- United States

- /

- Packaging

- /

- NYSE:AVY

The past year for Avery Dennison (NYSE:AVY) investors has not been profitable

It's easy to match the overall market return by buying an index fund. Active investors aim to buy stocks that vastly outperform the market - but in the process, they risk under-performance. For example, the Avery Dennison Corporation (NYSE:AVY) share price is down 23% in the last year. That contrasts poorly with the market return of 20%. Longer term shareholders haven't suffered as badly, since the stock is down a comparatively less painful 4.4% in three years. Shareholders have had an even rougher run lately, with the share price down 11% in the last 90 days.

So let's have a look and see if the longer term performance of the company has been in line with the underlying business' progress.

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the unfortunate twelve months during which the Avery Dennison share price fell, it actually saw its earnings per share (EPS) improve by 14%. Of course, the situation might betray previous over-optimism about growth.

It's surprising to see the share price fall so much, despite the improved EPS. But we might find some different metrics explain the share price movements better.

Revenue was pretty flat on last year, which isn't too bad. However, it is certainly possible the market was expecting an uptick in revenue, and that the share price fall reflects that disappointment.

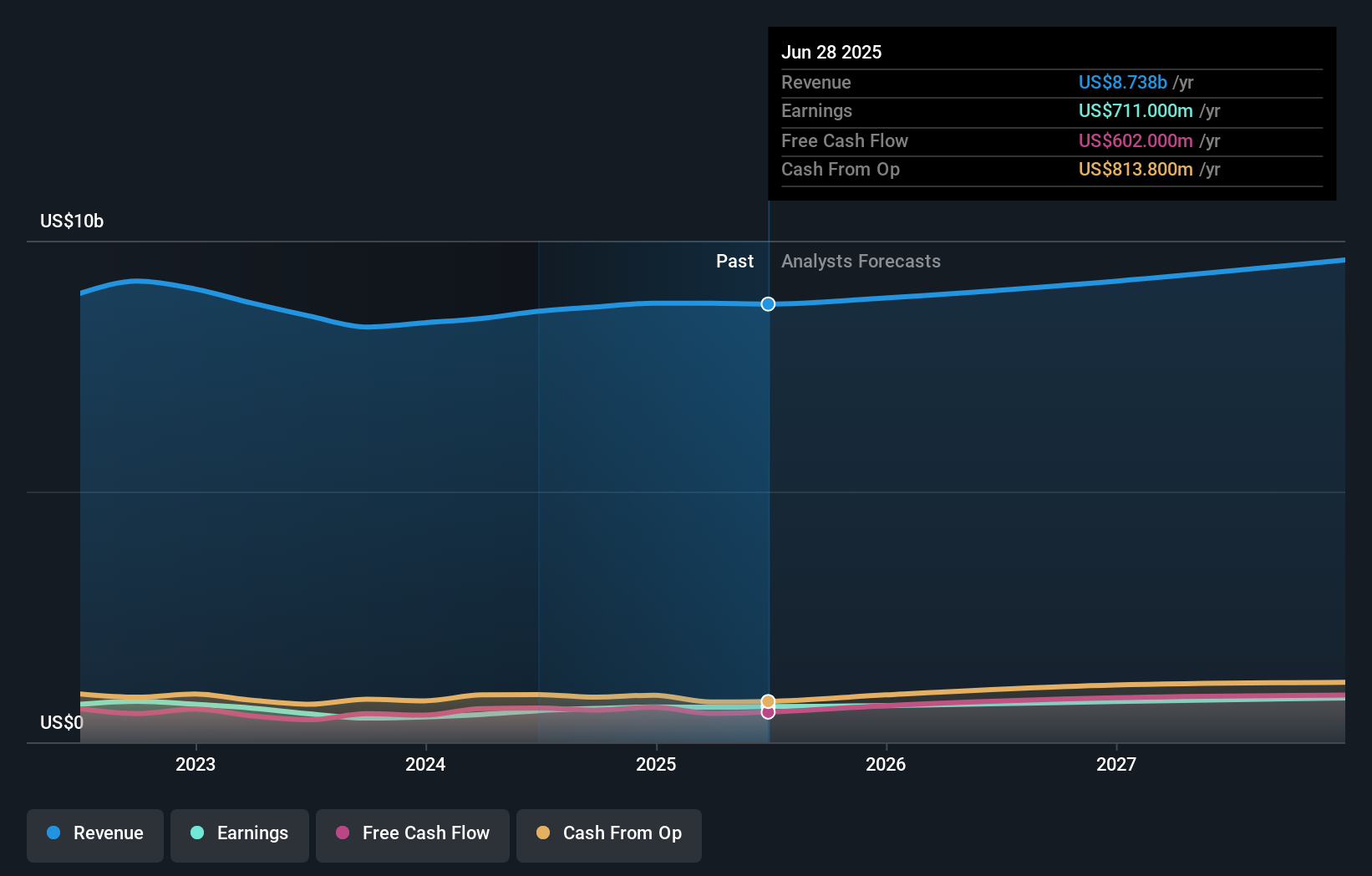

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Avery Dennison is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. If you are thinking of buying or selling Avery Dennison stock, you should check out this free report showing analyst consensus estimates for future profits.

A Different Perspective

Avery Dennison shareholders are down 22% for the year (even including dividends), but the market itself is up 20%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Longer term investors wouldn't be so upset, since they would have made 6%, each year, over five years. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 1 warning sign for Avery Dennison that you should be aware of.

We will like Avery Dennison better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:AVY

Avery Dennison

Operates as a materials science and digital identification solutions company in the United States, Europe, the Middle East, North Africa, Asia, Latin America, and internationally.

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives