- United States

- /

- Metals and Mining

- /

- NasdaqGS:TMC

TMC the metals (TMC) Is Up 16.5% After Securing $122M and Advancing US Regulatory Pathway - Has the Bull Case Changed?

Reviewed by Sasha Jovanovic

- In 2025, The Metals Company secured US$85.2 million from Korea Zinc and US$37 million in new financing led by Allseas, while also advancing regulatory compliance for its U.S. exploration licenses.

- The company’s progress provides both new funding and a parallel regulatory pathway, potentially reducing risk and accelerating its deep-sea mining ambitions.

- We’ll explore how establishing a viable U.S. regulatory alternative could reshape TMC’s investment narrative and project rollout expectations.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

What Is TMC the metals' Investment Narrative?

For TMC, the core belief an investor needs is that deep-sea mining will move from promise to reality, with TMC’s recent funding and regulatory wins providing fuel for that vision. The US$85.2 million infusion from Korea Zinc and a further US$37 million led by Allseas meaningfully extend the company’s cash runway, directly addressing earlier concerns about near-term liquidity, especially after sizable quarterly losses. In parallel, NOAA’s confirmation of regulatory compliance for TMC’s US exploration licenses offers a potential workaround to international permitting delays, which had previously stood as a key risk to the project timeline. This dual progress could make upcoming milestones, like the start of commercial mining and additional permitting, more achievable in the short run. However, with no current revenue and ongoing legal and governance headwinds, execution and regulatory clarity remain as crucial uncertainties for shareholders. Yet, regulatory hurdles and legal issues could still surprise investors at any turn.

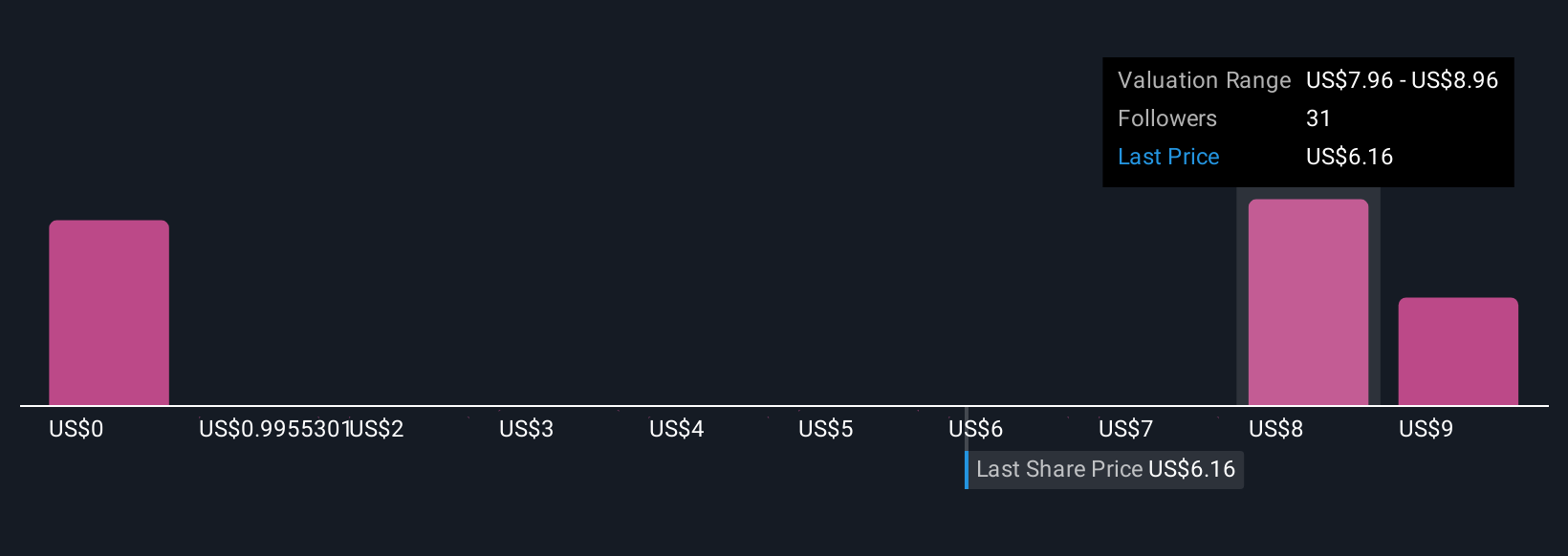

Our expertly prepared valuation report on TMC the metals implies its share price may be too high.Exploring Other Perspectives

Explore 32 other fair value estimates on TMC the metals - why the stock might be worth less than half the current price!

Build Your Own TMC the metals Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your TMC the metals research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free TMC the metals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate TMC the metals' overall financial health at a glance.

Interested In Other Possibilities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Find companies with promising cash flow potential yet trading below their fair value.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TMC the metals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TMC

TMC the metals

A deep-sea minerals exploration company, focuses on the collection, processing, and refining of polymetallic nodules found on the seafloor in California.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives