- United States

- /

- Metals and Mining

- /

- NYSE:AU

Could AngloGold Ashanti’s (AU) Board Refresh Signal a Shift in Its Long-Term Sustainability Priorities?

Reviewed by Sasha Jovanovic

- AngloGold Ashanti plc recently announced the appointment of Marcus Randolph as an independent non-executive director, effective October 27, 2025, adding him to the Compensation and Human Resources Committee and the Social, Ethics and Sustainability Committee.

- Mr. Randolph brings extensive leadership experience from across the mining and processing industries, strengthening the company’s boardroom expertise in operational sustainability and organizational development.

- We'll examine how the addition of a mining veteran to AngloGold Ashanti’s board could reshape its long-term operational and sustainability outlook.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

AngloGold Ashanti Investment Narrative Recap

To own shares of AngloGold Ashanti, you need to believe that sustained gold demand and disciplined cost control will continue to support earnings growth and dividends despite persistent inflationary pressures and the sector’s high dependence on strong gold prices. The addition of Marcus Randolph to the board brings deep operational expertise, but does not materially change the near-term catalyst of robust gold prices or address the core risks of rising production costs and asset-specific challenges.

Of the company’s recent announcements, the introduction of a base dividend of US$0.50 per share per annum alongside quarterly payouts stands out. This move provides investors with greater income visibility, a positive in the context of ongoing margin improvements and recent production gains, but heightened risks around cost inflation and regulatory uncertainty remain a key consideration.

However, investors should also be aware that continued success relies on the company’s ability to manage rising all-in sustaining costs and...

Read the full narrative on AngloGold Ashanti (it's free!)

AngloGold Ashanti's outlook foresees $9.5 billion in revenue and $3.0 billion in earnings by 2028. This is based on an assumed 7.6% annual revenue growth and a $1.2 billion increase in earnings from the current $1.8 billion.

Uncover how AngloGold Ashanti's forecasts yield a $67.17 fair value, a 8% downside to its current price.

Exploring Other Perspectives

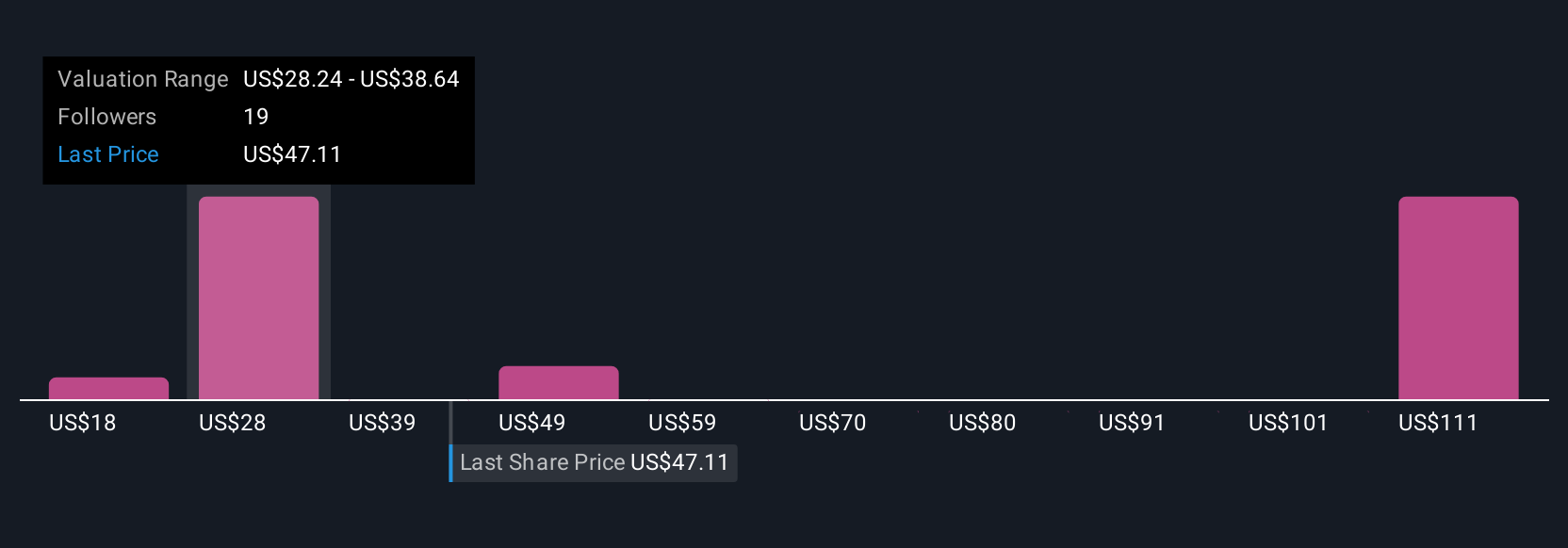

Twelve individual fair value estimates from the Simply Wall St Community range from US$17.84 to US$70 per share. While many believe in AngloGold Ashanti’s rising margins and cost control, there are risks if inflation outpaces discipline, consider multiple viewpoints to get the full picture.

Explore 12 other fair value estimates on AngloGold Ashanti - why the stock might be worth as much as $70.00!

Build Your Own AngloGold Ashanti Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your AngloGold Ashanti research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free AngloGold Ashanti research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate AngloGold Ashanti's overall financial health at a glance.

No Opportunity In AngloGold Ashanti?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AU

AngloGold Ashanti

Operates as a gold mining company in Africa, Australia, and the Americas.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives