- United States

- /

- Metals and Mining

- /

- NYSE:CDE

The Bull Case For Coeur Mining (CDE) Could Change Following Las Chispas-Driven Second-Quarter Sales Growth

Reviewed by Simply Wall St

- On August 6, 2025, Coeur Mining is set to report its second-quarter results, with investors expecting strong sales growth largely due to the full-quarter contribution from the Las Chispas mine and stable production guidance for the year.

- An important aspect is that, despite certain cost pressures at specific mines, robust gold and silver prices have continued to play a significant role in supporting the company's revenue momentum.

- We’ll now explore how the anticipated Las Chispas-driven sales growth could influence Coeur Mining’s investment story and future expectations.

AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Coeur Mining Investment Narrative Recap

To be a shareholder in Coeur Mining, you need to believe in its ability to capitalize on strong gold and silver prices while keeping cost pressures in check, leveraging growth from newly integrated assets like Las Chispas. The latest news about anticipated robust quarterly sales driven by Las Chispas confirms the significance of this catalyst, though higher costs at some mines could present a short-term risk; the impact appears balanced rather than materially shifting the investment story.

Of recent company actions, the share buyback program announced in May 2025 stands out, authorizing up to US$75 million in repurchases through the next year. This move aligns with recent revenue momentum and cash flow improvements, potentially supporting shareholder value as Las Chispas begins to deliver consistent contributions.

On the flip side, investors should be aware of how sharp changes in gold and silver prices could...

Read the full narrative on Coeur Mining (it's free!)

Coeur Mining's outlook anticipates $2.1 billion in revenue and $693.1 million in earnings by 2028. This is based on a projected annual revenue growth rate of 19.7% and a $571.7 million increase in earnings from the current level of $121.4 million.

Uncover how Coeur Mining's forecasts yield a $11.28 fair value, a 22% upside to its current price.

Exploring Other Perspectives

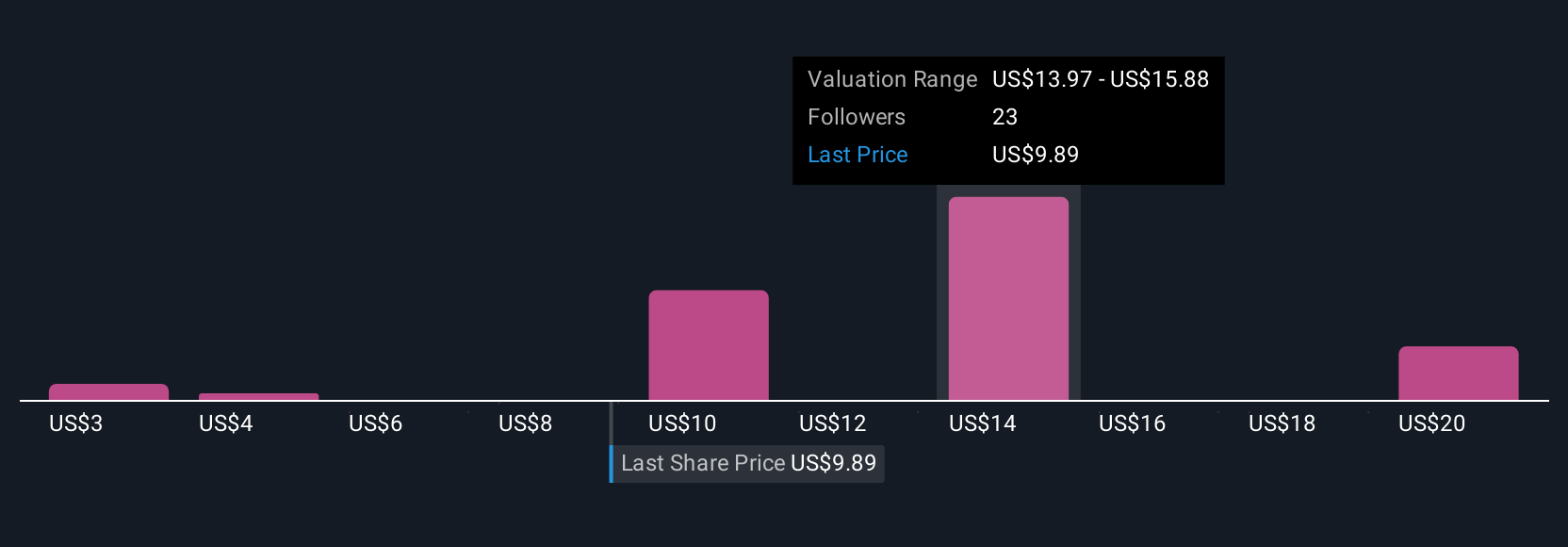

Nine individual fair value estimates from the Simply Wall St Community for Coeur Mining range from US$2.52 to US$21.60 per share. While some see significant upside, keep in mind that ongoing cost pressures at specific mines could shape the company's near-term financial performance and future outlook. Explore the range of views for a fuller picture.

Explore 9 other fair value estimates on Coeur Mining - why the stock might be worth over 2x more than the current price!

Build Your Own Coeur Mining Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Coeur Mining research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Coeur Mining research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Coeur Mining's overall financial health at a glance.

Searching For A Fresh Perspective?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CDE

Coeur Mining

Operates as a gold and silver producer in the United States, Canada, and Mexico.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives