- United States

- /

- Metals and Mining

- /

- NYSE:CDE

Revenues Tell The Story For Coeur Mining, Inc. (NYSE:CDE) As Its Stock Soars 45%

Coeur Mining, Inc. (NYSE:CDE) shareholders would be excited to see that the share price has had a great month, posting a 45% gain and recovering from prior weakness. Looking back a bit further, it's encouraging to see the stock is up 27% in the last year.

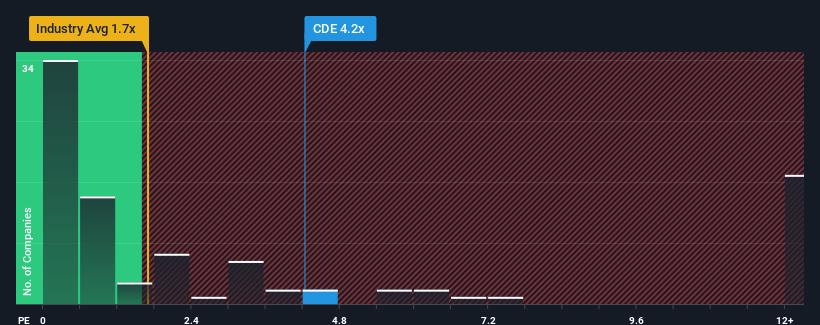

Following the firm bounce in price, you could be forgiven for thinking Coeur Mining is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 4.2x, considering almost half the companies in the United States' Metals and Mining industry have P/S ratios below 1.7x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

Check out our latest analysis for Coeur Mining

What Does Coeur Mining's Recent Performance Look Like?

With revenue growth that's superior to most other companies of late, Coeur Mining has been doing relatively well. The P/S is probably high because investors think this strong revenue performance will continue. If not, then existing shareholders might be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Coeur Mining.How Is Coeur Mining's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as steep as Coeur Mining's is when the company's growth is on track to outshine the industry decidedly.

Taking a look back first, we see that the company grew revenue by an impressive 28% last year. As a result, it also grew revenue by 27% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Looking ahead now, revenue is anticipated to climb by 23% per year during the coming three years according to the four analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 5.8% per year, which is noticeably less attractive.

In light of this, it's understandable that Coeur Mining's P/S sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Final Word

Coeur Mining's P/S has grown nicely over the last month thanks to a handy boost in the share price. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our look into Coeur Mining shows that its P/S ratio remains high on the merit of its strong future revenues. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

There are also other vital risk factors to consider and we've discovered 2 warning signs for Coeur Mining (1 is a bit unpleasant!) that you should be aware of before investing here.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:CDE

Coeur Mining

Operates as a gold and silver producer in the United States, Canada, and Mexico.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success