- United States

- /

- Chemicals

- /

- NYSE:ALB

Albemarle (NYSE:ALB) Removed From FTSE All-World Index As Stock Dips 8% Over The Past Month

Reviewed by Simply Wall St

Albemarle (NYSE:ALB) experienced a 7% decline over the past month, a move significantly impacted by its removal from the FTSE All-World Index. This change in status likely affected investor sentiment, contributing to the stock's performance. Additionally, general market volatility has intensified due to escalating global trade tensions and a tariff-induced sell-off, which pushed the Dow Jones and Nasdaq into correction and bear market territories, respectively. Amid this widespread market downturn, Albemarle's stock movement aligns with broader economic concerns, overshadowing potential company-specific developments or prospects within the chemical sector.

Buy, Hold or Sell Albemarle? View our complete analysis and fair value estimate and you decide.

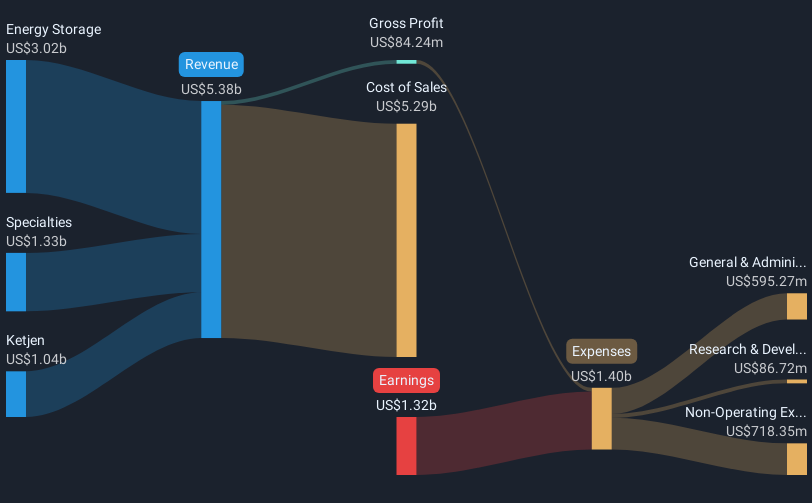

Over the past five years, Albemarle (NYSE:ALB) reported a total shareholder return of 4.89%. Recent challenges, such as a full-year net loss of US$1.18 billion for 2024, contributed to a lackluster longer-term performance. These financial results marked a significant change from a net income of US$1.57 billion previously. Additionally, Albemarle's drop from the FTSE All-World Index may have compounded the recent investor sentiment, influencing both short-term and long-term returns.

During this period, Albemarle's strategic efforts included a collaboration with Caterpillar Inc. on sustainable lithium mining operations, an initiative reflecting an attempt to strengthen its growth potential. However, despite these efforts, Albemarle's stock underperformed both the US market and the chemicals industry over the last year, with challenges such as being perceived as expensive relative to peers and operating at a loss. The absence of stock buybacks in recent quarters further amplifies shareholder concerns about financial priorities.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Albemarle, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ALB

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives