- United States

- /

- Basic Materials

- /

- NasdaqGS:USLM

A Fresh Look at United States Lime & Minerals (USLM) Valuation After Strong Demand Update

Reviewed by Simply Wall St

Recent commentary from Diamond Hill Capital pointed to United States Lime & Minerals (USLM) as a strong performer this quarter. This was attributed to rising sales supported by renewed demand across its construction, environmental, and steel customer base.

See our latest analysis for United States Lime & Minerals.

Momentum has taken a breather for United States Lime & Minerals lately, with a 1-year total shareholder return of -20.37%. Despite this, triple-digit gains were seen over the past three and five years. While the latest quarter brought upbeat news driven by infrastructure and construction demand, the longer-term track record signals that opportunities and volatility can emerge quickly in this space.

If you want to see what else is catching investors’ attention right now, it is a great time to broaden your search and discover fast growing stocks with high insider ownership

With the stock trading just below analyst targets and at a notable discount to intrinsic value, the big question is whether United States Lime & Minerals is an overlooked bargain or if markets have already accounted for the company’s growth trajectory.

Price-to-Earnings of 26.6x: Is it justified?

United States Lime & Minerals trades at a price-to-earnings ratio of 26.6x, which places it notably above the industry standard and may signal a premium. The last close was $121.57, showing that investors might be factoring in high growth or stability relative to peers.

The price-to-earnings (P/E) ratio reflects how much investors are willing to pay for each dollar of earnings. In basic materials, this multiple often captures expectations of future demand cycles, earnings quality, and capital intensity. USLM's P/E signals strong market confidence in its future profit potential amid sector volatility.

Compared to the global basic materials industry average of 14.8x, USLM's P/E is considerably higher, which may imply that the market expects better growth or resilience versus competitors. However, when compared to its peer average of 66.8x, USLM appears attractively valued. This could present a compelling entry point if growth expectations are realized.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 26.6x (ABOUT RIGHT)

However, ongoing price volatility and sensitivity to shifts in construction demand could quickly alter the market outlook for United States Lime & Minerals.

Find out about the key risks to this United States Lime & Minerals narrative.

Another View: Discounted Cash Flow Perspective

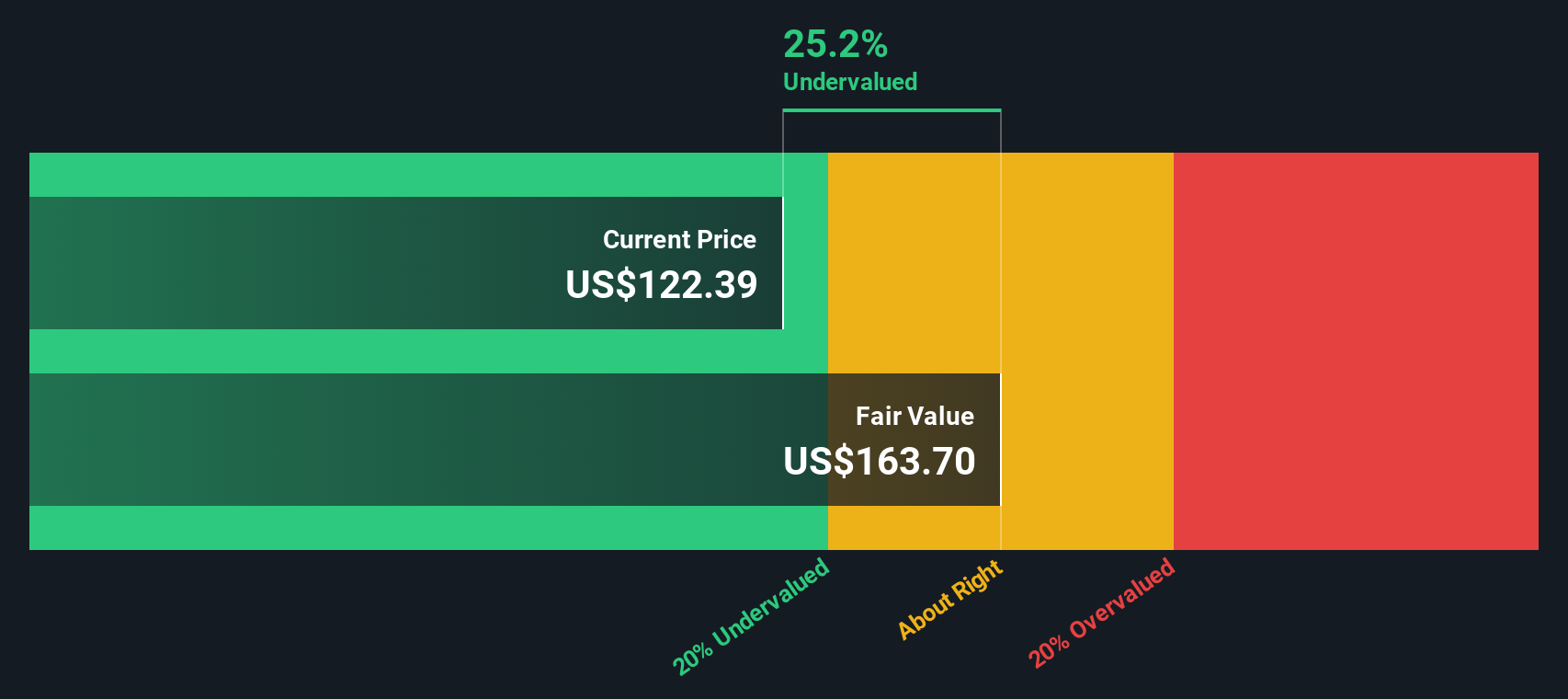

Taking a different approach, the SWS DCF model values United States Lime & Minerals at $163.04 per share. This is about 25% higher than the current market price, which suggests the stock might be undervalued even though it has a higher price-to-earnings ratio. Does this mean the market is missing something?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out United States Lime & Minerals for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 920 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own United States Lime & Minerals Narrative

If you have a different perspective or enjoy digging into the numbers yourself, you can craft your own view of United States Lime & Minerals in just a few minutes. Do it your way

A great starting point for your United States Lime & Minerals research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t miss out on the next big opportunity. Simply Wall Street’s intuitive tools make it easy to spot tomorrow’s winners before the crowd. Act now to give your portfolio a smarter edge.

- Unlock potential high yield by targeting reliable income streams with these 15 dividend stocks with yields > 3% that consistently outperform traditional savings accounts.

- Find the next wave of tech leaders shaping healthcare with artificial intelligence by checking out these 30 healthcare AI stocks.

- Capitalize on early-stage innovation and growth with these 3572 penny stocks with strong financials that show robust financials and unique market positioning.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:USLM

United States Lime & Minerals

Manufactures and supplies lime and limestone products in the United States.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.