- United States

- /

- Metals and Mining

- /

- NYSE:AU

Share Capital Increase Might Change The Case For Investing In AngloGold Ashanti (AU)

Reviewed by Simply Wall St

- AngloGold Ashanti plc recently announced an increase in its share capital, as disclosed in an official press release without additional details provided.

- This move draws attention to the company’s capital strategy and potential future financing activities, which are significant considerations for stakeholders.

- We will now explore how AngloGold Ashanti’s decision to raise its share capital may alter the company’s investment narrative and outlook.

AngloGold Ashanti Investment Narrative Recap

To own shares in AngloGold Ashanti, an investor typically needs to believe in the resilience of its global gold mining operations, the potential for ongoing cost reductions, and the successful integration of new assets amidst a volatile gold price environment. The recent share capital increase sheds light on future financing and balance sheet flexibility, but does not materially alter the short-term production ramp-up at Obuasi, nor does it magnify the key risk of climate-related operational disruptions already present in the investment narrative.

Among recent developments, the company’s reaffirmed production guidance for 2025 stands out, emphasizing continuity in its growth plans. This guidance is particularly relevant in the context of the new capital raised, since maintaining or lifting output targets can support the company’s ability to capitalize on operational improvements and manage cost or integration risks tied to its broader ambitions.

By contrast, investors should pay close attention to how unexpected climate events could affect operational stability and …

Read the full narrative on AngloGold Ashanti (it's free!)

AngloGold Ashanti's outlook anticipates $8.3 billion in revenue and $1.9 billion in earnings by 2028. This reflects a projected 12.9% annual revenue growth rate and a $0.9 billion increase in earnings from the current $1.0 billion level.

Exploring Other Perspectives

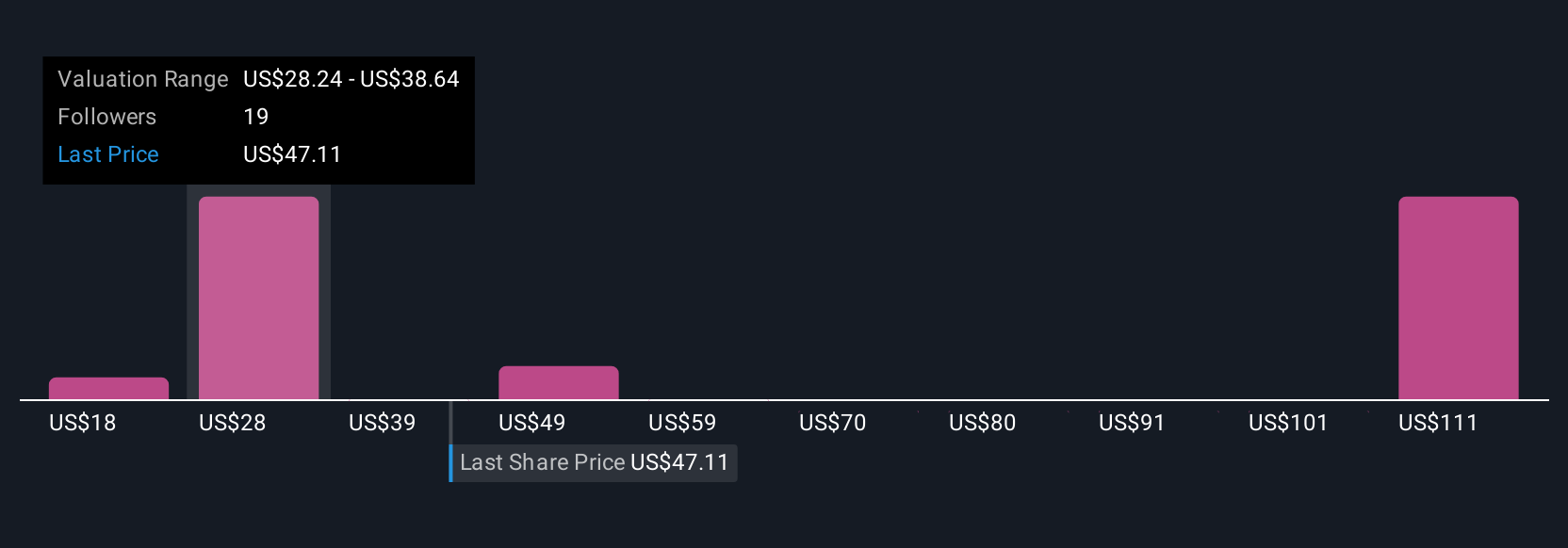

Simply Wall St Community members submitted 11 fair value estimates for AngloGold Ashanti, ranging widely from US$17.84 to US$121.82 per share. While you consider these diverse opinions, remember that the company’s ability to meet its production guidance will be a focus and could weigh on future results, see how the community assesses these scenarios for yourself.

Build Your Own AngloGold Ashanti Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your AngloGold Ashanti research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free AngloGold Ashanti research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate AngloGold Ashanti's overall financial health at a glance.

Searching For A Fresh Perspective?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Outshine the giants: these 23 early-stage AI stocks could fund your retirement.

- This technology could replace computers: discover the 26 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AU

AngloGold Ashanti

Operates as a gold mining company in Africa, Australia, and the Americas.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives