- United States

- /

- Chemicals

- /

- NYSE:ASPN

Aspen Aerogels, Inc.'s (NYSE:ASPN) Popularity With Investors Is Clear

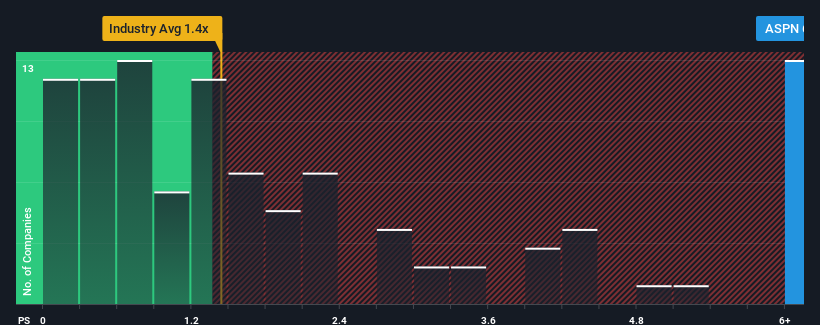

When you see that almost half of the companies in the Chemicals industry in the United States have price-to-sales ratios (or "P/S") below 1.4x, Aspen Aerogels, Inc. (NYSE:ASPN) looks to be giving off strong sell signals with its 6.7x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

See our latest analysis for Aspen Aerogels

How Aspen Aerogels Has Been Performing

With its revenue growth in positive territory compared to the declining revenue of most other companies, Aspen Aerogels has been doing quite well of late. Perhaps the market is expecting the company's future revenue growth to buck the trend of the industry, contributing to a higher P/S. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Aspen Aerogels' future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The High P/S?

The only time you'd be truly comfortable seeing a P/S as steep as Aspen Aerogels' is when the company's growth is on track to outshine the industry decidedly.

Retrospectively, the last year delivered an exceptional 53% gain to the company's top line. The latest three year period has also seen an excellent 188% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 44% each year as estimated by the eight analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 7.1% each year, which is noticeably less attractive.

In light of this, it's understandable that Aspen Aerogels' P/S sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What We Can Learn From Aspen Aerogels' P/S?

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our look into Aspen Aerogels shows that its P/S ratio remains high on the merit of its strong future revenues. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless these conditions change, they will continue to provide strong support to the share price.

Plus, you should also learn about these 4 warning signs we've spotted with Aspen Aerogels (including 1 which makes us a bit uncomfortable).

If you're unsure about the strength of Aspen Aerogels' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ASPN

Aspen Aerogels

An aerogel technology company, designs, develops, manufactures, and sells aerogel materials primarily for use in the energy industrial, sustainable insulation materials, and electric vehicle (EV) markets in the United States, Canada, Asia, Europe, and Latin America.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PRME remains a long shot but publication in the New England Journal of Medicine helps.

This one is all about the tax benefits

Estimated Share Price is $79.54 using the Buffett Value Calculation

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026