- United States

- /

- Metals and Mining

- /

- NasdaqGS:TMC

Korea Zinc Private Placement With TMC the Metals (NasdaqGS:TMC)

Reviewed by Simply Wall St

TMC the Metals Company (NasdaqGS:TMC) experienced a remarkable 266% increase in its share price over the last quarter, a surge potentially influenced by significant developments including a private placement with Korea Zinc Company, Ltd., and the appointment of seasoned board directors Michael Hess and Alex Spiro. These events, contributing to TMC's strategic focus on commercial recovery of polymetallic nodules, occurred amidst a broader market environment that saw slight gains in major indices despite trade policy uncertainties. The market momentum, alongside TMC's advancements, likely played a collective role in the company's impressive price performance.

Outshine the giants: these 21 early-stage AI stocks could fund your retirement.

Over the past three years, TMC the Metals Company achieved a very large total return of 620.72%, illustrating a significant long-term uptrend. This performance exceeds the one-year returns of both the broader US Market, which gained 12.6%, and the US Metals and Mining industry, which rose 9.9%. Such robust growth highlights the company's capacity to outperform its sector and the market.

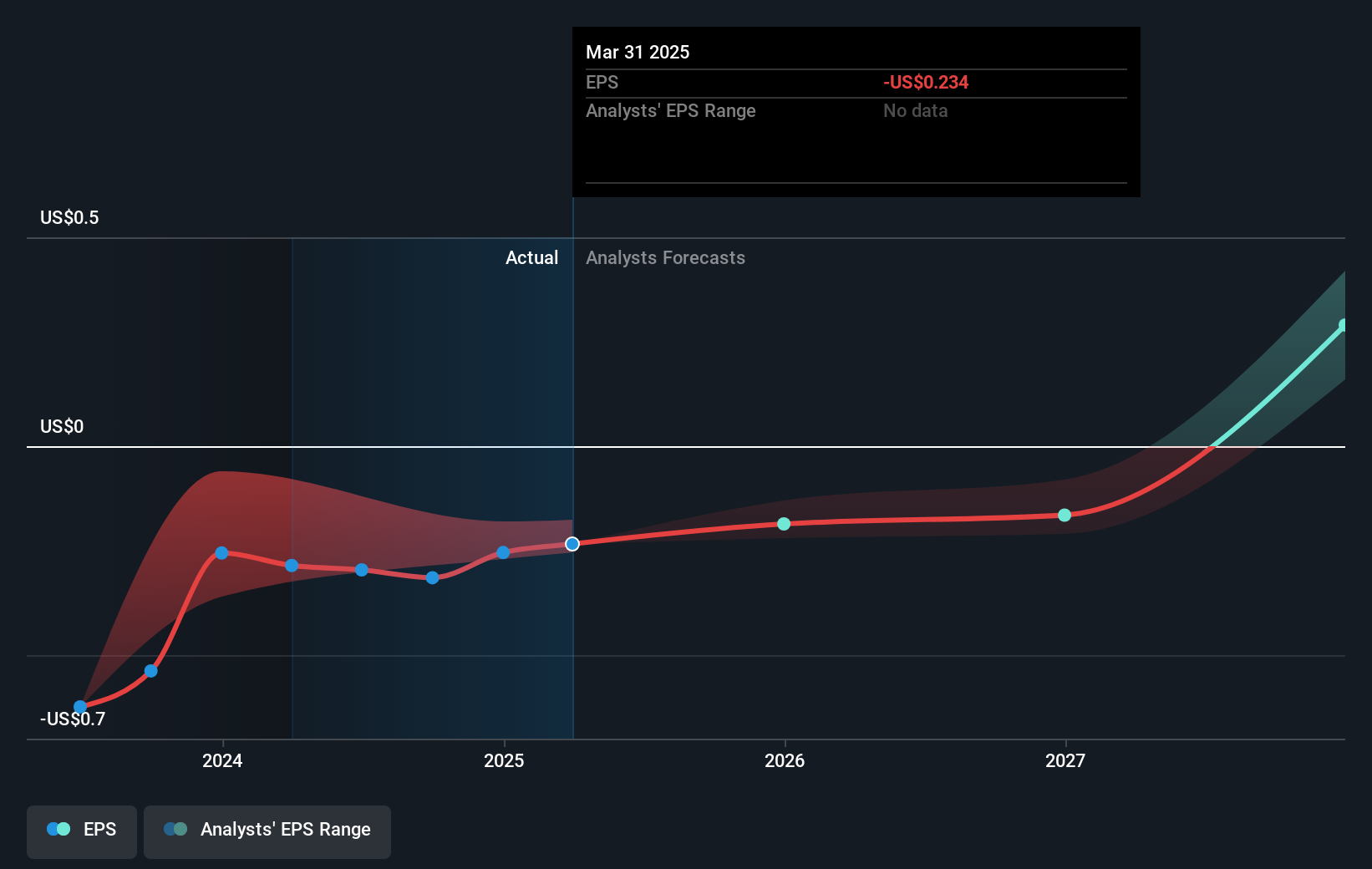

The recent private placement with Korea Zinc and board appointments could potentially influence both revenue and earnings forecasts by strengthening TMC's operational foundation and strategic direction. However, with TMC currently unprofitable and expected to have no revenue next year, these advancements do not immediately translate to revenue changes. Analysts' consensus places TMC's fair value price target at US$8.85, significantly higher than the current trading price, indicating potential for further price appreciation if growth forecasts are met.

Evaluate TMC the metals' prospects by accessing our earnings growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TMC the metals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TMC

TMC the metals

A deep-sea minerals exploration company, focuses on the collection, processing, and refining of polymetallic nodules found on the seafloor in California.

Reasonable growth potential slight.

Market Insights

Community Narratives