- United States

- /

- Chemicals

- /

- NYSE:ALTM

More Unpleasant Surprises Could Be In Store For Arcadium Lithium plc's (NYSE:ALTM) Shares After Tumbling 27%

Arcadium Lithium plc (NYSE:ALTM) shares have had a horrible month, losing 27% after a relatively good period beforehand. For any long-term shareholders, the last month ends a year to forget by locking in a 51% share price decline.

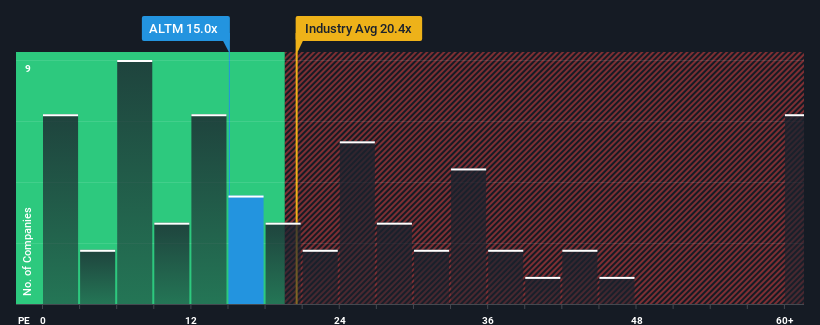

In spite of the heavy fall in price, it's still not a stretch to say that Arcadium Lithium's price-to-earnings (or "P/E") ratio of 15x right now seems quite "middle-of-the-road" compared to the market in the United States, where the median P/E ratio is around 17x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

With its earnings growth in positive territory compared to the declining earnings of most other companies, Arcadium Lithium has been doing quite well of late. One possibility is that the P/E is moderate because investors think the company's earnings will be less resilient moving forward. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

See our latest analysis for Arcadium Lithium

How Is Arcadium Lithium's Growth Trending?

Arcadium Lithium's P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 76% last year. Still, EPS has barely risen at all from three years ago in total, which is not ideal. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Looking ahead now, EPS is anticipated to slump, contracting by 24% each year during the coming three years according to the ten analysts following the company. With the market predicted to deliver 12% growth per annum, that's a disappointing outcome.

In light of this, it's somewhat alarming that Arcadium Lithium's P/E sits in line with the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the negative growth outlook.

The Final Word

With its share price falling into a hole, the P/E for Arcadium Lithium looks quite average now. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Arcadium Lithium's analyst forecasts revealed that its outlook for shrinking earnings isn't impacting its P/E as much as we would have predicted. When we see a poor outlook with earnings heading backwards, we suspect share price is at risk of declining, sending the moderate P/E lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Before you settle on your opinion, we've discovered 2 warning signs for Arcadium Lithium that you should be aware of.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:ALTM

Arcadium Lithium

Engages in the production of lithium chemicals products in the Asia Pacific, North America, Europe, the Middle East, Africa, and Latin America.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives