- United States

- /

- Metals and Mining

- /

- NYSE:BVN

Compañía de Minas Buenaventura (NYSE:BVN) Valuation in Focus as Earnings and Margins Strengthen

Reviewed by Simply Wall St

Recent figures at Compañía de Minas Buenaventura (NYSE:BVN) highlight annual earnings per share growth and expanding EBIT margins, reflecting efforts that may drive ongoing profitability. Substantial insider ownership also supports alignment between management and shareholders.

See our latest analysis for Compañía de Minas BuenaventuraA.

Momentum has clearly been on Compañía de Minas BuenaventuraA's side, with the stock’s share price more than doubling year-to-date and boasting a stellar 1-year total shareholder return of nearly 111%. Such gains reflect a market that is quickly warming up to the company’s turnaround story and stronger financial footing.

If this kind of rapid progress has you looking for your next opportunity, you might enjoy uncovering fast growing stocks with high insider ownership.

Yet with shares posting triple-digit returns and trading almost exactly in line with analyst price targets, the question now is whether there is still value to be found here or if investor optimism has already priced in future growth.

Most Popular Narrative: Fairly Valued

With Compañía de Minas BuenaventuraA's widely tracked narrative fair value now at $24.57, almost matching its latest close, attention turns to key business levers expected to drive future performance.

The imminent start-up and ramp-up of the San Gabriel project, with first gold production targeted for Q4 2025 and stabilization by mid-2026, is set to meaningfully boost gold output and diversify the company's revenue streams. At the same time, ongoing macroeconomic uncertainty may increase gold's appeal as a safe-haven asset, supporting both revenue and margins.

Want to know which production targets and margin trends could reshape the valuation? The narrative hinges on specific expansion milestones and competitive margin assumptions. Ready to discover what numbers analysts think can justify today's price and pinpoint the most debated financial drivers? Find out what’s under the surface in the full narrative.

Result: Fair Value of $24.57 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, potential setbacks such as project delays at San Gabriel or sharply rising operational costs could quickly shift sentiment and challenge the company's optimistic outlook.

Find out about the key risks to this Compañía de Minas BuenaventuraA narrative.

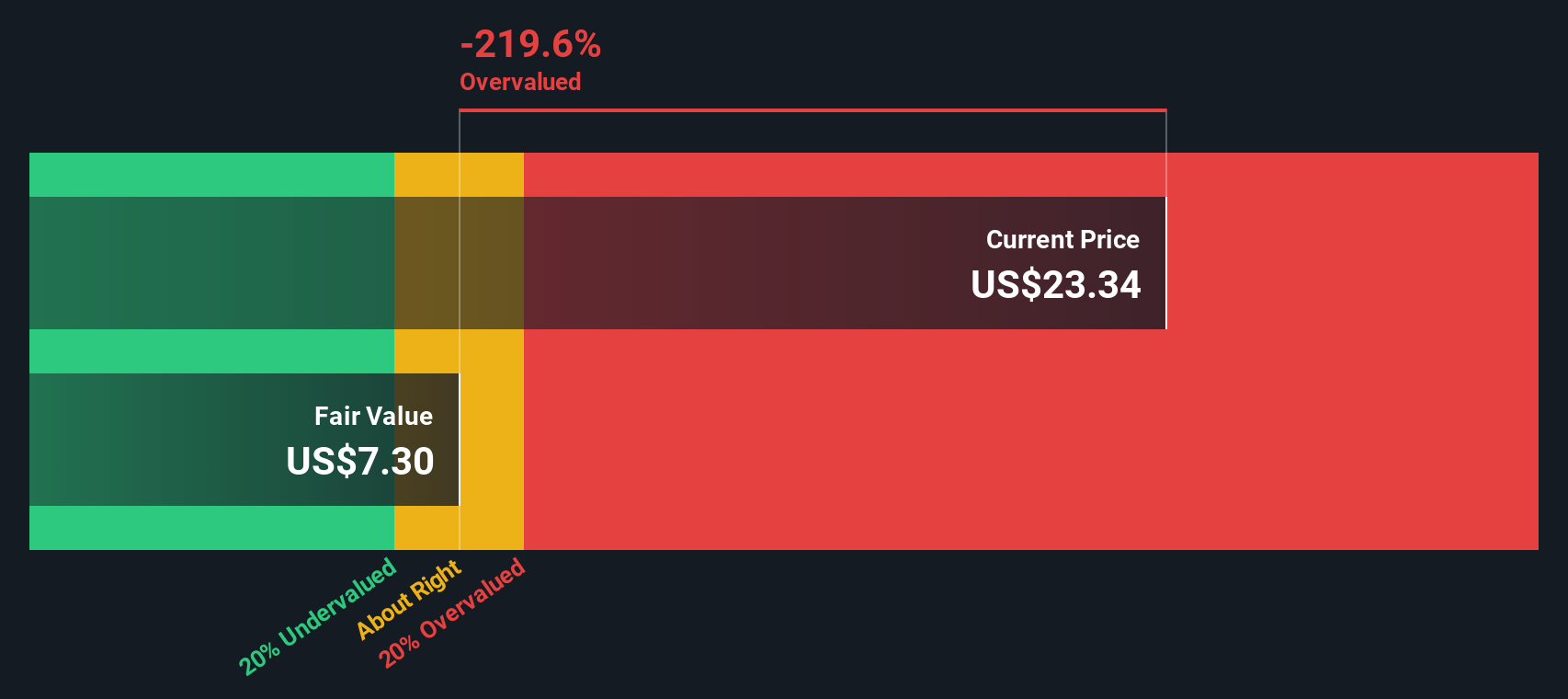

Another View: DCF Tells a Different Story

While valuation by earnings multiples points to Compañía de Minas BuenaventuraA trading at a discount to industry peers, our SWS DCF model offers a more cautious perspective. The DCF calculation suggests the shares may actually be trading above their fair value, which could indicate possible overvaluation based on cash flow assumptions.

Look into how the SWS DCF model arrives at its fair value.

This raises an important question for investors: should you trust current multiples or focus on long-term cash flow projections when weighing your next move?

Build Your Own Compañía de Minas BuenaventuraA Narrative

If you see things differently or want to dig deeper into the numbers yourself, it only takes a few minutes to build your own perspective. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Compañía de Minas BuenaventuraA.

Looking for More Investment Ideas?

Smart investors never settle for just one opportunity. Expand your shortlist with unique investments that could power up your portfolio before the crowd catches on.

- Unlock steady income by checking out these 15 dividend stocks with yields > 3%, which offers market-beating yields and reliable cash flow.

- Catch the next tech wave by reviewing these 25 AI penny stocks, which are making breakthroughs in artificial intelligence and redefining industry standards.

- Spot hidden value and strong financials with these 913 undervalued stocks based on cash flows before others capitalize on them in the market.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BVN

Compañía de Minas BuenaventuraA

Engages in the exploration, mining, concentration, smelting, and marketing of polymetallic ores and metals in Peru.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026