- United States

- /

- Metals and Mining

- /

- NYSE:AU

Is Broad Russell Index Inclusion Altering The Investment Case For AngloGold Ashanti (AU)?

Reviewed by Simply Wall St

- On June 30, 2025, AngloGold Ashanti plc (NYSE:AU) was added to a wide range of Russell indexes, including both value and growth benchmarks spanning small, mid, and large cap segments.

- This rare inclusion across multiple key indexes highlights AngloGold Ashanti’s broad investment appeal to a diverse range of institutional and index-tracking investors.

- Now, we’ll explore how AngloGold Ashanti’s broad-based index inclusion could influence its investment narrative and capital inflows.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

AngloGold Ashanti Investment Narrative Recap

To invest in AngloGold Ashanti, you need to believe in the long-term resilience of gold mining, the company's capacity to manage operational risks across diverse geographies, and the potential benefits from its new U.S. market presence. The recent index additions reflect enhanced visibility among institutional investors, but do not immediately change the company’s biggest short-term catalyst, realizing operational and cost synergies from its recent Centamin acquisition, nor do they significantly mitigate the risks tied to gold price volatility or production disruptions.

Among recent news, the new dividend policy, setting a minimum US$0.50 per share annually with quarterly payments, stands out, especially as AngloGold Ashanti seeks to broaden its investor base after these index inclusions. This policy could appeal to income-focused shareholders, but the ability to sustain dividends still hinges on effective cost control and operational execution as core catalysts for stability and growth.

Yet, despite these advances, it’s important for investors to watch for contrasting risks around weather-driven production impacts, as...

Read the full narrative on AngloGold Ashanti (it's free!)

AngloGold Ashanti's narrative projects $8.3 billion revenue and $1.9 billion earnings by 2028. This requires 12.9% yearly revenue growth and a $0.9 billion increase in earnings from the current $1.0 billion.

Exploring Other Perspectives

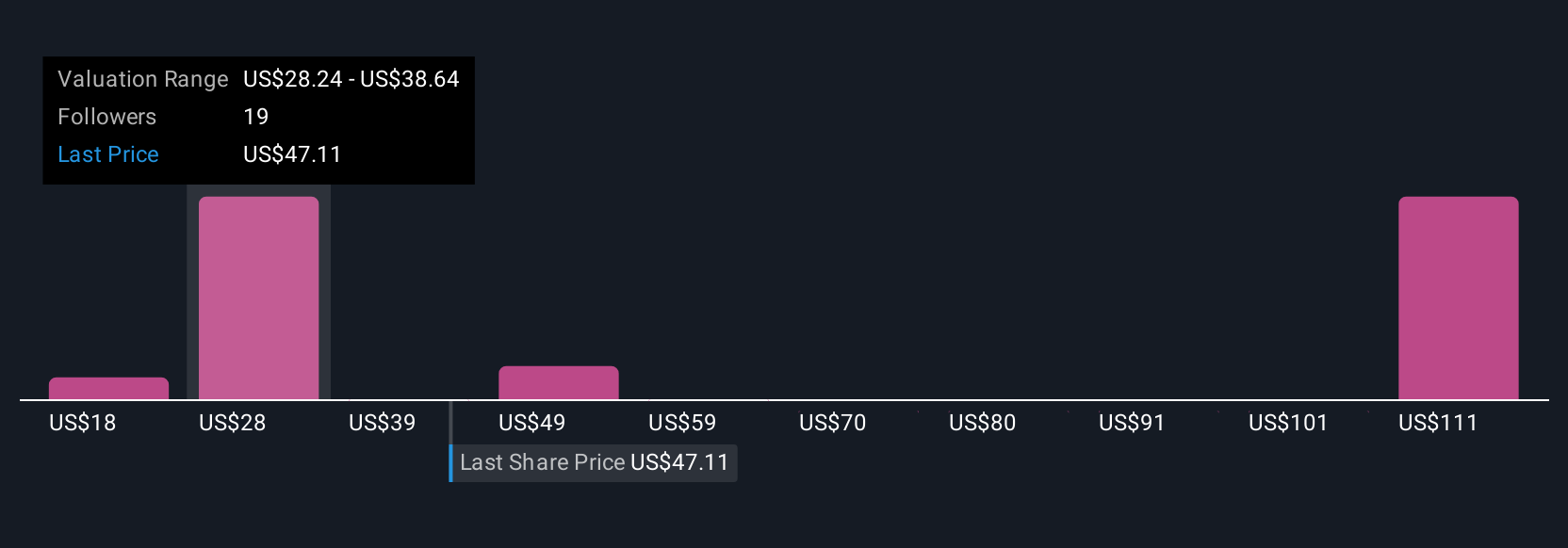

Eleven private investors in the Simply Wall St Community arrived at fair value estimates from as low as US$17.84 up to US$121.50 per share. While opinions differ widely, controlling costs remains crucial for AngloGold Ashanti’s performance and is top of mind for many market participants considering the stock’s future direction.

Build Your Own AngloGold Ashanti Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your AngloGold Ashanti research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free AngloGold Ashanti research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate AngloGold Ashanti's overall financial health at a glance.

Ready For A Different Approach?

Our top stock finds are flying under the radar-for now. Get in early:

- This technology could replace computers: discover the 28 stocks are working to make quantum computing a reality.

- The end of cancer? These 24 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Outshine the giants: these 23 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AU

AngloGold Ashanti

Operates as a gold mining company in Africa, Australia, and the Americas.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives