- United States

- /

- Metals and Mining

- /

- NasdaqCM:SGML

Need To Know: Analysts Are Much More Bullish On Sigma Lithium Corporation (NASDAQ:SGML) Revenues

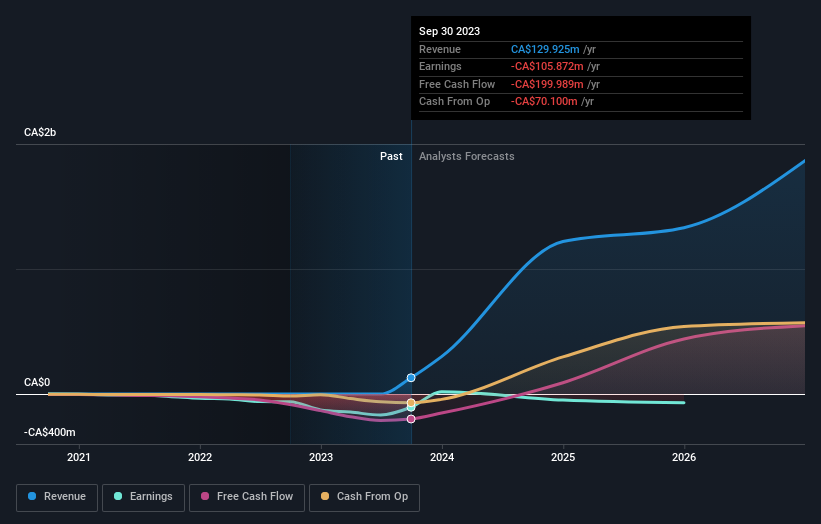

Sigma Lithium Corporation (NASDAQ:SGML) shareholders will have a reason to smile today, with the analysts making substantial upgrades to next year's statutory forecasts. The revenue forecast for next year has experienced a facelift, with analysts now much more optimistic on its sales pipeline. The stock price has risen 6.7% to US$13.93 over the past week, suggesting investors are becoming more optimistic. Could this big upgrade push the stock even higher?

Following the upgrade, the most recent consensus for Sigma Lithium from its three analysts is for revenues of CA$1.2b in 2024 which, if met, would be a sizeable increase on its sales over the past 12 months. Prior to the latest estimates, the analysts were forecasting revenues of CA$1.1b in 2024. The consensus has definitely become more optimistic, showing a solid increase in revenue forecasts.

See our latest analysis for Sigma Lithium

Looking at the bigger picture now, one of the ways we can make sense of these forecasts is to see how they measure up against both past performance and industry growth estimates. It's clear from the latest estimates that Sigma Lithium's rate of growth is expected to accelerate meaningfully, with the forecast 5x annualised revenue growth to the end of 2024 noticeably faster than its historical growth of 109% p.a. over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to grow their revenue at 4.8% per year. It seems obvious that, while the growth outlook is brighter than the recent past, the analysts also expect Sigma Lithium to grow faster than the wider industry.

The Bottom Line

The highlight for us was that analysts increased their revenue forecasts for Sigma Lithium next year. The analysts also expect revenues to grow faster than the wider market. Seeing the dramatic upgrade to next year's forecasts, it might be time to take another look at Sigma Lithium.

Analysts are definitely bullish on Sigma Lithium, but no company is perfect. Indeed, you should know that there are several potential concerns to be aware of, including dilutive stock issuance over the past year. For more information, you can click through to our platform to learn more about this and the 4 other concerns we've identified .

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:SGML

Sigma Lithium

Engages in the exploration and development of lithium deposits in Brazil.

High growth potential with low risk.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion