- United States

- /

- Packaging

- /

- NYSE:BALL

What Ball (BALL)'s Upgraded 2025 Earnings Guidance Means For Shareholders

Reviewed by Sasha Jovanovic

- Ball Corporation recently raised its fiscal 2025 comparable EPS growth guidance to a range of 12% to 15% ahead of its third-quarter earnings announcement, which is expected before the market opens on November 4.

- The company's consistent history of surpassing Wall Street earnings estimates has contributed to increased optimism about its operational momentum and profit outlook.

- With management now forecasting stronger EPS growth, we'll examine how this updated outlook could influence Ball’s long-term investment case.

Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

Ball Investment Narrative Recap

Ball shareholders need conviction in the long-term demand for sustainable aluminum packaging, disciplined cost control, and resilient contracts, even as short-term earnings momentum increases following the renewed EPS growth guidance. While the guidance lift sharpens focus on operational gains, headwinds from input cost volatility remain a key risk, and the update does not fundamentally alter this concern as the most important near-term challenge.

The company’s recent buyback activity, repurchasing almost 7.6 million shares in just one quarter, underscores its confidence in future prospects. This capital return complements higher EPS targets, though effectiveness depends on stable margins as input costs fluctuate.

However, investors should be mindful that despite upbeat guidance, ongoing input cost pressure poses challenges, especially if...

Read the full narrative on Ball (it's free!)

Ball's narrative projects $14.2 billion revenue and $1.1 billion earnings by 2028. This requires 4.6% yearly revenue growth and a $519 million earnings increase from $581 million today.

Uncover how Ball's forecasts yield a $63.23 fair value, a 32% upside to its current price.

Exploring Other Perspectives

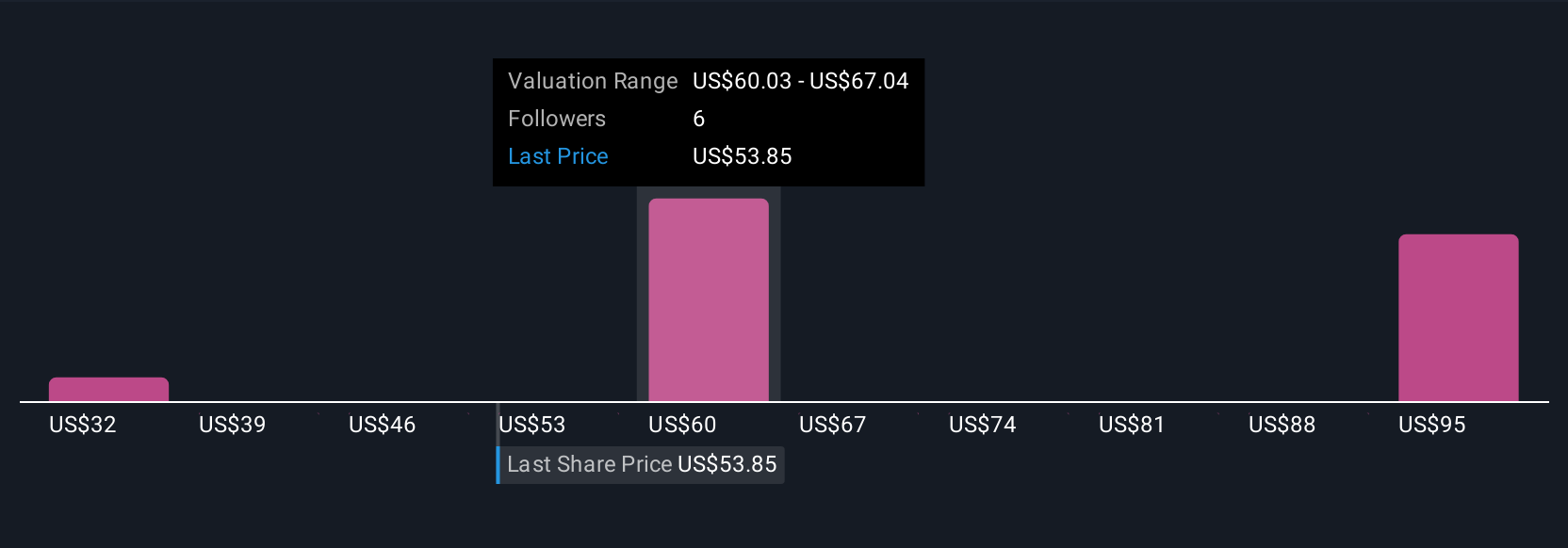

Four fair value estimates from the Simply Wall St Community range from as low as US$32 to nearly US$96 per share. While some see significant upside, input cost volatility could affect Ball’s ability to meet new growth targets, explore the full range of viewpoints to inform your decisions.

Explore 4 other fair value estimates on Ball - why the stock might be worth as much as 99% more than the current price!

Build Your Own Ball Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ball research is our analysis highlighting 5 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Ball research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ball's overall financial health at a glance.

Looking For Alternative Opportunities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Ball might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BALL

Ball

Supplies aluminum packaging products for the beverage, personal care, and household products industries in the United States, Brazil, and internationally.

Established dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives