- United States

- /

- Metals and Mining

- /

- NYSE:AA

A Look at Alcoa’s Valuation After Strong Q3 Earnings, New Energy Contract, and Massena Investment

Reviewed by Simply Wall St

Alcoa (NYSE:AA) delivered a strong third-quarter update, revealing that net income more than doubled from last year. The company also confirmed its full-year production outlook, while unveiling a new long-term energy contract and a fresh investment in its Massena smelter.

See our latest analysis for Alcoa.

Alcoa’s recent string of positive news, from robust third-quarter results to a new energy contract and strategic investments, has clearly energized investor sentiment. The stock’s share price has leapt over 20% in the past month and 30% over the past 90 days, significantly outpacing its modest year-to-date gains. However, looking longer term, Alcoa’s total shareholder return is down 3% over the past year but remains impressive at nearly 197% over five years. Momentum here appears to be building again as market confidence returns.

If you're curious where else investors are spotting fresh momentum, now's a perfect time to discover fast growing stocks with high insider ownership.

With shares rallying sharply in the wake of strong results and major new investments, the key question now is whether Alcoa remains undervalued or if the stock’s recent gains have already factored in most of its future growth potential. Is this the next buying opportunity, or is the market already looking ahead?

Most Popular Narrative: 30% Overvalued

Analyst consensus forecasts imply a fair value well below Alcoa’s recent closing price, highlighting tensions between short-term optimism and longer-term expectations. This sets the context for a deeper look at the drivers shaping this narrative.

Growing adoption of recycled aluminum and substitute lightweight materials in automotive and construction could erode long-term demand growth for primary aluminum. This may make future revenue growth expectations for Alcoa optimistic and possibly contribute to overvaluation.

How do analysts justify their view with such a big gap between market price and their fair value? The answer lies in surprisingly cautious assumptions for future earnings, margin compression, and the premium investors must believe is sustainable far into the future. What number would Alcoa need to hit to support that higher price? The full narrative reveals the boldest projections and why this valuation might surprise even seasoned investors.

Result: Fair Value of $39.21 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, strong global decarbonization efforts or breakthroughs in low-carbon aluminum production could rapidly strengthen demand and challenge current caution around Alcoa’s long-term growth prospects.

Find out about the key risks to this Alcoa narrative.

Another View: Market Compares Favorably

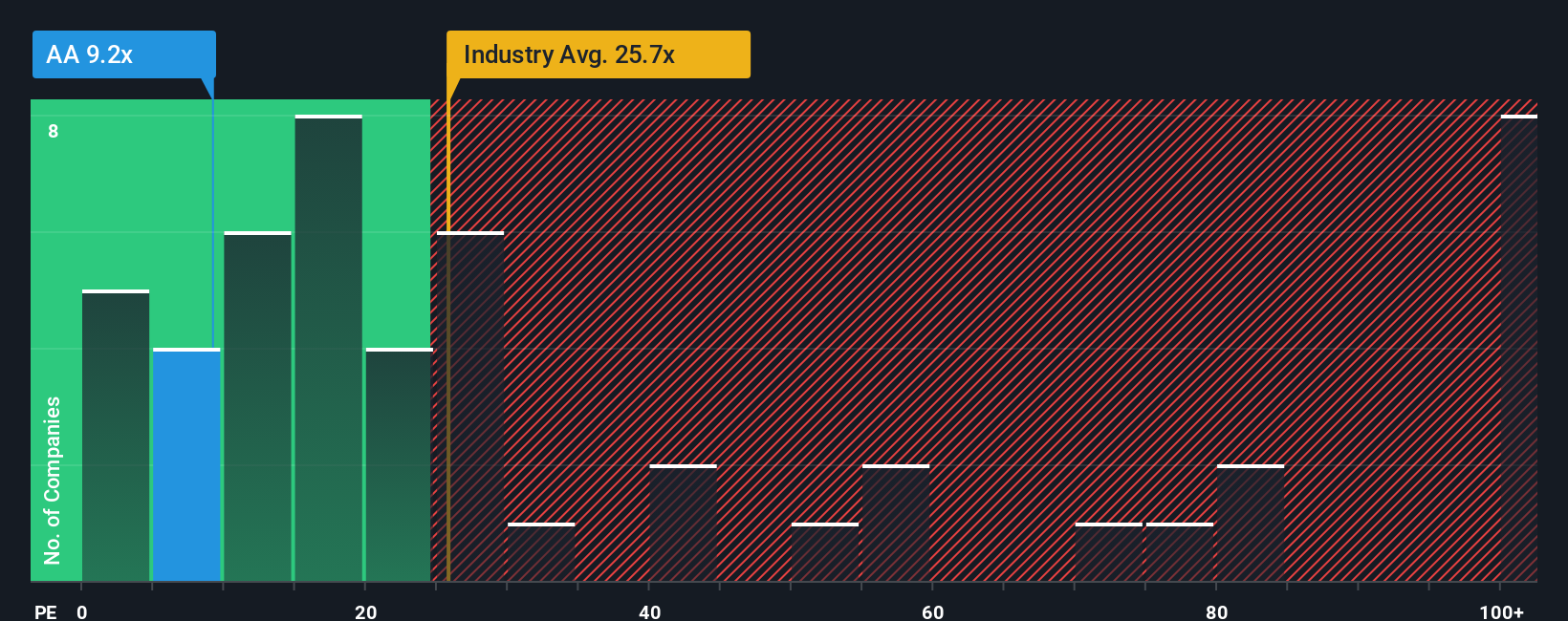

While the first method paints Alcoa as overvalued, taking a look at the market's most common snapshot method, the price-to-earnings ratio, offers a different story. Alcoa currently trades at just 9 times earnings, which is dramatically lower than both its peer average of 32.1x and the broader U.S. Metals and Mining industry average of 25.7x. The fair ratio for Alcoa is estimated at 17x, suggesting investors may be undervaluing the company compared to what the market might later reflect. Does this valuation gap point to an opportunity, or is it a warning about future growth?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Alcoa Narrative

If you see things differently or want to dig into the numbers and trends on your own terms, you can assemble your own view in just a few minutes. Do it your way.

A great starting point for your Alcoa research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Expand your investing toolkit and make your research count. Take action now and see what other opportunities are waiting for you on Simply Wall Street.

- Capture the upside of rapid tech disruption by scanning these 26 AI penny stocks primed for breakthroughs in artificial intelligence and automation.

- Fuel your portfolio with steady income via these 21 dividend stocks with yields > 3% featuring companies with robust yields and a proven track record of rewarding shareholders.

- Position yourself ahead of the curve and monitor these 81 cryptocurrency and blockchain stocks harnessing innovation in blockchain and digital assets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AA

Alcoa

Engages in the bauxite mining, alumina refining, aluminum production, and energy generation business in Australia, Brazil, Canada, Iceland, Norway, Spain, the United States, and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives