- United States

- /

- Chemicals

- /

- NYSE:CE

Celanese (CE) Is Down 5.7% After Large Asset Impairment and $1.36 Billion Quarterly Net Loss

Reviewed by Sasha Jovanovic

- Celanese Corporation recently reported third-quarter 2025 results, revealing US$1.49 billion in asset impairments, primarily related to goodwill and trade names, and a net loss of US$1.36 billion, alongside sales of US$2.42 billion.

- The steep increase in impairment charges versus the previous year highlights the significant impact of company-wide asset re-evaluations on reported earnings.

- We'll explore how Celanese's large asset impairment, especially affecting goodwill and trade name values, may influence its long-term investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Celanese Investment Narrative Recap

To believe in Celanese as a shareholder, you need confidence that a recovery in global demand for specialty polymers and acetyl products will eventually boost volumes and margins, offsetting ongoing industry headwinds. The recent US$1.49 billion impairment, centered on goodwill and trade names, signals a re-evaluation of past acquisitions but does not directly affect the company's short-term catalyst of end-market demand normalization; however, it underscores the biggest immediate risk, prolonged margin pressure from weak global orders and overcapacity.

Among recent developments, the sharp drop in dividend payouts, from US$0.70 to US$0.03 per share this quarter, draws attention as a key signal. This contraction in dividends aligns with current earnings stress and highlights the company's efforts to conserve cash, linking directly to challenges in managing profitability while waiting for order volumes and industry conditions to recover.

In contrast, investors should also consider the financial risk linked to Celanese’s debt levels and the company’s reliance on divestitures to achieve deleveraging targets...

Read the full narrative on Celanese (it's free!)

Celanese's narrative projects $10.2 billion in revenue and $799.9 million in earnings by 2028. This requires a 1.0% annual revenue decline and a $2.4 billion earnings increase from the current earnings of -$1.6 billion.

Uncover how Celanese's forecasts yield a $52.38 fair value, a 35% upside to its current price.

Exploring Other Perspectives

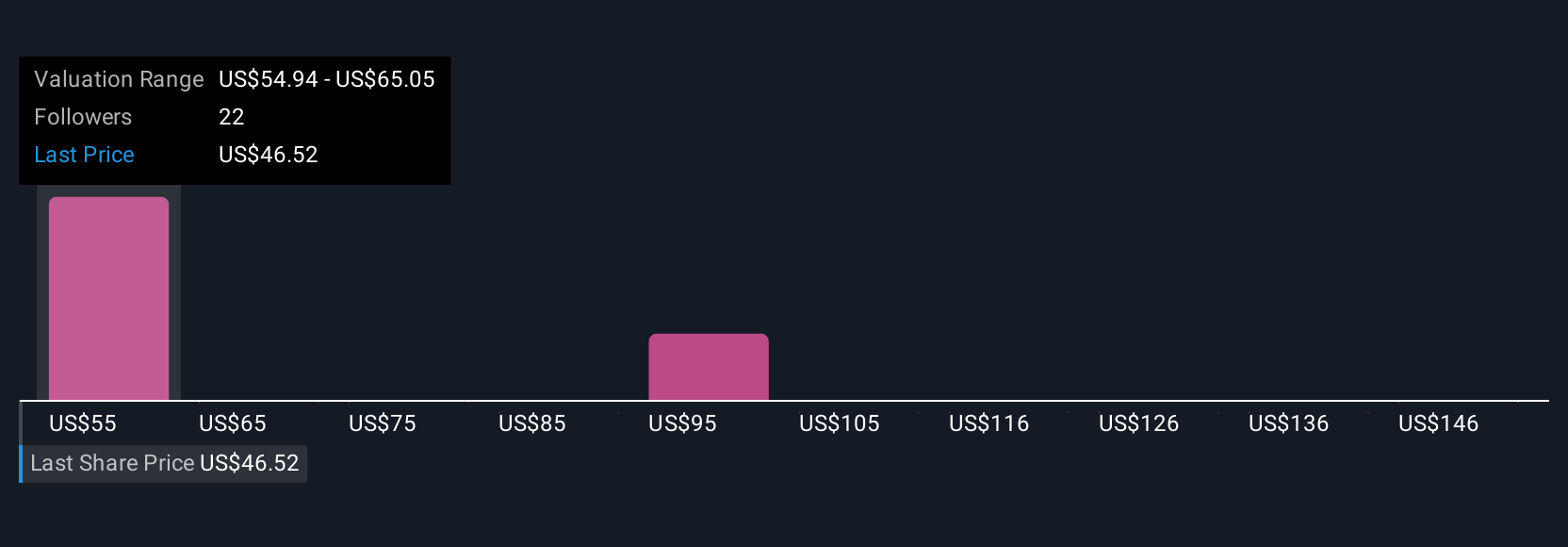

Six Simply Wall St Community members estimate Celanese’s fair value between US$52.38 and US$90.77, revealing a wide spectrum of views. However, persistent low demand and margin compression remain crucial challenges that could limit the company’s ability to close this gap; explore these differing outlooks to inform your own view.

Explore 6 other fair value estimates on Celanese - why the stock might be worth over 2x more than the current price!

Build Your Own Celanese Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Celanese research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Celanese research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Celanese's overall financial health at a glance.

Want Some Alternatives?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CE

Celanese

A chemical and specialty materials company, manufactures and sells engineered polymers worldwide.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives