- United States

- /

- Metals and Mining

- /

- NYSE:CDE

A Look at Coeur Mining’s (CDE) Valuation Following Gold and Silver Price Drop Ahead of Earnings and Fed Decision

Reviewed by Simply Wall St

Coeur Mining (NYSE:CDE) shares dropped as gold and silver prices slid, setting the stage for investor focus on its upcoming third quarter earnings report due October 29. That announcement will coincide with the Federal Reserve’s interest rate decision.

See our latest analysis for Coeur Mining.

While Coeur Mining’s 1-day share price return slipped 1.7% following weaker bullion prices, the big picture shows powerful momentum, with the share price up 201% year-to-date and a remarkable 176.7% total shareholder return over the past 12 months. Recent swings reflect shifting sentiment around precious metals and anticipation of the upcoming earnings report. Long-term shareholders have seen substantial gains as risk appetite has increased.

If this kind of volatility grabs your attention, it might be the perfect moment to expand your view and discover fast growing stocks with high insider ownership

After such dramatic gains and with growth metrics trending higher, investors need to ask whether Coeur Mining’s rapid ascent still leaves room for upside, or if all the optimism has already been priced in. Could there still be a buying opportunity here?

Most Popular Narrative: 7% Undervalued

Coeur Mining’s fair value in the most popular narrative sits above the last close, highlighting a modest gap that has investors watching the company’s transformation for further upside. As market optimism builds, new projects and operational improvements are giving shape to bullish forecasts beyond mere metal price swings.

The successful ramp-up and integration of the Rochester expansion and Las Chispas asset are driving significant increases in silver and gold production. This positions Coeur for robust revenue and earnings growth in the near to medium term. Strengthened operational efficiencies, reflected in declining cost applicable to sales per ounce and process improvements at key mines, are improving operating leverage and could further support margin expansion and cash generation.

What is the real foundation for this premium valuation? It is not just metal prices or short-term momentum. This narrative hints at optimistic future growth, ambitious margin improvements, and a bold leap in earnings. Want to see the numbers behind these big projections? The critical assumptions and their dramatic impact on fair value are waiting to be revealed.

Result: Fair Value of $20.08 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing regulatory hurdles and reliance on successful exploration may limit growth and interrupt Coeur Mining’s momentum if expectations are not met.

Find out about the key risks to this Coeur Mining narrative.

Another View: What Do Earnings Multiples Say?

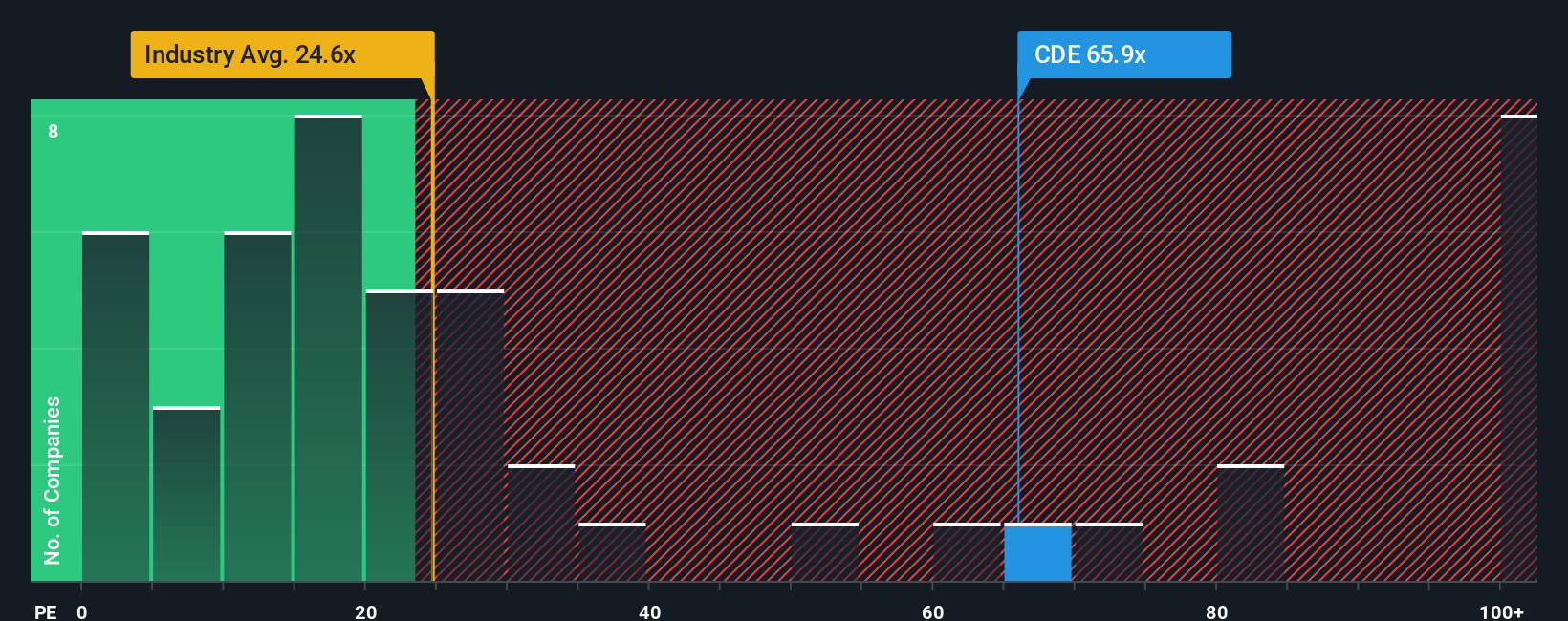

By looking at Coeur Mining's price-to-earnings ratio, a strikingly different picture emerges. The company's ratio stands at 62.9x, well above the US Metals and Mining industry average of 25.2x and its own fair ratio of 52.7x. This hefty premium suggests high expectations and potentially greater downside risk if growth disappoints. Will strong earnings growth be enough to justify these rich multiples?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Coeur Mining Narrative

If you want to dig into the numbers or think you've got a different angle, you can quickly piece together your own story in just a few minutes. Do it your way

A great starting point for your Coeur Mining research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let opportunity pass you by. Tap into Simply Wall Street’s powerful screener tools and get ahead by finding stocks other investors might overlook.

- Capture overlooked gems and accelerate your portfolio with these 3556 penny stocks with strong financials, which combine growth potential and financial strength.

- Boost your income strategy by targeting these 17 dividend stocks with yields > 3%, offering reliable yields above 3% in today’s market.

- Ride the next wave in artificial intelligence by evaluating these 27 AI penny stocks, filled with innovation and long-term promise.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CDE

Coeur Mining

Operates as a gold and silver producer in the United States, Canada, and Mexico.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives