- United States

- /

- Metals and Mining

- /

- NasdaqGM:USAR

Does USA Rare Earth’s Recent 57% Drop Offer Long-Term Value After Supply Chain News?

Reviewed by Bailey Pemberton

- If you have ever wondered whether USA Rare Earth is a hidden value gem or just another story stock, you are in the right place.

- The last year saw USA Rare Earth’s share price rise nearly 35.2%. However, it tumbled 16.5% over the past week and is down 57% for the month, showing its risk profile is anything but ordinary.

- Much of this volatility has been fueled by headlines about supply chain partnerships, new mining exploration licenses, and shifting policies around critical minerals in the US. As the rare earth sector continues to make headlines in the context of global tech and energy supply chains, market momentum often follows every new announcement.

- USA Rare Earth scores 2/6 on our valuation checklist, so there is clearly more to dig into. Let’s break down the main ways investors try to value a stock like this, and keep in mind there might be an even sharper approach by the end of this article.

USA Rare Earth scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: USA Rare Earth Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model seeks to estimate the true value of a company by projecting its future cash flows and then discounting them back to today’s value. This approach allows investors to look beyond short-term market fluctuations and focus on a business’s potential to generate cash over time.

For USA Rare Earth, the current Free Cash Flow (FCF) stands at -$39 million, reflecting a challenging start. Analyst forecasts extend for five years, projecting a turnaround with FCF expected to grow to $124.8 million by 2029. Beyond the analyst window, projections suggest even more substantial gains, with FCF growing steadily through 2035. All these values are reported in US dollars as the company operates and trades in this currency.

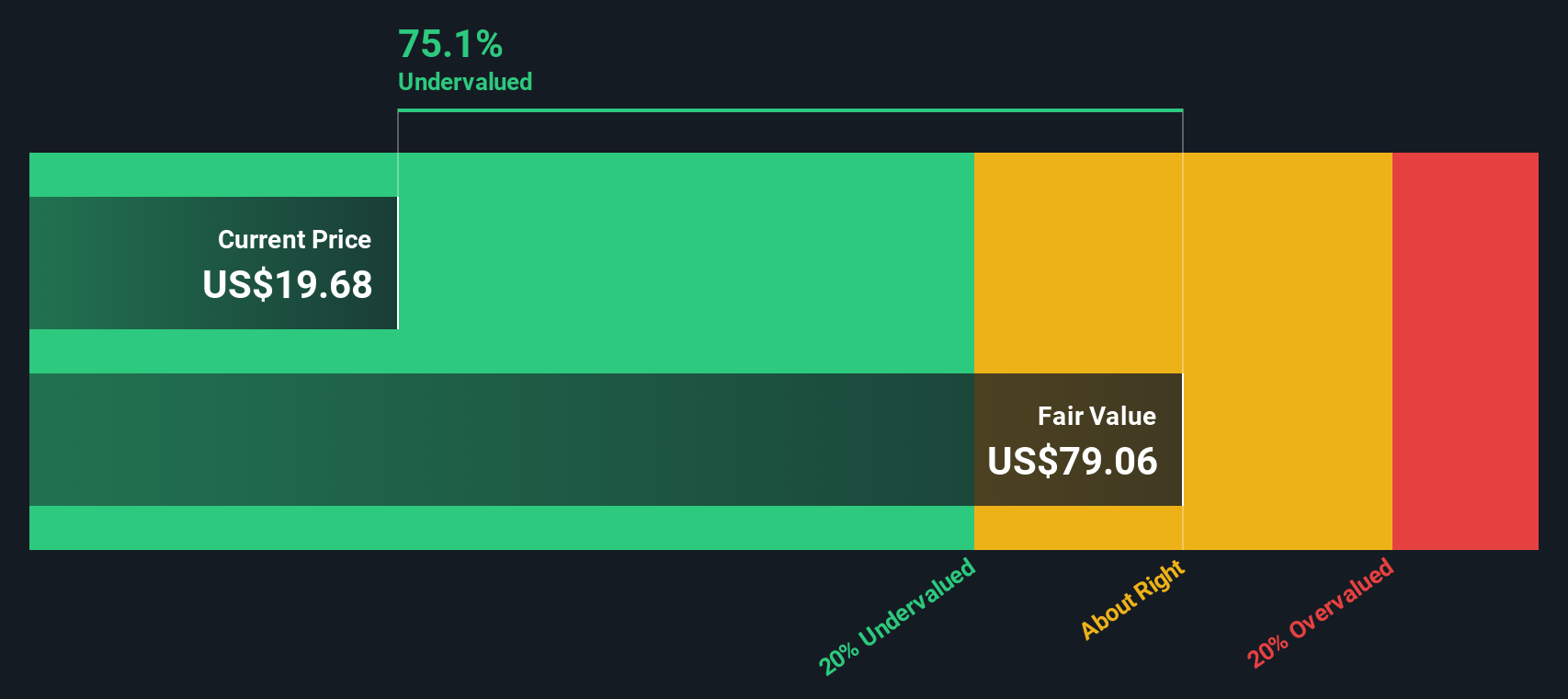

Based on this two-stage DCF model, the estimated intrinsic value per share is $41.43. The stock currently trades at a significant 65.0% discount to this intrinsic value, indicating that it may be considerably undervalued by this metric.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests USA Rare Earth is undervalued by 65.0%. Track this in your watchlist or portfolio, or discover 879 more undervalued stocks based on cash flows.

Approach 2: USA Rare Earth Price vs Book

The price-to-book (PB) ratio is often favored when evaluating companies in asset-heavy sectors such as metals and mining. It compares a company's market value to its book value, helping investors gauge how much they're paying for a company's tangible assets. For profitable companies with significant physical resources, the PB ratio is especially informative because it can highlight undervalued or overvalued situations driven by market sentiment or risk perceptions rather than actual asset worth.

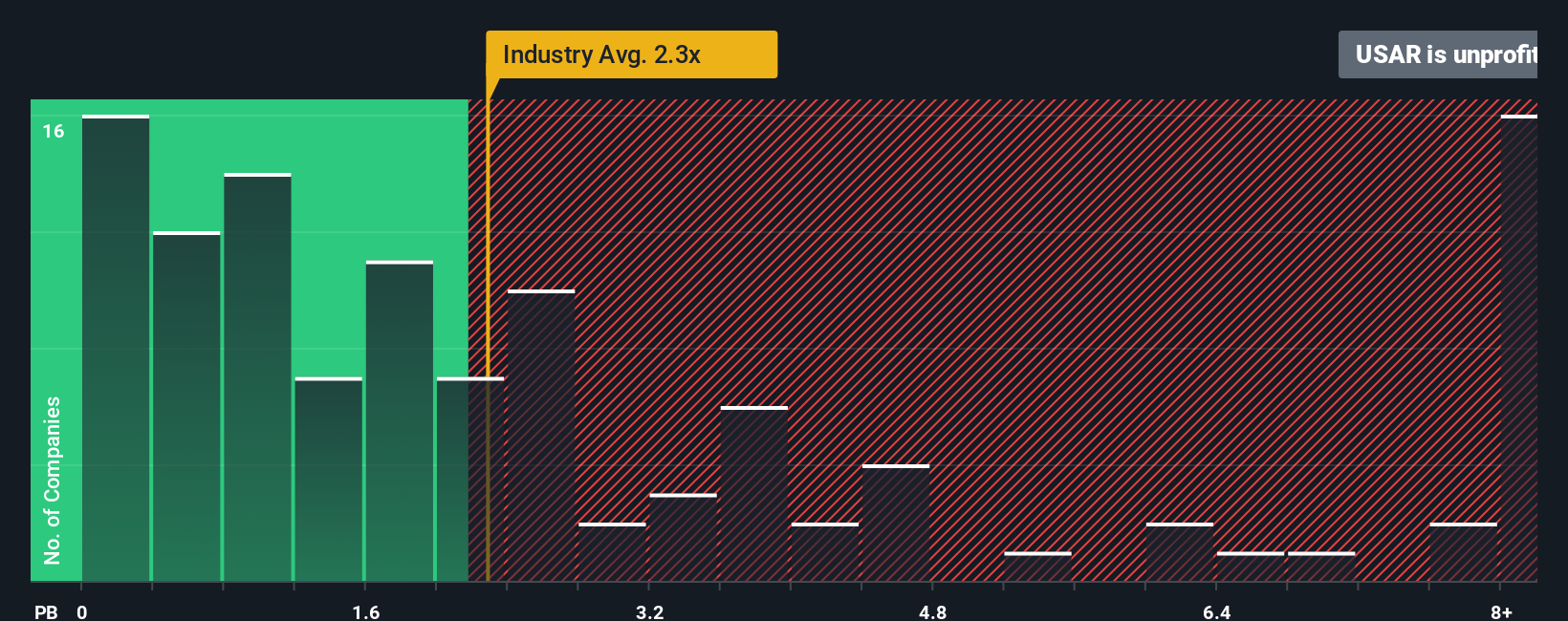

Growth prospects and risk play major roles in shaping what constitutes a fair PB ratio. Firms with higher expected growth or lower perceived risk tend to trade at premium PB multiples, while higher-risk or slower-growth firms trade at lower ratios. USA Rare Earth currently trades at a PB ratio of -31.74x, which is unusually low and far below both the industry average of 2.22x and the peer average of 11.21x.

Simply Wall St’s proprietary “Fair Ratio” metric is designed to offer a more nuanced valuation anchor than just industry or peer averages. Unlike basic comparisons, the Fair Ratio incorporates factors such as a company’s specific growth outlook, profit margins, risk profile, market cap, and the sector it operates in. This multi-dimensional analysis helps identify a multiple that is more closely tailored to USA Rare Earth’s unique situation.

In light of the Fair Ratio and the company’s actual PB, USA Rare Earth’s stock appears ABOUT RIGHT on this valuation basis. The difference is not significant enough to strongly indicate under- or overvaluation.

Result: ABOUT RIGHT

PB ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1406 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your USA Rare Earth Narrative

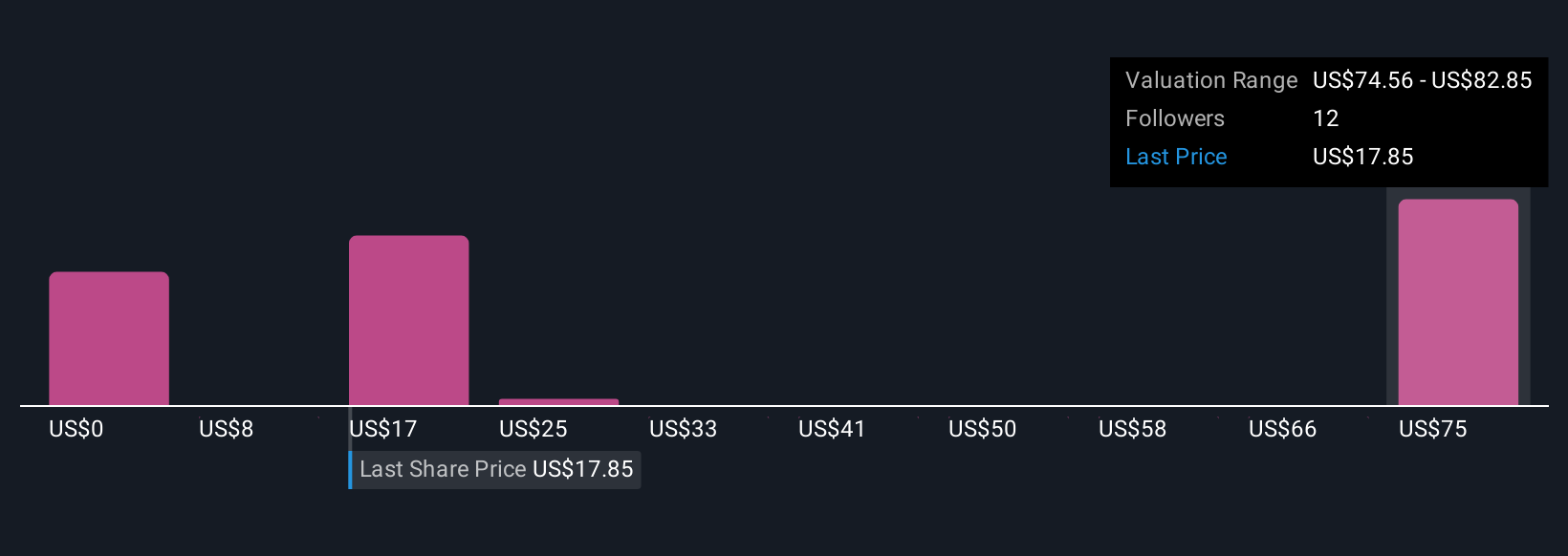

Earlier, we mentioned that there is an even better way to understand valuation. Let’s introduce you to Narratives. A Narrative is simply your story about a company, connecting your outlook and assumptions to numbers like estimated revenue, margins, or fair value. Narratives bridge the gap between a company’s unique story, the financial forecasts you expect, and how you calculate its true worth.

This approach is both powerful and accessible, and is built right into the Community page on Simply Wall St, where millions of investors share and compare their perspectives. Narratives help guide your investment decisions by highlighting whether today’s price is above or below your version of fair value, and they automatically update when important news or earnings reports land.

With USA Rare Earth, for example, some investors might create a very optimistic narrative, setting a high fair value if they see strong growth ahead. Others could be far more cautious, selecting the lowest fair value if they remain skeptical. Narratives make it easy for you to choose the story and strategy that fit your point of view, and to instantly see how changing information could impact your decisions.

Do you think there's more to the story for USA Rare Earth? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:USAR

USA Rare Earth

Engages in mining, processing, and supplying rare earths and other critical minerals in the United States.

Moderate risk and slightly overvalued.

Similar Companies

Market Insights

Community Narratives