- United States

- /

- Packaging

- /

- NYSE:AMCR

Did Amcor's (AMCR) CFO Transition and Healthcare Packaging Launch Just Shift Its Investment Narrative?

Reviewed by Sasha Jovanovic

- Amcor announced the appointment of Stephen R. Scherger as Chief Financial Officer, effective November 10, 2025, succeeding Michael Casamento, while also reaffirming its fiscal 2026 earnings guidance as previously outlined.

- The simultaneous leadership transition and the launch of AmSecure, a proprietary healthcare packaging innovation, mark significant steps toward operational development and market differentiation for Amcor.

- We'll examine how Stephen R. Scherger's arrival as CFO could impact Amcor's investment narrative and operational outlook.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Amcor Investment Narrative Recap

For shareholders, the case for Amcor centers on the company’s ability to deliver on earnings growth by capturing acquisition synergies, strengthening its focus on high-growth segments, and optimizing its product portfolio. The recent appointment of Stephen R. Scherger as CFO and the reaffirmation of fiscal 2026 guidance signal stability in Amcor's leadership and outlook, but these changes are not expected to materially impact near-term catalysts, such as synergy realization from the Berry merger, or lessen ongoing risks tied to persistent volume weakness, especially in North America.

Among recent developments, the company’s reaffirmed fiscal 2026 earnings guidance stands out as particularly relevant, offering clarity to investors during this period of executive transition. While the leadership handover may build operational momentum, the core issues, like restoring organic growth and executing portfolio reviews, remain at the forefront of Amcor’s near-term narrative.

However, investors should be mindful that persistent volume declines in key businesses could still pose significant headwinds if ...

Read the full narrative on Amcor (it's free!)

Amcor's narrative projects $24.3 billion revenue and $1.7 billion earnings by 2028. This requires 17.5% yearly revenue growth and a $1.19 billion earnings increase from $510.0 million.

Uncover how Amcor's forecasts yield a $10.59 fair value, a 30% upside to its current price.

Exploring Other Perspectives

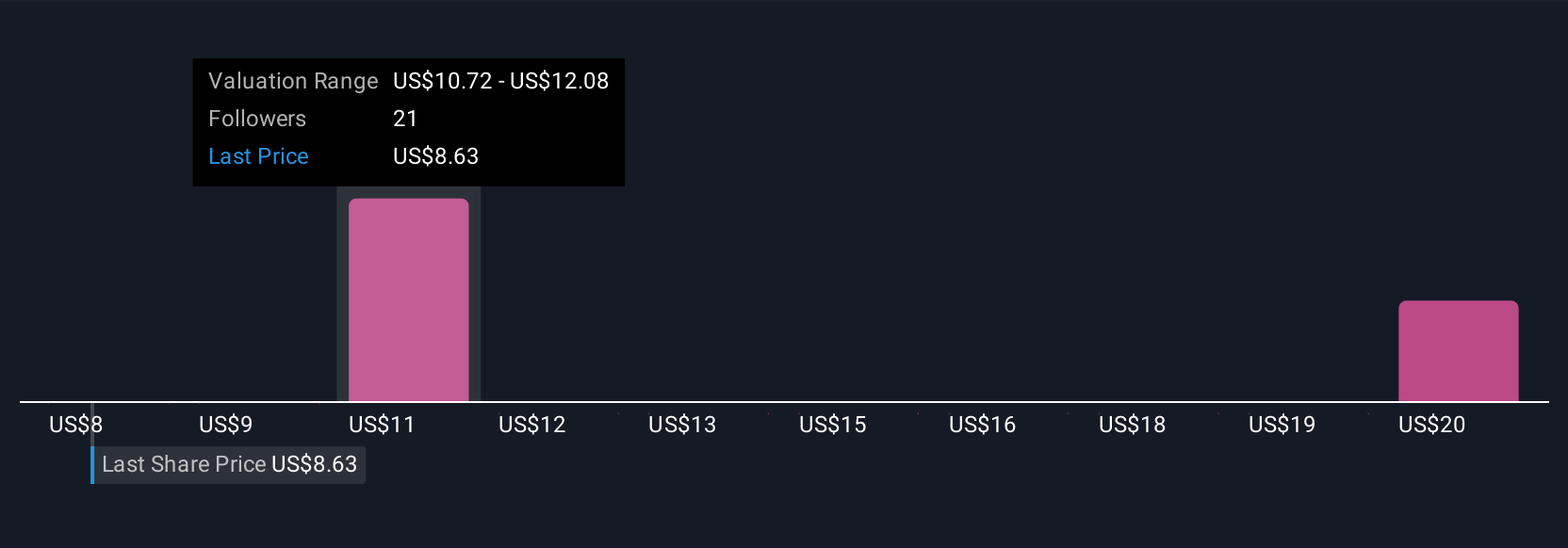

Five fair value estimates from the Simply Wall St Community range from US$8.43 to US$10.59 per share. While many see upside in Amcor’s projected earnings growth, the wide spectrum of opinion highlights how much expectations for synergy realization and volume recovery can shape perspectives on future performance.

Explore 5 other fair value estimates on Amcor - why the stock might be worth just $8.43!

Build Your Own Amcor Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Amcor research is our analysis highlighting 3 key rewards and 5 important warning signs that could impact your investment decision.

- Our free Amcor research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Amcor's overall financial health at a glance.

Looking For Alternative Opportunities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AMCR

Amcor

Engages in the production and sale of packaging products in Europe, North America, Latin America, and the Asia Pacific.

Moderate risk with moderate growth potential.

Similar Companies

Market Insights

Community Narratives