- United States

- /

- Chemicals

- /

- NYSE:ENFY

China Green Agriculture, Inc.'s (NYSE:CGA) Share Price Boosted 33% But Its Business Prospects Need A Lift Too

The China Green Agriculture, Inc. (NYSE:CGA) share price has done very well over the last month, posting an excellent gain of 33%. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 30% in the last twelve months.

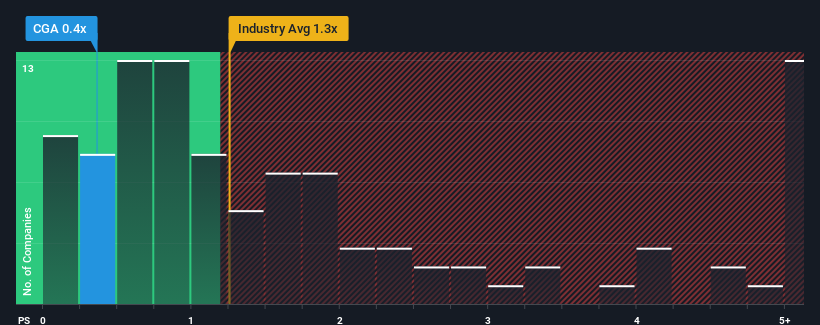

Although its price has surged higher, considering around half the companies operating in the United States' Chemicals industry have price-to-sales ratios (or "P/S") above 1.3x, you may still consider China Green Agriculture as an solid investment opportunity with its 0.4x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for China Green Agriculture

How Has China Green Agriculture Performed Recently?

For instance, China Green Agriculture's receding revenue in recent times would have to be some food for thought. Perhaps the market believes the recent revenue performance isn't good enough to keep up the industry, causing the P/S ratio to suffer. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on China Green Agriculture will help you shine a light on its historical performance.Do Revenue Forecasts Match The Low P/S Ratio?

China Green Agriculture's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Retrospectively, the last year delivered a frustrating 24% decrease to the company's top line. The last three years don't look nice either as the company has shrunk revenue by 44% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 6.3% shows it's an unpleasant look.

With this information, we are not surprised that China Green Agriculture is trading at a P/S lower than the industry. However, we think shrinking revenues are unlikely to lead to a stable P/S over the longer term, which could set up shareholders for future disappointment. Even just maintaining these prices could be difficult to achieve as recent revenue trends are already weighing down the shares.

What Does China Green Agriculture's P/S Mean For Investors?

The latest share price surge wasn't enough to lift China Green Agriculture's P/S close to the industry median. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of China Green Agriculture revealed its shrinking revenue over the medium-term is contributing to its low P/S, given the industry is set to grow. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

It is also worth noting that we have found 3 warning signs for China Green Agriculture (1 is a bit concerning!) that you need to take into consideration.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Enlightify might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:ENFY

Enlightify

Through its subsidiaries, engages in the research, development, production, and sale of fertilizers, agricultural products in the People’s Republic of China and the United States.

Excellent balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives