- United States

- /

- Metals and Mining

- /

- NYSE:BVN

Buenaventura (NYSE:BVN) Valuation: Gauging Potential After Recent Share Price Surge

Reviewed by Kshitija Bhandaru

Compañía de Minas BuenaventuraA (NYSE:BVN) has caught investor attention lately, thanks to its steady revenue and net income growth, along with a sharp share price rally over the past month. These trends have put the stock under the spotlight for anyone watching the mining sector.

See our latest analysis for Compañía de Minas BuenaventuraA.

After a stellar stretch, Compañía de Minas BuenaventuraA's share price has risen sharply with a 29.01% return over the last month alone and more than doubling year-to-date, suggesting positive momentum may be building. Looking at the bigger picture, the company reports a notable 90.21% total shareholder return in the past year and an even stronger 290.08% over three years. This highlights both short-term excitement and sustained long-term gains as investors react to improvements in underlying performance and shifting sector sentiment.

If this surge has you rethinking your investment radar, now is a great time to explore fast growing stocks with high insider ownership.

But with shares now trading significantly above analyst price targets, the important question is whether Compañía de Minas BuenaventuraA is truly undervalued, or if the recent run-up means future growth is already reflected in the market.

Most Popular Narrative: 33.5% Overvalued

With Compañía de Minas BuenaventuraA’s last close at $25.57 and the most widely followed fair value estimate at $19.15, the market is pricing in far more future potential than most analysts currently expect. The valuation debate centers on new project ramp-ups and margin sustainability. Investors are weighing whether this premium is justified.

The imminent start-up and ramp-up of the San Gabriel project, with first gold production targeted for Q4 2025 and stabilization by mid-2026, is set to meaningfully boost gold output and diversify the company's revenue streams at a time when ongoing macroeconomic uncertainty may increase gold's appeal as a safe-haven asset, supporting both revenue and margins.

How bold are the revenue and profit margin expectations driving this valuation? One key project’s timing and the market’s appetite for gold could make or break the case. Curious what else the narrative projects could propel or hinder Buenvantura’s value? Read on and discover the surprising calculations behind this analyst outlook.

Result: Fair Value of $19.15 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing operational disruptions or a persistent rise in production costs could quickly derail projections and put significant pressure on future margins.

Find out about the key risks to this Compañía de Minas BuenaventuraA narrative.

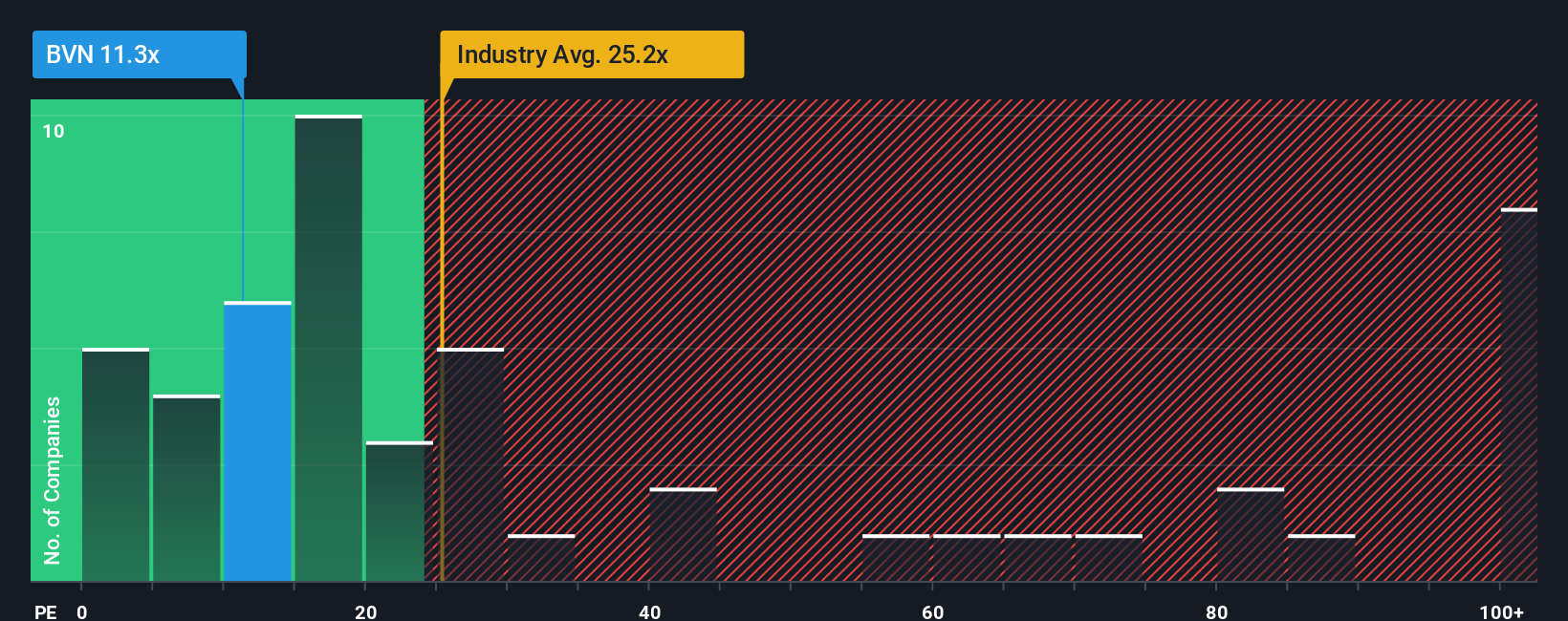

Another Perspective: Market Multiples Tell a Different Story

While analysts see the stock as overvalued based on fair value estimates, a look at its price-to-earnings ratio adds useful context. At 12.8x, Compañía de Minas BuenaventuraA trades well below both the industry average of 25.3x and the fair ratio of 21x. This sizeable gap signals the market is more cautious than its peers. Does this reflect hidden risks or an opportunity worth seizing?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Compañía de Minas BuenaventuraA Narrative

If you’re curious to see the numbers for yourself and craft a story that fits your perspective, you can do so in just a few minutes with Do it your way.

A great starting point for your Compañía de Minas BuenaventuraA research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don't miss your chance to find winning stocks with fresh growth stories, strong fundamentals, or income potential. Use these top screeners to spot savvy opportunities before others do:

- Capture market trends early by checking out these 24 AI penny stocks, which power advances in artificial intelligence and automation across key sectors.

- Secure consistent income by targeting these 18 dividend stocks with yields > 3% that offer yields above 3 percent. This can help strengthen your portfolio and provide resilience during market volatility.

- Seize value opportunities with these 877 undervalued stocks based on cash flows, based on rigorous analysis of future cash flows and attractive prices compared to intrinsic worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BVN

Compañía de Minas BuenaventuraA

Engages in the exploration, mining, concentration, smelting, and marketing of polymetallic ores and metals in Peru.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives