- United States

- /

- Packaging

- /

- NYSE:CCK

Assessing Crown Holdings (CCK): Is the Stock Undervalued After Its Recent Dip?

Reviewed by Kshitija Bhandaru

See our latest analysis for Crown Holdings.

While Crown Holdings experienced some recent volatility, the stock's solid 1-year total shareholder return of 3.9% serves as a reminder that longer-term holders have continued to see value build. With momentum steady rather than surging, investors seem to be weighing growth prospects against today's valuation.

If you're interested in tracking what else savvy investors are watching, now might be the ideal moment to broaden your scope and discover fast growing stocks with high insider ownership

With shares hovering below analyst targets and steady, if unspectacular, growth, the real question for investors is whether Crown Holdings is undervalued at current levels or if the market has already factored in its earnings momentum. Could this be a buying opportunity, or is future growth fully priced in?

Most Popular Narrative: 20.8% Undervalued

With Crown Holdings trading at $96.43, the most widely followed narrative points to a fair value well above this level. This reflects optimism around growth and margin improvement.

Ongoing investments in capacity expansion and plant modernization, especially in high-growth markets such as Europe and Brazil, are enabling Crown to capture market share and support future sales growth. These efforts also position the company to take advantage of tightening supply and potential future customer wins, which could boost both revenue and operating margins.

Want to know which numbers power this bullish thesis? The narrative hinges on higher earnings, expanding profit margins, and a future price-to-earnings multiple that targets sector leaders. Eager to see what analysts are betting on for Crown Holdings’ next five years? Follow the numbers driving this valuation.

Result: Fair Value of $121.79 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weakness in key markets like Asia or ongoing cost inflation could undermine the optimistic outlook and put pressure on both margins and future growth.

Find out about the key risks to this Crown Holdings narrative.

Another View: Multiples Paint a Different Picture

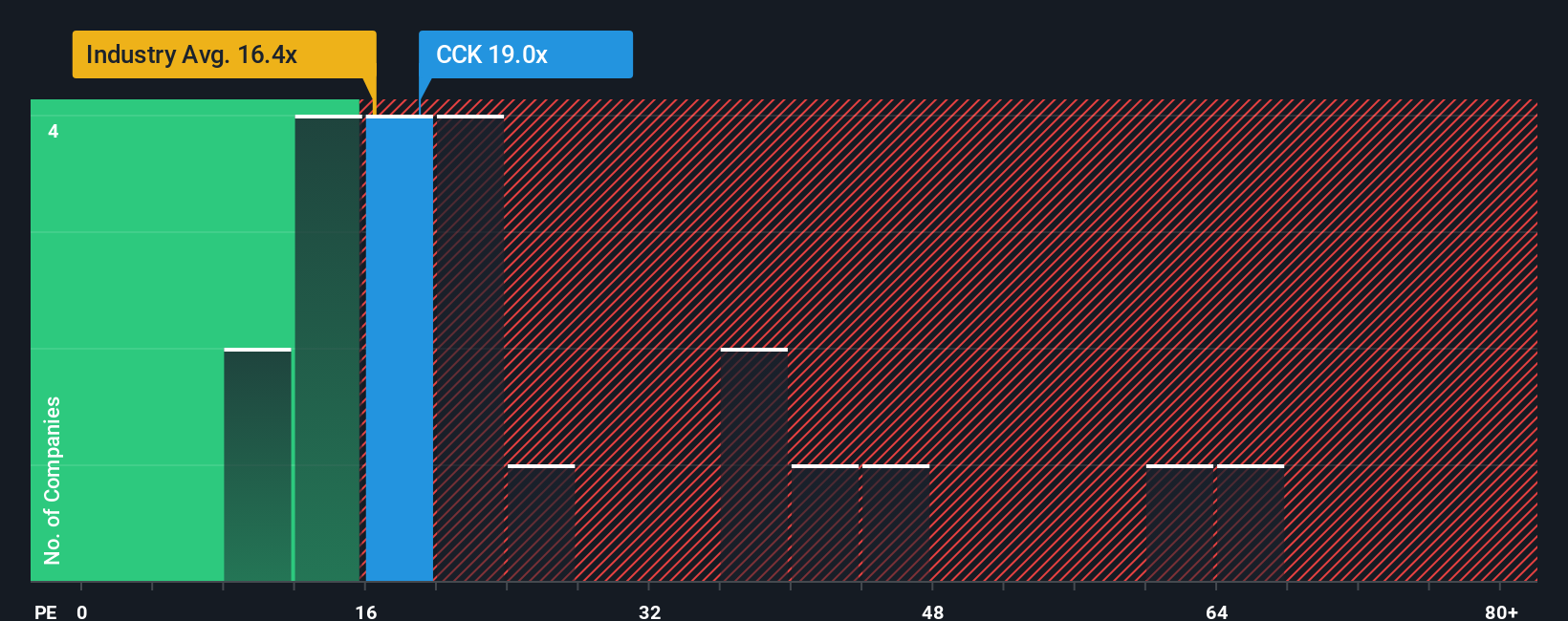

Looking from a price-to-earnings angle, Crown Holdings trades at 19.9x earnings, higher than the global packaging industry average of 16.2x and just above its fair ratio of 19.6x. While it is cheaper than some direct peers, this premium hints at limited upside if industry conditions soften. Could this mean investors are pricing in more growth than the market delivers?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Crown Holdings Narrative

If you see things differently or want to dig deeper into the numbers yourself, you can easily put together your own view in just a few minutes. Do it your way

A great starting point for your Crown Holdings research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors never stop at just one opportunity. Now is your chance to pinpoint high-potential stocks across multiple themes using the Simply Wall Street Screener. Power up your portfolio while these opportunities are still under the radar.

- Unlock the potential of untapped digital assets when you browse these 78 cryptocurrency and blockchain stocks to explore innovation in blockchain and decentralized finance.

- Tap into steady income streams by reviewing these 19 dividend stocks with yields > 3%, which offers yields above 3%, ideal for building reliable, long-term returns.

- Spot undervalued gems set for a comeback by scanning these 896 undervalued stocks based on cash flows, based on strong cash flow fundamentals and compelling valuation signals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CCK

Crown Holdings

Engages in the packaging business in the United States and internationally.

Good value with proven track record.

Similar Companies

Market Insights

Community Narratives