- United States

- /

- Metals and Mining

- /

- NYSE:AMR

What Alpha Metallurgical Resources (AMR)'s Lower 2025 Shipment Guidance Means For Shareholders

Reviewed by Sasha Jovanovic

- Alpha Metallurgical Resources recently reduced its 2025 shipment guidance for metallurgical coal to a range of 13.8 million to 14.8 million tons, with expected total sales volumes now between 14.6 million and 16.0 million tons.

- While the company maintained strong liquidity and continued to emphasize cost reductions, its updated outlook and recent net loss reflect continued challenges amid global steel demand softness.

- We'll examine how the reduced shipment guidance for 2025 could reshape Alpha Metallurgical Resources' future earnings outlook and investment narrative.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Alpha Metallurgical Resources Investment Narrative Recap

To consider Alpha Metallurgical Resources as a shareholder today, you need to believe in a rebound in global steel demand and the resilience of premium metallurgical coal markets. The latest cut to 2025 shipping guidance raises concerns about short-term sales volumes but does not fundamentally alter the potential benefit from future critical minerals tax incentives, which remain a key catalyst. However, weaker shipment outlook underscores that sustained demand recovery is still the main unknown for Alpha, while persistent cost discipline remains vital for margins.

Of the recent company announcements, the lowered shipment guidance for 2025 aligns directly with ongoing headwinds from weak steel demand and a softer coal price environment. In this context, Alpha's efforts to improve cost performance and maintain strong liquidity become central, not only for navigating tough quarters but for preserving the flexibility to capture earnings upsides if demand stabilizes. The company's commitment to cost reductions and liquidity appears increasingly important as shipment volumes remain pressured.

In contrast, investors should also be aware that exposure to regulatory and operational risks in the Central Appalachian region remains a significant factor to watch...

Read the full narrative on Alpha Metallurgical Resources (it's free!)

Alpha Metallurgical Resources’ outlook anticipates $2.9 billion in revenue and $505.0 million in earnings by 2028. This scenario is based on a 7.3% annual revenue growth rate and an increase in earnings of $542.2 million from the current loss of $-37.2 million.

Uncover how Alpha Metallurgical Resources' forecasts yield a $184.50 fair value, a 6% upside to its current price.

Exploring Other Perspectives

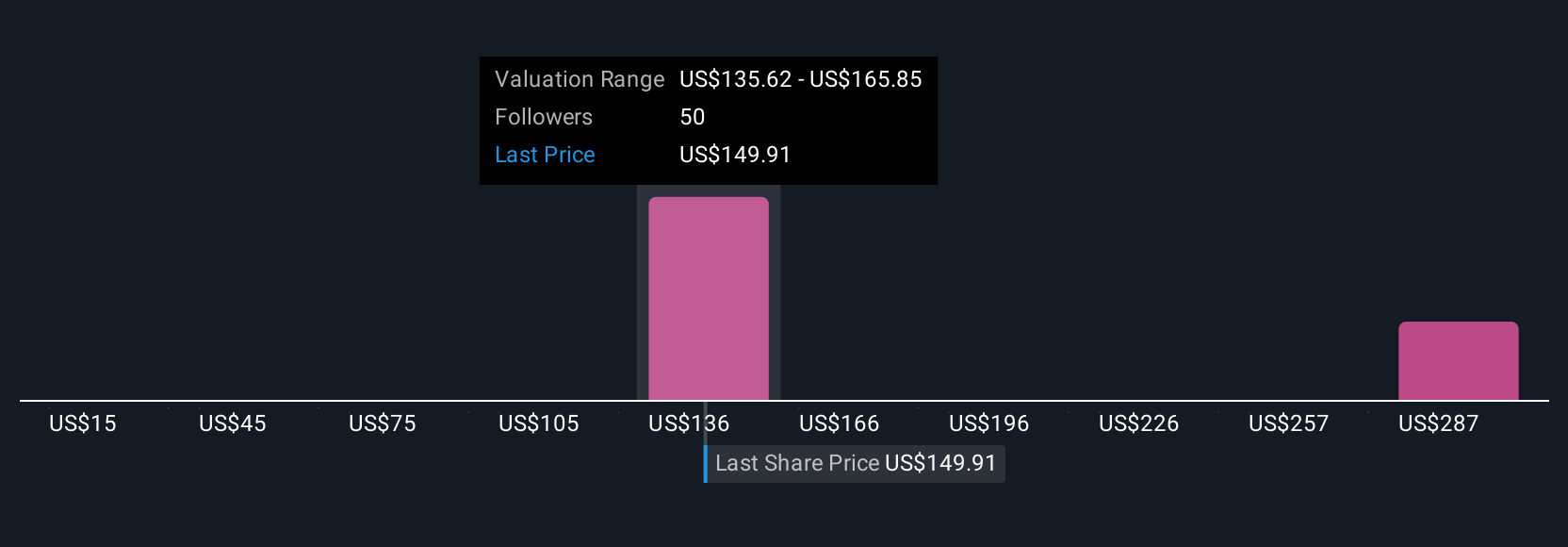

Six members of the Simply Wall St Community placed Alpha’s fair value anywhere from US$14.69 to US$524.72 per share. Ongoing weakness in global steel demand may shape financial results differently than many expect, so consider how much perspectives can vary before making decisions.

Explore 6 other fair value estimates on Alpha Metallurgical Resources - why the stock might be worth less than half the current price!

Build Your Own Alpha Metallurgical Resources Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Alpha Metallurgical Resources research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Alpha Metallurgical Resources research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Alpha Metallurgical Resources' overall financial health at a glance.

Looking For Alternative Opportunities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 38 companies in the world exploring or producing it. Find the list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AMR

Alpha Metallurgical Resources

A mining company, produces, processes, and sells met and thermal coal in Virginia and West Virginia.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives