- United States

- /

- Packaging

- /

- NYSE:AMBP

Is Ardagh Metal Packaging Still Attractive After Recent Double-Digit Rally in 2025?

Reviewed by Bailey Pemberton

Thinking about what to do with Ardagh Metal Packaging stock? You are definitely not alone. As markets continue to gauge everything from raw material prices to shifting demand in the beverage can industry, Ardagh’s stock has quietly put in a run that should catch investors’ attention. Even after a modest 0.8% slip in the past week, the stock is up 9.5% over the past month, 32.0% year-to-date, and a solid 19.2% in the past year. However, if you zoom out to the longer term, the five-year return stands at -42.3%, highlighting a past rough patch that many investors haven’t forgotten.

So, what do these moves tell us? The shorter-term performance suggests a noticeable shift in sentiment. Industry analysts have noted that steadier aluminum costs and growing demand for sustainable packaging play well for Ardagh’s business model. There is growing optimism that current market developments such as increased focus on recyclable materials and supply chain stabilization are contributing factors nudging the stock higher.

The real question for anyone eyeing Ardagh Metal Packaging is valuation. Is the stock’s recent momentum justified, or is the market getting ahead of itself? Based on our valuation framework, Ardagh scores a 5 out of 6, signaling the company appears undervalued on nearly every measure we track.

Next, we will unpack what drives this score by diving into the main valuation methods, showing how Ardagh stacks up across each one. But stay tuned, because I will wrap up by sharing an even more insightful way to weigh value that many investors overlook.

Approach 1: Ardagh Metal Packaging Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates the value of a company by projecting its future free cash flows (FCF) and then discounting those amounts back to their value in today's dollars. This approach is favored for capital-intensive businesses where cash generation is critical to long-term value.

For Ardagh Metal Packaging, current trailing twelve month free cash flow stands at $113.3 million. Analysts forecast growth in free cash flow each year, and by 2027, it is projected to reach $269.9 million. Beyond this period, Simply Wall St extrapolates up to ten years ahead and estimates that free cash flow could rise even further as the business matures and benefits from growing demand for sustainable packaging. All cash flows are measured in U.S. dollars.

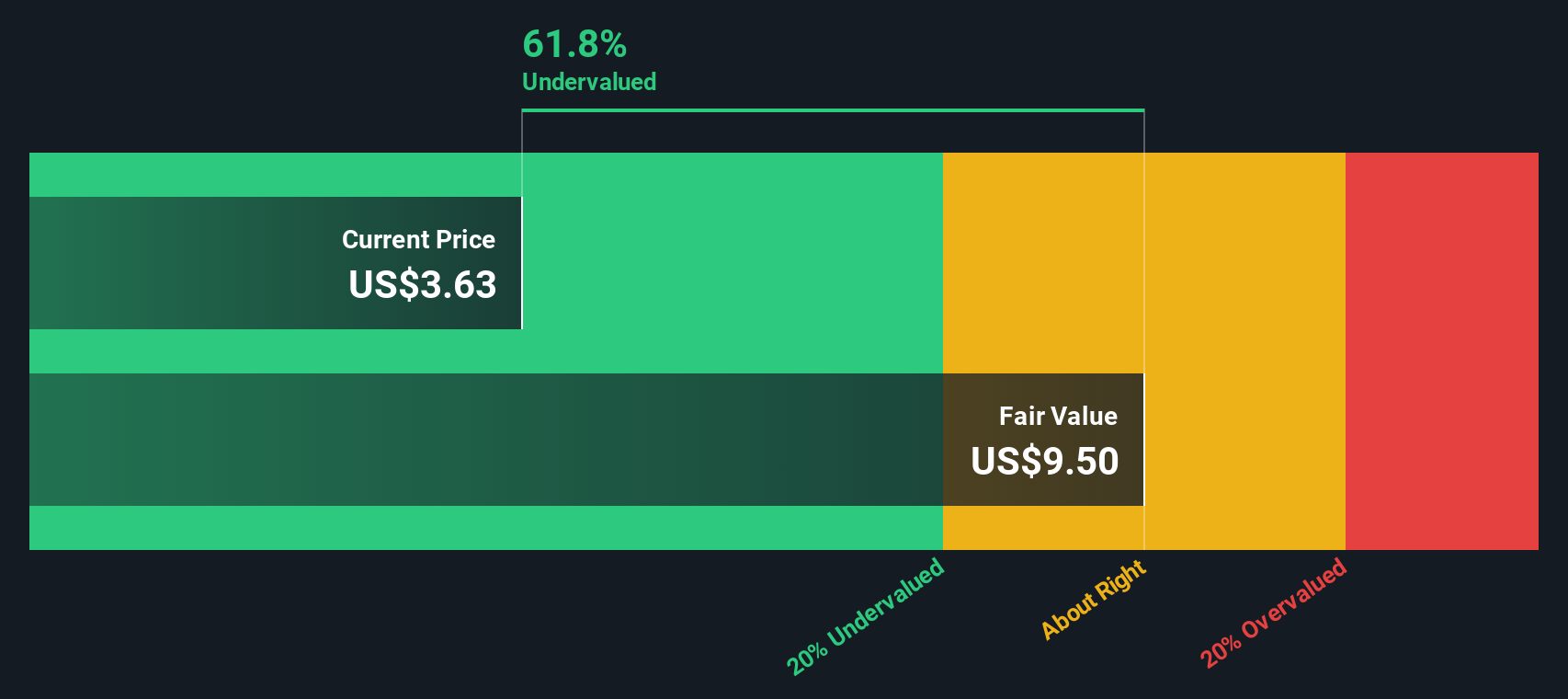

When these future cash flows are discounted back to the present, the estimated intrinsic value per share is $9.94. With the current market price implying a 60.6 percent discount, the DCF model indicates Ardagh Metal Packaging is significantly undervalued at current levels.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Ardagh Metal Packaging is undervalued by 60.6%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Ardagh Metal Packaging Price vs Sales

The price-to-sales (P/S) ratio is the preferred multiple for evaluating Ardagh Metal Packaging, especially relevant for companies in capital-intensive, lower margin industries like packaging where earnings can fluctuate. For profitable firms such as Ardagh, P/S offers a clear snapshot of how the market values every dollar of revenue. This makes it a useful baseline for comparison both within the packaging sector and among close peers.

While a company’s fair valuation often depends on expectations for future growth and perceived risk, generally companies with stronger growth and lower risk warrant a higher P/S ratio. Slower-growing or higher-risk businesses naturally command a lower multiple.

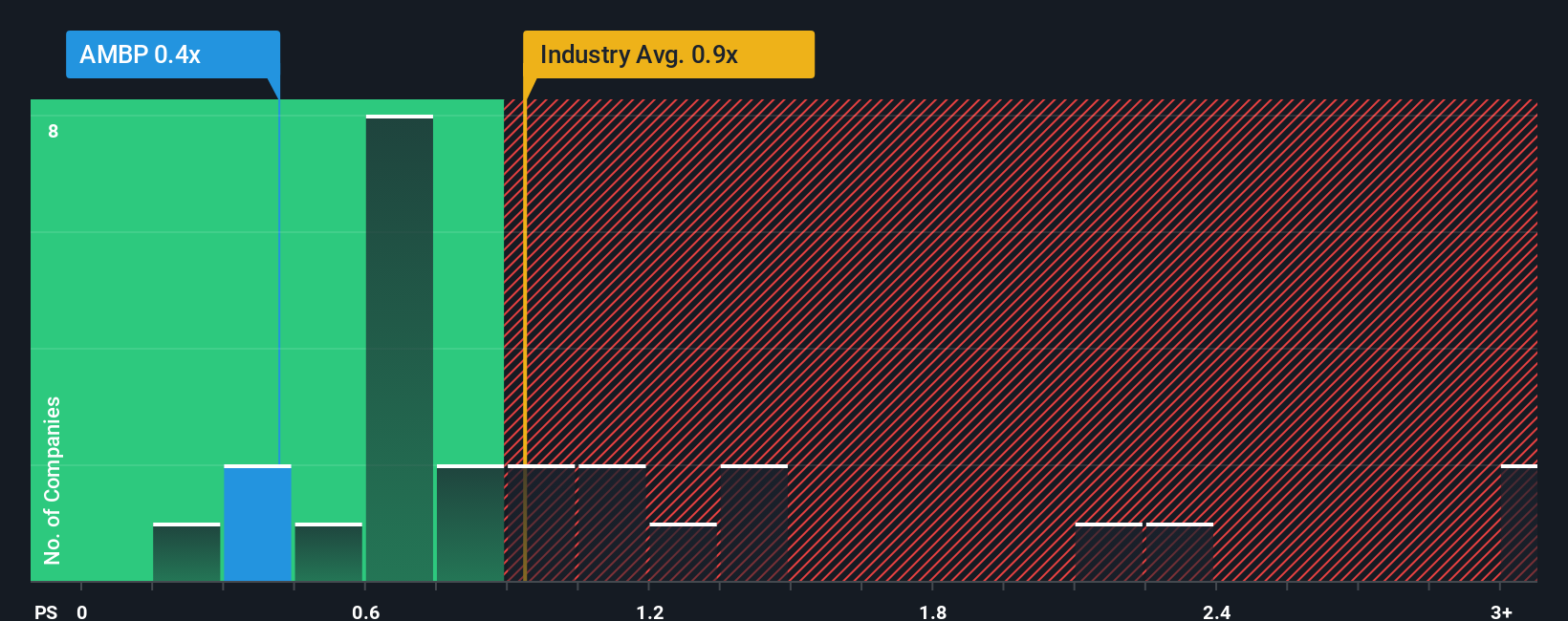

Currently, Ardagh’s P/S multiple sits at 0.45x. For context, the industry average P/S is 1.01x, and its peer group averages 0.79x. On the surface, Ardagh trades at a notable discount. However, Simply Wall St’s proprietary “Fair Ratio” for Ardagh, which incorporates more than just simple industry benchmarks by factoring in growth prospects, profit margins, market cap, and unique business risks, is 0.74x. This Fair Ratio provides a much more tailored and comprehensive assessment than basic benchmarking alone.

Comparing Ardagh’s P/S multiple of 0.45x to its Fair Ratio of 0.74x, the stock once again looks undervalued relative to its specific fundamentals and the sector overall.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Ardagh Metal Packaging Narrative

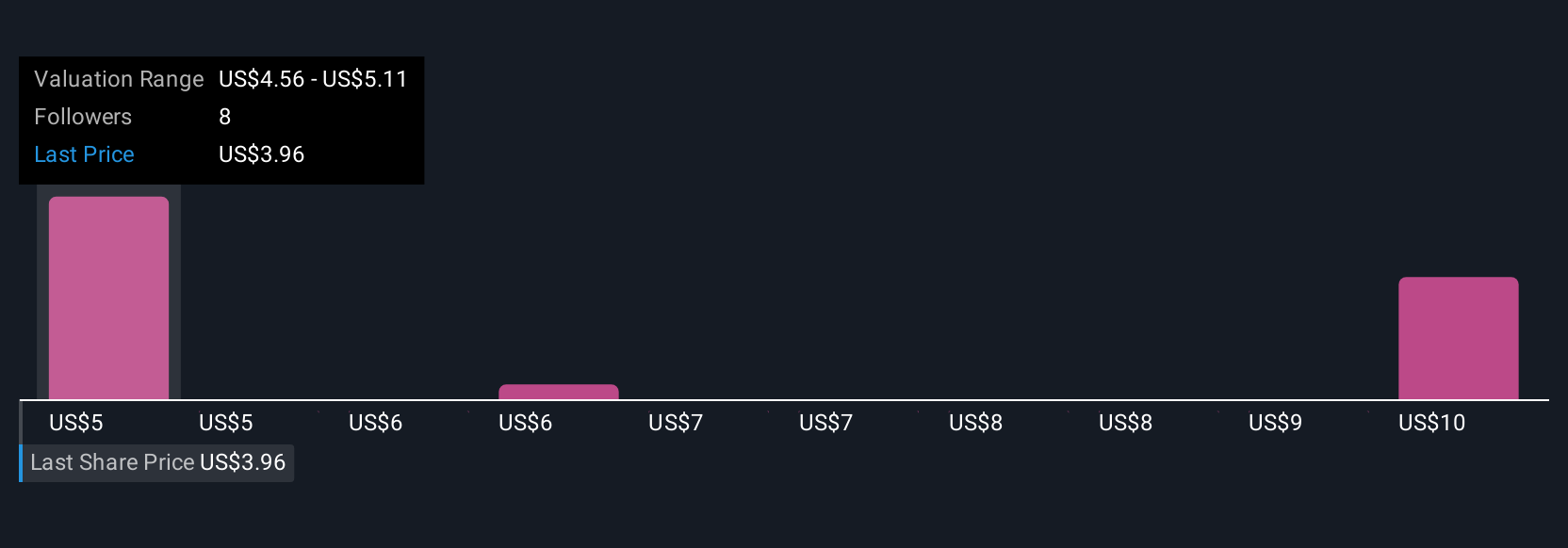

Earlier we mentioned that there is an even better way to understand valuation. Let's introduce you to Narratives. A Narrative is essentially your story about a company, built around your expectations for its financial future, including how you think its revenue, margins, and fair value will evolve. Narratives link a company’s real-world situation and growth prospects directly to your forecasts and a dynamic estimate of fair value, providing a more personal and insightful lens beyond just the numbers.

Narratives are easy to build and access on Simply Wall St’s platform within the Community page, where millions of investors share and update their perspectives. With Narratives, you can see at a glance how your view of fair value compares to the current price, helping you decide not just what the stock is worth now, but when it might make sense to buy or sell. The best part is, Narratives auto-update when new news, earnings, or data changes emerge, keeping your investment thesis fresh and relevant.

For example, one investor might have a bullish Narrative for Ardagh Metal Packaging with a fair value of $5.00, driven by optimism about global expansion and sustainable packaging trends; whereas another might see more risk and set their fair value closer to $4.00. Which Narrative do you think fits best?

Do you think there's more to the story for Ardagh Metal Packaging? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AMBP

Ardagh Metal Packaging

Operates as a metal beverage can company in Europe, the United States, and Brazil.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives