- United States

- /

- Metals and Mining

- /

- NYSE:BVN

Buenaventura (NYSE:BVN) Valuation in Focus After Strong 3-Month Share Price Gains

Reviewed by Simply Wall St

Compañía de Minas BuenaventuraA (NYSE:BVN) has caught the attention of investors recently as its stock has moved through varying cycles, with share prices showing a strong gain over the past 3 months. Shares are seeing renewed interest as the company’s financials and long-term growth trends come under closer review.

See our latest analysis for Compañía de Minas BuenaventuraA.

BuenaventuraA’s share price momentum has shifted into a higher gear this year, climbing an impressive 29.4% over the last 90 days and delivering a total shareholder return of 71.9% for investors over the past year. Confidence appears to be building as the company’s growth story gains attention in the market.

If strong tailwinds in the mining sector have you curious about what else could be on the move, it’s a great time to discover fast growing stocks with high insider ownership

With shares running hot but trading right around analyst price targets, the key question is whether Compañía de Minas BuenaventuraA remains undervalued or if the market is already factoring in further growth. Is there real upside left for new investors?

Most Popular Narrative: 9.7% Overvalued

The most widely followed narrative comes in at $20.48 per share, which is below the last close price of $22.47. This sets the stage for a debate over whether current optimism has gone too far or if the market sees something even brighter ahead.

"Revenue Growth projections rose from 6.26 percent to 10.18 percent, marking a significant upgrade in expected topline expansion. Net Profit Margin improved from 33.76 percent to 40.70 percent, indicating enhanced profitability expectations."

Want to know the real engine behind this bullish valuation? The narrative reveals impressive leapfrogs in revenue growth and profitability expectations, setting up a numbers-driven future that could surprise even seasoned investors. Don’t miss the surprising assumptions and bold analyst moves that anchor this price target.

Result: Fair Value of $20.48 (OVERVALUEd)

Have a read of the narrative in full and understand what's behind the forecasts.

However, potential setbacks such as sustained production declines or higher operating costs could quickly challenge the current momentum and outlook for BuenaventuraA.

Find out about the key risks to this Compañía de Minas BuenaventuraA narrative.

Another View: Multiples Suggest a Discount

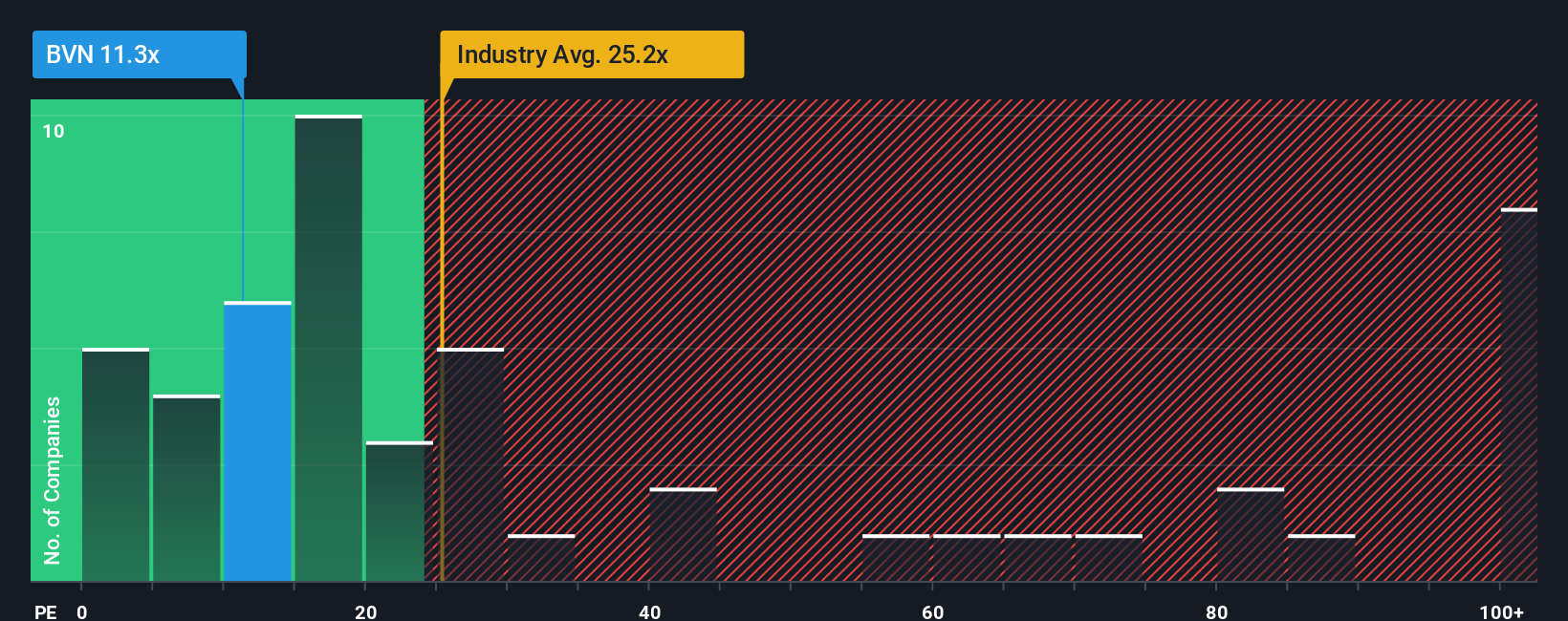

While fair value estimates point to Compañía de Minas BuenaventuraA being overvalued, comparing its price-to-earnings ratio (11.3x) reveals a different story. This is much lower than both the US Metals and Mining industry average (24.9x) and its peer average (33.2x). It also trails the fair ratio of 20.8x. Such a gap signals the market may not be fully recognizing potential upside or could be underpricing possible risks. Does this suggest there is more value here than meets the eye?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Compañía de Minas BuenaventuraA Narrative

If you want to shape your own perspective or review the numbers firsthand, you can create a personalized analysis in just a few minutes. Do it your way

A great starting point for your Compañía de Minas BuenaventuraA research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

You could miss out on the next big opportunity if you aren’t searching beyond the obvious stocks. Give yourself an edge and broaden your watchlist with these standout themes:

- Unlock growth by checking out these 877 undervalued stocks based on cash flows, which is packed with companies currently trading below their estimated cash flow values.

- Boost potential income by exploring these 17 dividend stocks with yields > 3%, featuring yields above 3 percent for steady cash generation.

- Tap into cutting-edge innovation and start your search for tomorrow’s breakthroughs with these 27 AI penny stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BVN

Compañía de Minas BuenaventuraA

Engages in the exploration, mining, concentration, smelting, and marketing of polymetallic ores and metals in Peru.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives