhance free cash flow, reduce leverage, and support a structurally higher earnings profile through improved operating margins.

The most closely watched numbers are still beneath the surface. Behind the fair value lies an ambitious forecast for profit growth, margin improvement, and a future multiple that could shake up industry expectations. Want to see the assumptions that analysts are betting on for Cleveland-Cliffs’s next chapter? Don’t miss the full breakdown.

Result: Fair Value of $12.58 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, such as potential changes to steel tariffs or a shifting automotive landscape. These factors could quickly alter the current valuation outlook.

Find out about the key risks to this Cleveland-Cliffs narrative.

Another View: Is the Market Missing Something?

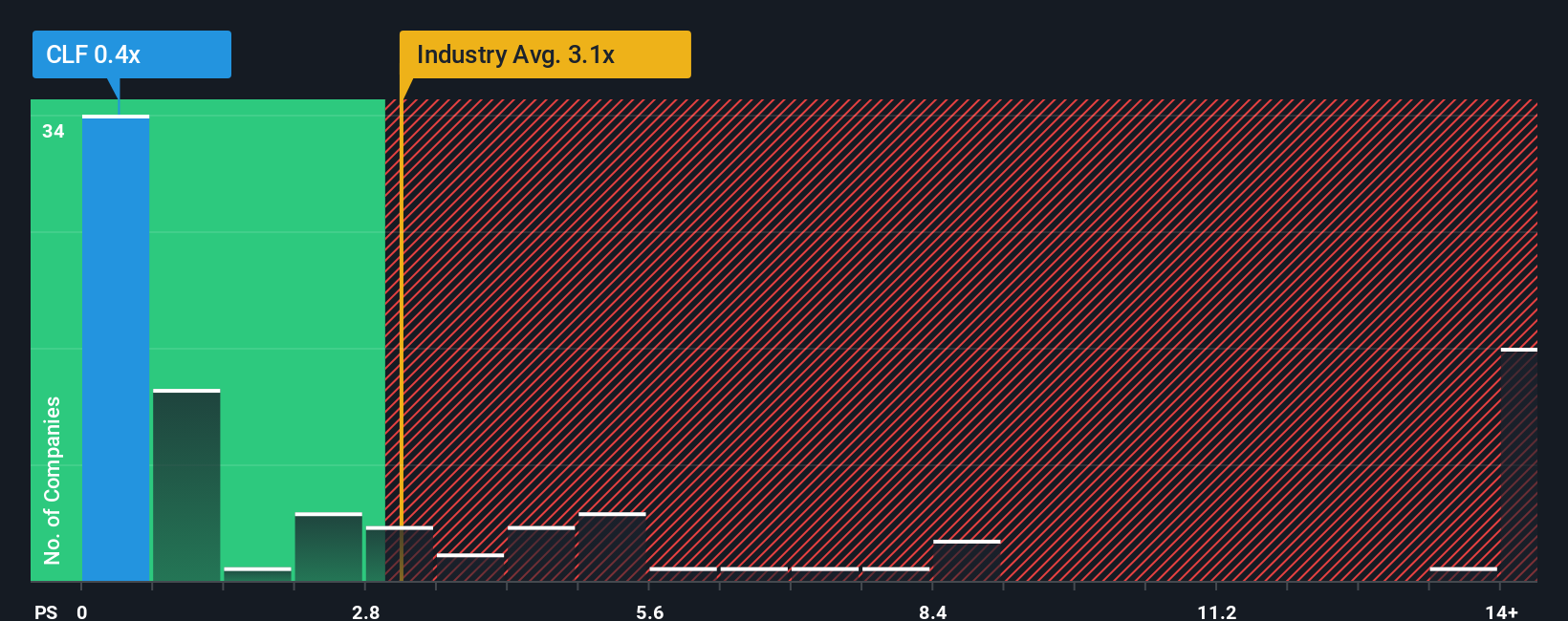

While fair value estimates and analyst targets suggest Cleveland-Cliffs is priced about right, a look at its price-to-sales ratio tells a different story. The company's ratio of 0.4x is far lower than both its industry peers (2.1x) and the fair ratio of 0.6x. This hints at possible undervaluation. Does the market see too much risk, or is there a hidden opportunity for patient investors?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Cleveland-Cliffs Narrative

If you have a different take on the numbers or want to dig into the details yourself, it’s easy to shape your own view in just a few minutes. Do it your way.

A great starting point for your Cleveland-Cliffs research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

True investing success comes from acting on the best opportunities. Don’t limit your focus to just one stock when there’s a world of possibilities available.

- Unlock potential growth by examining these 926 undervalued stocks based on cash flows and see which companies are trading below their intrinsic worth right now.

- Pounce on yield by checking out these 15 dividend stocks with yields > 3% offering attractive returns above 3% for income-focused investors.

- Seize the future of technology and innovation through these 25 AI penny stocks leading advancements in artificial intelligence-driven industries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CLF

Cleveland-Cliffs

Operates as a flat-rolled steel producer in the United States, Canada, and internationally.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success