- United States

- /

- Metals and Mining

- /

- NYSE:AU

AngloGold Ashanti (NYSE:AU) Sells Cote d'Ivoire Gold Projects For US$260 Million

Reviewed by Simply Wall St

AngloGold Ashanti (NYSE:AU) recently agreed to sell its interests in two gold projects in Côte d'Ivoire, marking a shift in its operational strategy. This decision aligns with the company's focus on enhancing its operational assets in the U.S. and developing projects like the Mansala Project in Guinea. Over the last quarter, AngloGold's share price rose 31%, a strong performance that mirrors broader market trends, with the S&P 500 experiencing a winning streak. While the company's strategic moves might have reinforced its price gain, the broader positive market sentiment likely played a significant role.

Find companies with promising cash flow potential yet trading below their fair value.

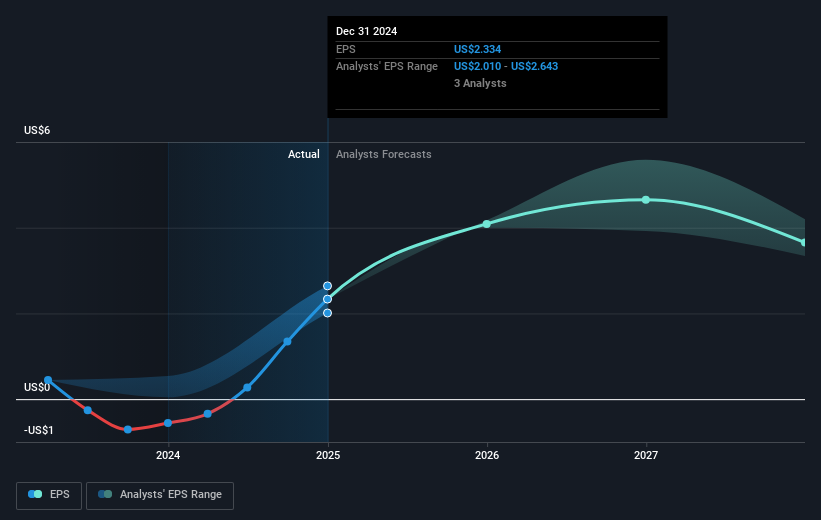

The recently announced sale of interest in two gold projects in Côte d'Ivoire by AngloGold Ashanti suggests a focus on concentrating efforts in key regions such as the U.S. and Guinea. This strategic pivot is expected to align the company with high-value peers and potentially improve capital access. In terms of revenue and earnings, such moves might boost operational efficiency and production output, contributing to enhanced profit margins. The integration of Centamin is anticipated to unlock operational synergies, which could further support revenue and earnings growth projections.

Over the past three years, AngloGold Ashanti's total shareholder return, including dividends, has reached 112.32%. This marks a significant growth period, with the company's shares showing strong performance compared to the broader U.S. market's one-year return of 9.5%. This trajectory indicates an overall robust performance in the longer term, bolstered by strategic repositioning and operational improvements.

As of today, AngloGold's current share price of US$40.68 is close to the consensus analyst price target of US$43.00, indicating a 5.4% potential upside. This proximity suggests that analysts see limited immediate underpricing of the stock based on current valuations. However, the company's future earnings and revenue growth expectations, assuming successful execution of its expansion projects, might justify a reassessment of the fair value in the coming years.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AU

AngloGold Ashanti

Operates as a gold mining company in Africa, Australia, and the Americas.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives