- United States

- /

- Metals and Mining

- /

- NYSE:BVN

Is Buenaventura’s (BVN) Updated 2025 Production Guidance Shifting the Investment Case for the Year Ahead?

Reviewed by Sasha Jovanovic

- Compañía de Minas Buenaventura S.A.A. recently reported its operating results for the third quarter and first nine months of 2025, including gold production of 30,894 ounces and copper output of 13,194 metric tons for the most recent quarter.

- The company also updated its annual 2025 production guidance, which provides fresh insight into expected output levels of key metals and plays a significant role in shaping market expectations for the balance of the year.

- We'll now explore how the updated production guidance could reshape Buenaventura's investment narrative and future expectations.

The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Compañía de Minas BuenaventuraA Investment Narrative Recap

To be a shareholder in Compañía de Minas Buenaventura S.A.A., you need to believe in the company’s ability to sustain and grow production in multiple metals while managing costs and capital requirements. The recently updated production guidance confirms that output for gold, silver, and copper stays within previously anticipated ranges, so for now, there is little to suggest a material shift in the near-term catalyst of higher gold and copper output, or a mitigation of the biggest risk: project delay at San Gabriel. Among recent events, the updated 2025 production guidance stands out. This is especially relevant as investors assess whether the ramp-up at San Gabriel, targeted for late 2025, will occur as planned, and how closely actual output will track these new projections, which are a key input in shaping market sentiment for the remainder of the year. Yet, while investors may be focused on the headline production numbers, what’s less visible are the ongoing challenges tied to construction and timely permitting for San Gabriel that could reshape expectations if...

Read the full narrative on Compañía de Minas BuenaventuraA (it's free!)

Compañía de Minas BuenaventuraA is projected to reach $1.4 billion in revenue and $490.9 million in earnings by 2028. This forecast assumes a 2.8% annual revenue growth rate, but a decrease in earnings of $15.5 million from current earnings of $506.4 million.

Uncover how Compañía de Minas BuenaventuraA's forecasts yield a $20.48 fair value, a 7% downside to its current price.

Exploring Other Perspectives

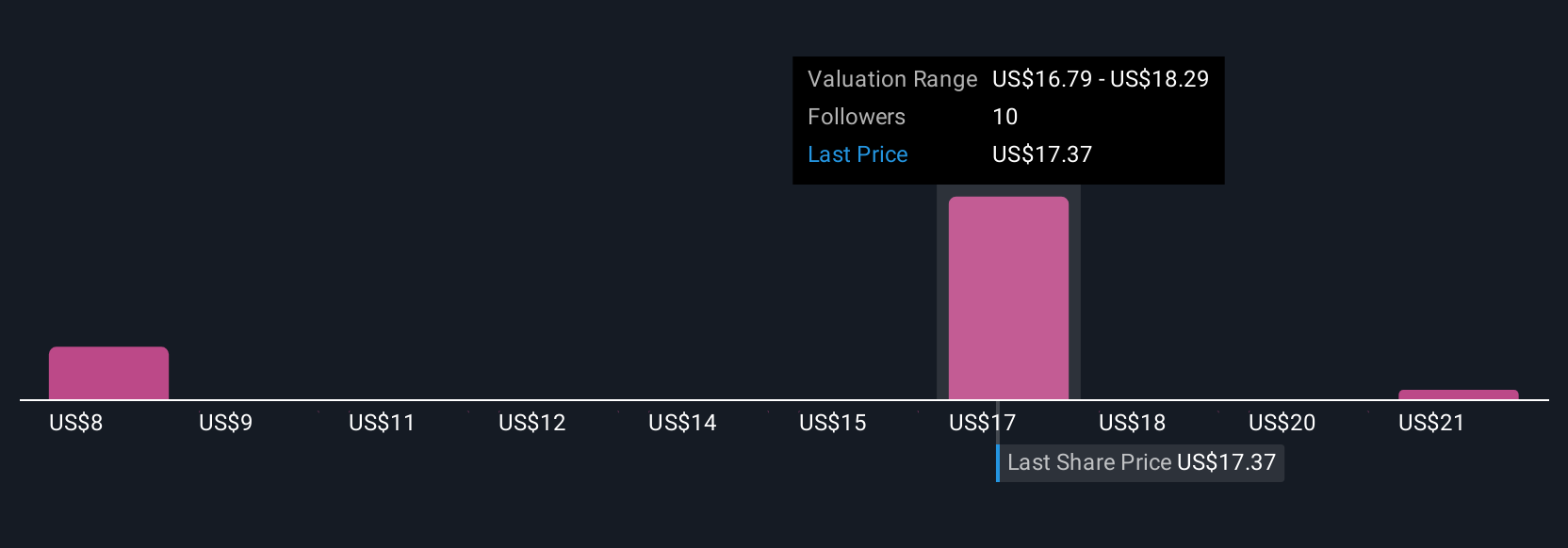

Simply Wall St Community members offered five distinct fair value estimates for the company’s stock, ranging from US$7.62 to US$22.78. Against this broad span of opinions, a potential delay or complication at the San Gabriel project remains a central factor that could influence the company’s results going forward, so you may want to consider multiple viewpoints on these risks and their implications.

Explore 5 other fair value estimates on Compañía de Minas BuenaventuraA - why the stock might be worth less than half the current price!

Build Your Own Compañía de Minas BuenaventuraA Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Compañía de Minas BuenaventuraA research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Compañía de Minas BuenaventuraA research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Compañía de Minas BuenaventuraA's overall financial health at a glance.

Looking For Alternative Opportunities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BVN

Compañía de Minas BuenaventuraA

Engages in the exploration, mining, concentration, smelting, and marketing of polymetallic ores and metals in Peru.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives