- United States

- /

- Metals and Mining

- /

- NYSE:AEM

Here's Why We Think Agnico Eagle Mines (NYSE:AEM) Is Well Worth Watching

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

In contrast to all that, many investors prefer to focus on companies like Agnico Eagle Mines (NYSE:AEM), which has not only revenues, but also profits. While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

See our latest analysis for Agnico Eagle Mines

How Fast Is Agnico Eagle Mines Growing?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. That means EPS growth is considered a real positive by most successful long-term investors. Shareholders will be happy to know that Agnico Eagle Mines' EPS has grown 23% each year, compound, over three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be beaming.

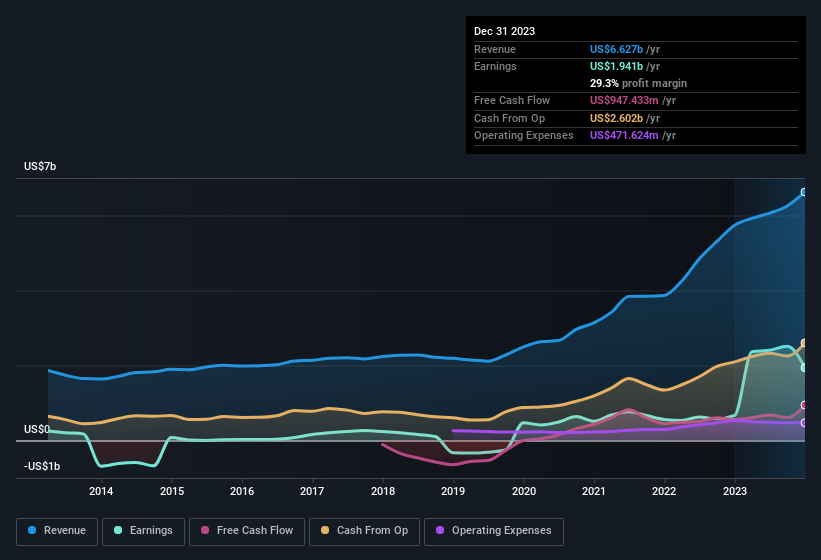

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. The music to the ears of Agnico Eagle Mines shareholders is that EBIT margins have grown from 25% to 27% in the last 12 months and revenues are on an upwards trend as well. Ticking those two boxes is a good sign of growth, in our book.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for Agnico Eagle Mines.

Are Agnico Eagle Mines Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. Because often, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

In the last year insider at Agnico Eagle Mines were both selling and buying shares; but happily, as a group they spent US$155k more on stock, than they netted from selling it. Shareholders who may have questioned insiders selling will find some reassurance in this fact. We also note that it was the Executive VP of Finance & Chief Financial Officer, James Porter, who made the biggest single acquisition, paying US$489k for shares at about US$48.99 each.

The good news, alongside the insider buying, for Agnico Eagle Mines bulls is that insiders (collectively) have a meaningful investment in the stock. To be specific, they have US$44m worth of shares. This considerable investment should help drive long-term value in the business. Despite being just 0.2% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

While insiders are apparently happy to hold and accumulate shares, that is just part of the big picture. The cherry on top is that the CEO, Ammar Al-Joundi is paid comparatively modestly to CEOs at similar sized companies. Our analysis has discovered that the median total compensation for the CEOs of companies like Agnico Eagle Mines, with market caps over US$8.0b, is about US$12m.

Agnico Eagle Mines' CEO took home a total compensation package worth US$7.6m in the year leading up to December 2022. That seems pretty reasonable, especially given it's below the median for similar sized companies. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Should You Add Agnico Eagle Mines To Your Watchlist?

You can't deny that Agnico Eagle Mines has grown its earnings per share at a very impressive rate. That's attractive. Not only that, but we can see that insiders both own a lot of, and are buying more shares in the company. So it's fair to say that this stock may well deserve a spot on your watchlist. Before you take the next step you should know about the 4 warning signs for Agnico Eagle Mines (1 makes us a bit uncomfortable!) that we have uncovered.

Keen growth investors love to see insider buying. Thankfully, Agnico Eagle Mines isn't the only one. You can see a a curated list of companies which have exhibited consistent growth accompanied by recent insider buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:AEM

Agnico Eagle Mines

A gold mining company, exploration, development, and production of precious metals.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives