- United States

- /

- Packaging

- /

- NYSE:AMCR

Reassessing Amcor (NYSE:AMCR) Valuation as Shares Lag Analyst Targets Despite Earnings Growth

Reviewed by Simply Wall St

Amcor (NYSE:AMCR) shares have seen mixed movement over the past month, with the stock slipping around 1%. Despite this, the company’s annual revenue and net income have both grown, which has drawn interest from valuation-focused investors.

See our latest analysis for Amcor.

Amcor’s share price has felt the pressure lately, with a 17% drop over the past three months and a 12.9% decline year-to-date. This reflects shifting sentiment in packaging stocks. The total shareholder return over the past year sits at minus 21.8%, so momentum remains on the back foot, even as the company remains profitable and continues to grow its underlying business.

If you’re weighing up other opportunities as the market mood shifts, it could be a smart time to discover fast growing stocks with high insider ownership

With shares trading well below analyst targets despite recent growth in earnings and revenue, investors may be wondering whether Amcor is flying under the radar or if the market is already looking ahead and pricing in its future prospects.

Most Popular Narrative: 21.9% Undervalued

At $8.14 per share, Amcor trades noticeably below the narrative fair value estimate of $10.43, hinting at a substantial gap between market sentiment and projected growth. The setup for this view rests on transformative bets and ambitious integration plans within the packaging sector.

The integration of Berry Global with Amcor is expected to yield $650 million in synergies by fiscal 2028 (with $260 million in fiscal 2026), primarily through cost reduction, procurement optimization, and operational efficiencies, which should support sustained EPS and margin expansion.

Curious about what powers this bold valuation leap? The most popular analyst narrative banks on big margin improvements and a sharp profit climb by 2028. There is one financial projection that will catch you off guard. Tap in to uncover the precise growth drivers and why the consensus is sticking to its high target.

Result: Fair Value of $10.43 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weak consumer demand and ongoing volume declines in key segments could challenge Amcor's ability to deliver on its optimistic growth outlook.

Find out about the key risks to this Amcor narrative.

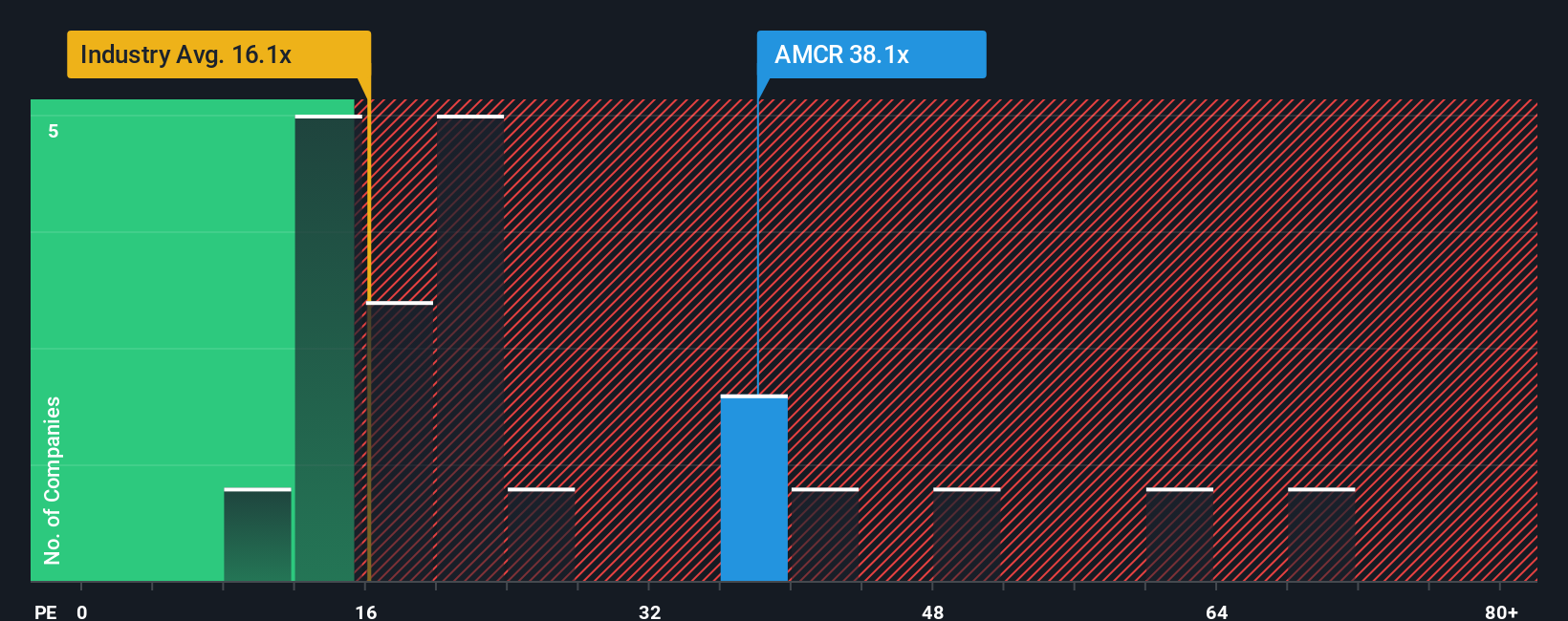

Another View: Valuation Through Multiples

Taking a step back from fair value estimates, Amcor currently trades at a price-to-earnings ratio of 36.8x. This is not only higher than the global packaging industry average of 16x and its peer average of 29.7x, but is also well above the market’s fair ratio of 25.6x. This wide gap can mean heightened risk of the share price being pulled back, especially if earnings growth does not accelerate. Are investors banking too much on turnaround, or is the market slow to factor in future upside?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Amcor Narrative

If you want to dig into the details or think a different story is emerging, it's easy to shape your own view in just a few minutes, so Do it your way.

A great starting point for your Amcor research is our analysis highlighting 3 key rewards and 5 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Boost your investing confidence by checking out stock ideas beyond Amcor. These handpicked opportunities could unlock new returns and put you ahead of the market.

- Spot income potential and secure attractive yields with these 17 dividend stocks with yields > 3%, offering reliable payouts for long-term portfolios.

- Catch innovation early as these 24 AI penny stocks reshape industries through artificial intelligence breakthroughs and rapid growth trajectories.

- Capitalize on deep value with these 879 undervalued stocks based on cash flows, surfacing companies whose fundamentals signal true bargain territory.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AMCR

Amcor

Engages in the production and sale of packaging products in Europe, North America, Latin America, and the Asia Pacific.

Moderate risk with moderate growth potential.

Similar Companies

Market Insights

Community Narratives