- United States

- /

- Metals and Mining

- /

- NYSE:AMR

Alpha Metallurgical Resources (AMR): Assessing Valuation After Rolling Thunder Mine Fatal Accident and Operational Risks

Reviewed by Simply Wall St

Alpha Metallurgical Resources (AMR) shares came under pressure after the company confirmed a fatal flooding incident at its Rolling Thunder Mine in West Virginia, which led to the tragic loss of a section foreman.

See our latest analysis for Alpha Metallurgical Resources.

The recent fatal incident at Rolling Thunder Mine has cast a shadow over Alpha Metallurgical Resources, amplifying already cautious sentiment after a year of operational setbacks and softer earnings. Despite robust share buybacks and volume guidance updates, these challenges have weighed on momentum, as reflected in a year-to-date share price return of -21.4% and a one-year total shareholder return of -34.6%. Nevertheless, the long-term picture remains remarkable: Alpha’s five-year total shareholder return stands at an impressive 2,239%, far outpacing most peers in the sector.

If heightened industry risk has you interested in broader opportunities, now's a great time to step back and discover fast growing stocks with high insider ownership

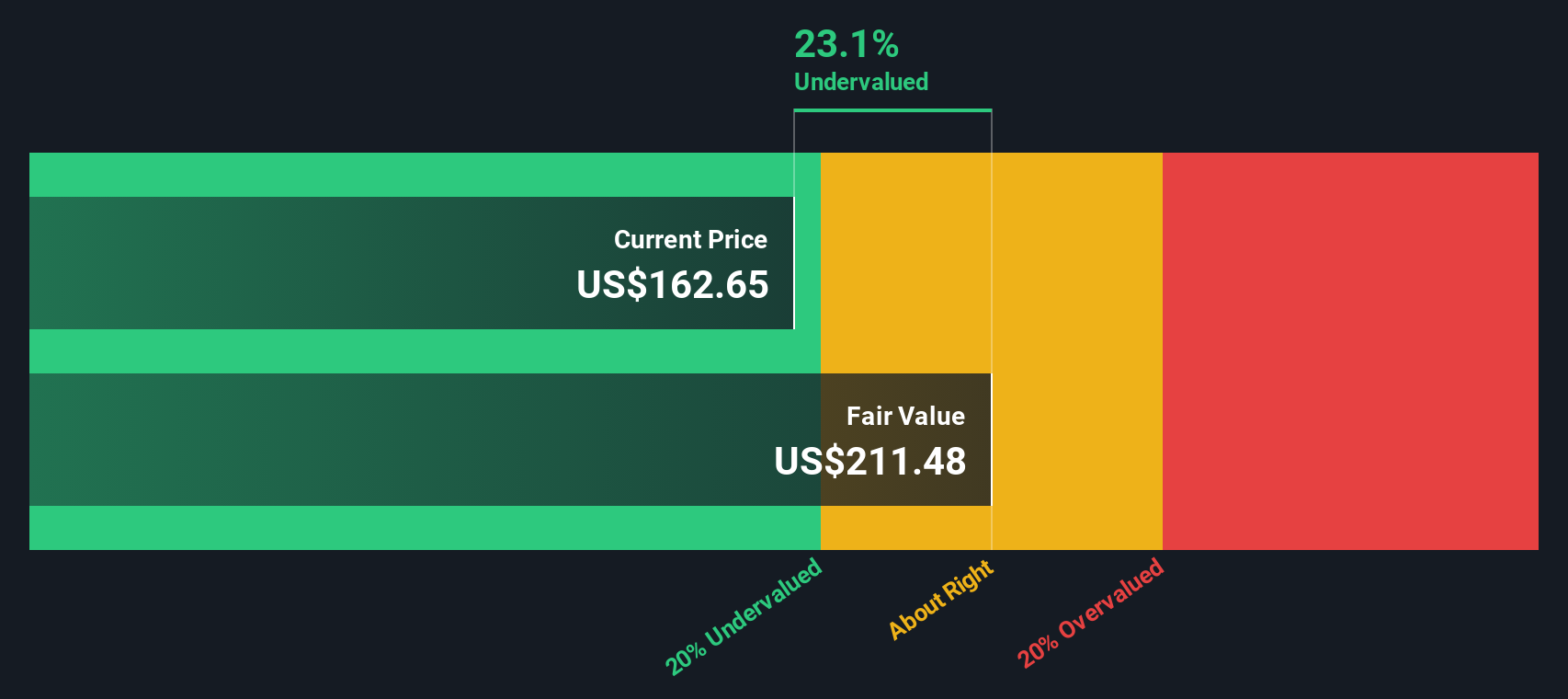

With the share price now sitting well below recent highs and sentiment running low, the question is whether Alpha Metallurgical Resources is trading at an appealing discount or if the market has already factored in future risks and growth.

Most Popular Narrative: 14.1% Undervalued

Alpha Metallurgical Resources is trading around $158.55, but the most-followed narrative sets its fair value at $184.50. This view sees upside based on the company's operational strengths and sector tailwinds, despite recent challenges.

Ongoing productivity improvements and sustained cost reductions have driven coal sales costs to their lowest levels since 2021. Management is confident cost discipline is "fundamental," and further marginal efficiency gains are possible, a development that enhances EBITDA margins and could produce above-consensus future earnings as coal price cycles normalize.

What is powering that premium? Behind the scenes, analysts are betting on aggressive earnings growth and margin expansion, with a valuation model that challenges sector norms. Want to know the exact levers they expect to drive Alpha's price even higher? The full narrative reveals every bold projection and makes the entire case in detail.

Result: Fair Value of $184.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained weakness in global steel demand or operational disruptions in Alpha’s core Appalachian mines could quickly challenge this optimistic fair value outlook.

Find out about the key risks to this Alpha Metallurgical Resources narrative.

Another View: DCF Model Paints a Different Picture

Switching gears, our SWS DCF model suggests Alpha Metallurgical Resources may be even more undervalued, calculating a fair value of $476.77, which is far above both its current price and analyst targets. Could the market be missing something, or is the DCF too optimistic in its outlook?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Alpha Metallurgical Resources Narrative

If you want to take a different approach or have insights of your own, it takes just a few minutes to build your independent view. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Alpha Metallurgical Resources.

Looking for More Investment Ideas?

Smart investors know that opportunity never sleeps. Spark your next move by tapping into these unique trends so you don’t let the perfect stock slip out of your grasp.

- Uncover companies building tomorrow’s AI landscape by starting your search with these 25 AI penny stocks and see which innovators are set for rapid growth.

- Boost your portfolio’s income potential by targeting reliable cash flows and strong yields through these 16 dividend stocks with yields > 3%, and stay ahead of the market curve.

- Catch the early wave in digital assets with these 82 cryptocurrency and blockchain stocks, where you can find emerging leaders shaping the future of blockchain and crypto innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AMR

Alpha Metallurgical Resources

A mining company, produces, processes, and sells met and thermal coal in Virginia and West Virginia.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives