- United States

- /

- Metals and Mining

- /

- NasdaqGS:TMC

TMC the metals (TMC) Is Up 6.6% After Advancing Deep-Sea Mining Permits With U.S. Backing – Has The Bull Case Changed?

Reviewed by Simply Wall St

- Earlier this year, The Metals Company advanced its deep-sea mining ambitions by opting for a U.S.-based regulatory path to secure mining permits for extracting polymetallic nodules from the Clarion Clipperton Zone.

- This move, paired with executive orders from the Trump administration supporting and accelerating deep-sea mining permitting, has been highlighted by industry experts as reducing operational risks for the company.

- We’ll explore how U.S. regulatory progress and government backing are shaping The Metals Company’s investment narrative in the sector.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

What Is TMC the metals' Investment Narrative?

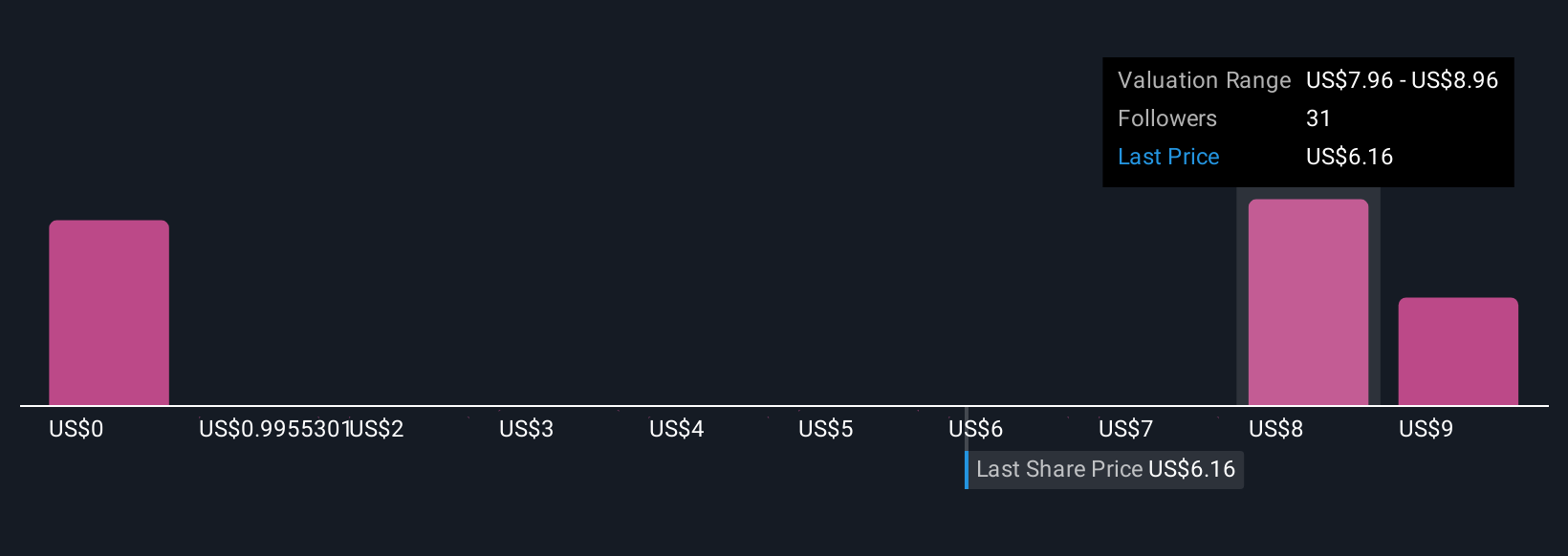

To get behind TMC as a shareholder, you really have to believe in the long-term future of deep-sea minerals as a critical source of metals for energy transition. The company's pivot to a U.S.-based regulatory approach is a meaningful shift, especially in light of the Trump administration’s recent executive orders supporting deep-sea mining. This may help reduce regulatory hurdles that have been some of the biggest short-term risks for TMC, potentially speeding up permitting, access to the Clarion Clipperton Zone, and eventually, commercial revenues. Still, despite these positive signals, TMC remains unprofitable with no revenue, increased losses this year, and its valuation remains far above sector averages. It also faces shareholder dilution, legal uncertainties, and a volatile share price. The latest regulatory news could address one major risk, but does not solve others overnight.

However, regulatory support is just one part of a complex risk equation investors should consider.

Exploring Other Perspectives

Explore 34 other fair value estimates on TMC the metals - why the stock might be worth less than half the current price!

Build Your Own TMC the metals Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your TMC the metals research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free TMC the metals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate TMC the metals' overall financial health at a glance.

Want Some Alternatives?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 31 companies in the world exploring or producing it. Find the list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TMC the metals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TMC

TMC the metals

A deep-sea minerals exploration company, focuses on the collection, processing, and refining of polymetallic nodules found on the seafloor in California.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives