- United States

- /

- Metals and Mining

- /

- NYSE:AEM

Is Agnico Eagle Mines (AEM) Reshaping Its Core Priorities With the Royal Road Minerals Exit?

Reviewed by Sasha Jovanovic

- On September 29, 2025, Agnico Eagle Mines Limited announced it had sold its entire stake of nearly 48 million shares in Royal Road Minerals Limited via the Toronto Stock Exchange.

- This divestment signals Agnico Eagle's commitment to optimizing its investment portfolio and prioritizing projects that align closely with its core operations.

- We’ll explore how the decision to exit Royal Road Minerals could enhance Agnico Eagle’s focus on core growth projects and financial flexibility.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Agnico Eagle Mines Investment Narrative Recap

To be a shareholder in Agnico Eagle Mines right now, you’d need confidence that strong gold prices and effective execution of core projects will continue to drive performance, while understanding that profitability is closely tied to gold market volatility. The recent sale of the Royal Road Minerals stake doesn’t materially impact the company’s most immediate catalyst, continued organic production growth, but it does affirm management’s focus on core assets. The primary risk remains the company’s exposure to gold price swings, which could rapidly affect margins and bottom-line results.

Among recent company updates, Agnico’s reaffirmation of its 2025 production guidance following robust quarterly earnings and gold production stands out. This ongoing operational consistency reinforces the key catalyst for shareholders: the ability to deliver production growth and strong cash flow from core mining assets, irrespective of portfolio adjustments like the Royal Road exit.

However, for those weighing the company’s outlook, it's essential to recognize that if gold prices shift lower for a sustained period, the company’s earnings and expansion plans could look very different...

Read the full narrative on Agnico Eagle Mines (it's free!)

Agnico Eagle Mines is projected to achieve $11.0 billion in revenue and $3.4 billion in earnings by 2028. This outlook is based on annual revenue growth of 4.4% and an earnings increase of $0.4 billion from the current $3.0 billion level.

Uncover how Agnico Eagle Mines' forecasts yield a $148.55 fair value, a 12% downside to its current price.

Exploring Other Perspectives

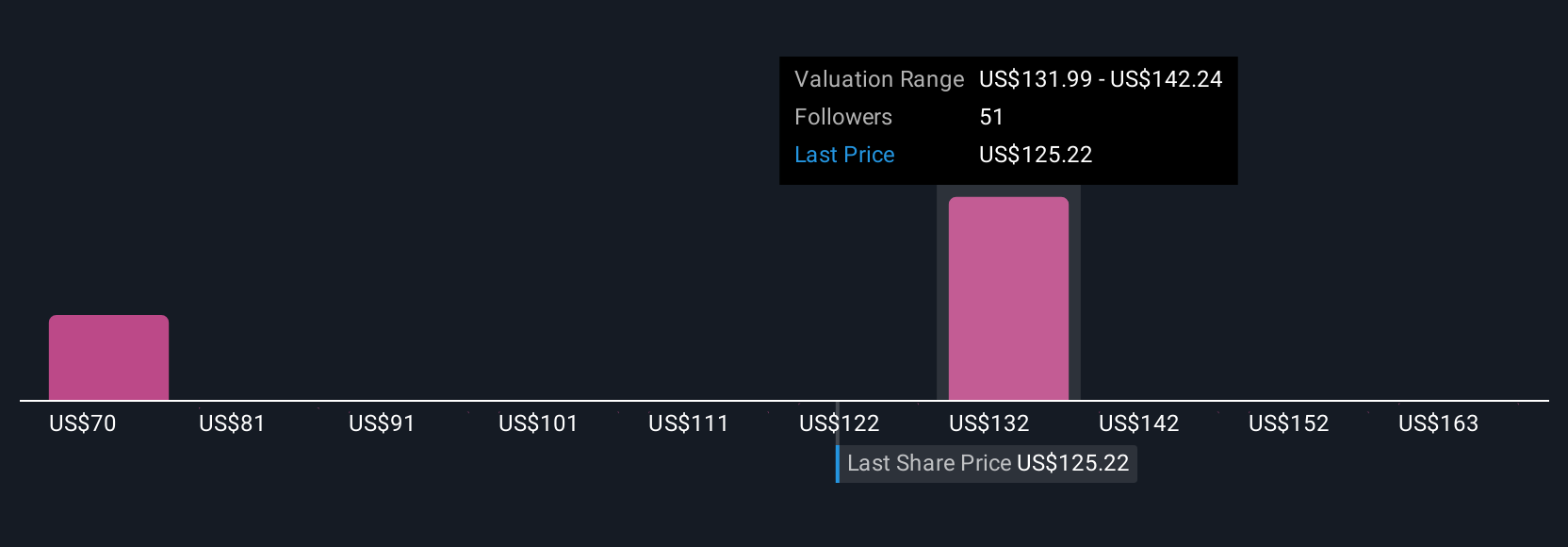

Simply Wall St Community members shared 11 fair value estimates for Agnico Eagle Mines, ranging from US$62.26 to US$207.22 per share. With such diverse viewpoints, considering the company’s dependence on elevated gold prices is key to understanding how different market outcomes might affect its future.

Explore 11 other fair value estimates on Agnico Eagle Mines - why the stock might be worth less than half the current price!

Build Your Own Agnico Eagle Mines Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Agnico Eagle Mines research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Agnico Eagle Mines research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Agnico Eagle Mines' overall financial health at a glance.

No Opportunity In Agnico Eagle Mines?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AEM

Agnico Eagle Mines

A gold mining company, engages in the exploration, development, and production of precious metals.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.