- United States

- /

- Metals and Mining

- /

- NasdaqGS:RGLD

Royal Gold Stock Dips 8% but Remains Up 34% in 2025 Valuation Review

Reviewed by Bailey Pemberton

If you are looking at Royal Gold and wondering if now is the right time to buy, sell, or simply hold your position, you are not alone. The stock has been on quite a ride lately, which always grabs investors’ attention. Over the past month, Royal Gold shares have dropped 8.2%, continuing a short-term trend with a 2.2% decline in just the last week. If you zoom out, though, things get more interesting. The stock is up an impressive 34.2% year to date, and nearly 93% over three years, showing there is plenty of long-term growth powering this name despite recent volatility.

Much of the recent price action has been linked to broader shifts in the price of gold and evolving central bank policies, alongside fresh developments in the mining sector. Some of these changes have increased perceived risk in the short term, which likely contributed to the pullback you might have noticed. Still, there is also a sense of optimism building as global gold demand remains robust and analysts note the company’s solid asset base.

For those of you focused squarely on valuation, Royal Gold currently enjoys a value score of 2 out of 6. This means it passes two key undervaluation screens, a decent sign in a sector where premiums are often baked in. So how does Royal Gold stack up across the standard valuation methods? That’s up next, but stay tuned as I will reveal an even deeper approach to understanding what the company is really worth as we go.

Royal Gold scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

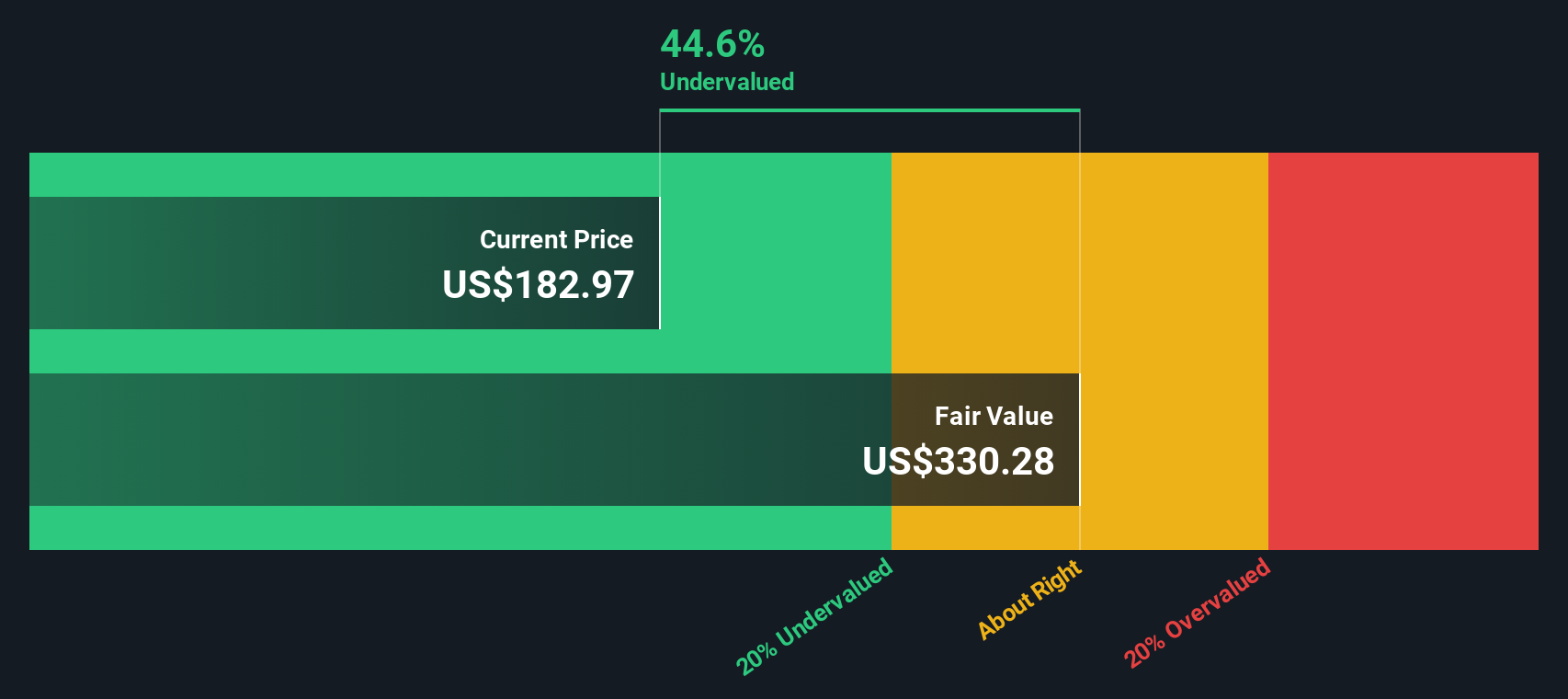

Approach 1: Royal Gold Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future free cash flows and discounting them back to today's value. This approach helps investors understand what the business is truly worth, based on its ability to generate cash in the years ahead.

For Royal Gold, the latest reported Free Cash Flow stands at $107.7 million. Analyst estimates and extrapolations indicate a robust growth outlook, with projected free cash flows rising to roughly $1.05 billion by 2026 and just over $1.06 billion by 2035, all in US dollars. These forecasts rely on a 2 Stage Free Cash Flow to Equity model, combining direct analyst expectations for the next five years with longer-term trends projected by Simply Wall St.

After discounting these future cash flows to reflect their present value, the DCF model estimates Royal Gold's intrinsic fair value at $222.53 per share. This suggests the stock is currently trading at an 18.8% discount compared to its projected value.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Royal Gold is undervalued by 18.8%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

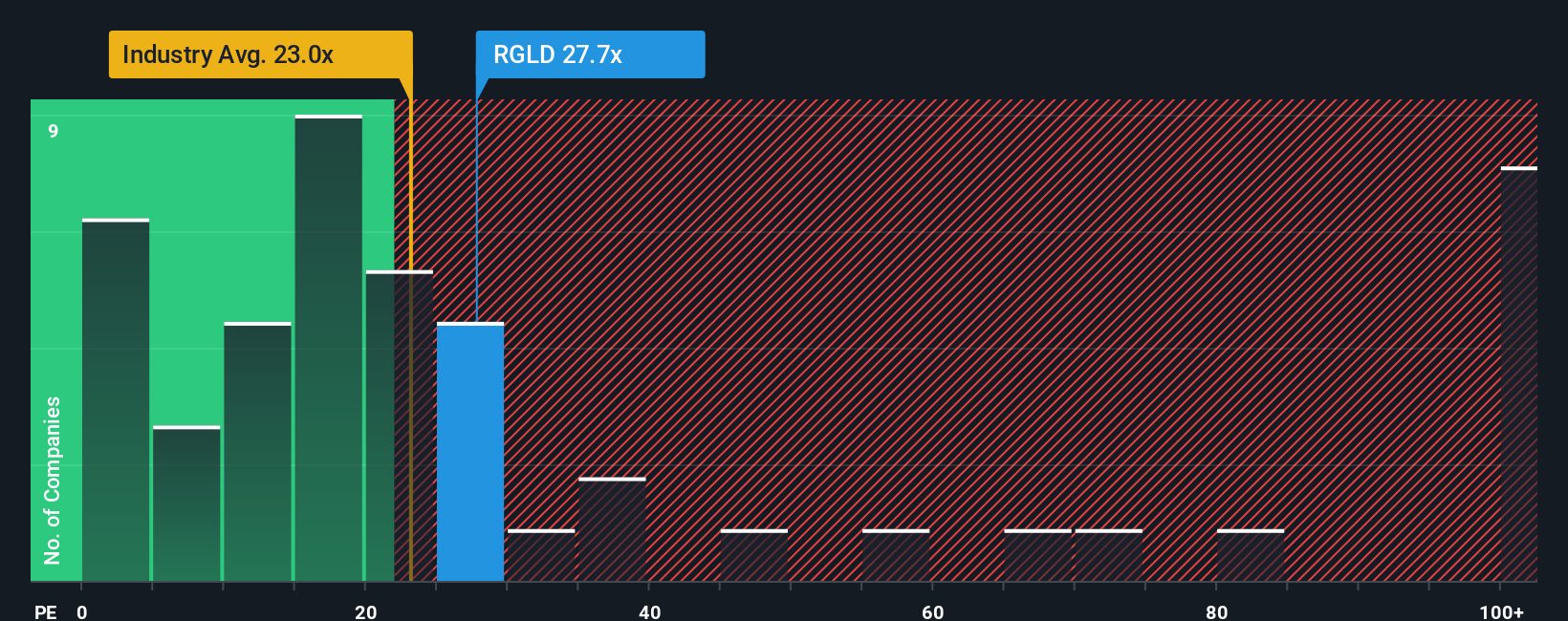

Approach 2: Royal Gold Price vs Earnings (P/E Ratio)

The Price-to-Earnings (P/E) ratio is a widely used valuation tool for profitable companies like Royal Gold because it directly relates a company's share price to its annual net earnings, helping investors gauge how much they are paying for each dollar of profit. When a business is consistently generating profits, the P/E ratio becomes a straightforward way to compare its value to other companies and historical norms.

Growth prospects and risk play a big role in what is considered a "fair" P/E ratio. Higher growth companies or those with more predictable earnings can often justify higher P/E ratios, while those facing more risk or sluggish growth typically trade at lower ratios. For Royal Gold, the current P/E ratio is 33.9x, which is notably above the Metals and Mining industry average of 23.9x and also higher than the average for its peers at 29.4x. This suggests that, at a glance, the market is assigning Royal Gold a premium compared to many of its counterparts.

However, Simply Wall St's "Fair Ratio" provides a more tailored benchmark. Unlike standard industry averages or peer comparisons, the Fair Ratio analyzes Royal Gold’s unique fundamentals, such as its earnings growth outlook, profit margins, industry characteristics, company size, and risk profile, to estimate what a reasonable P/E multiple should be for this stock. For Royal Gold, the Fair Ratio is calculated at 32.0x.

Because Royal Gold's current P/E of 33.9x is very close to the Fair Ratio of 32.0x, the stock looks to be appropriately valued for its risk-adjusted growth and industry position, rather than significantly overpriced or undervalued by typical standards.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Royal Gold Narrative

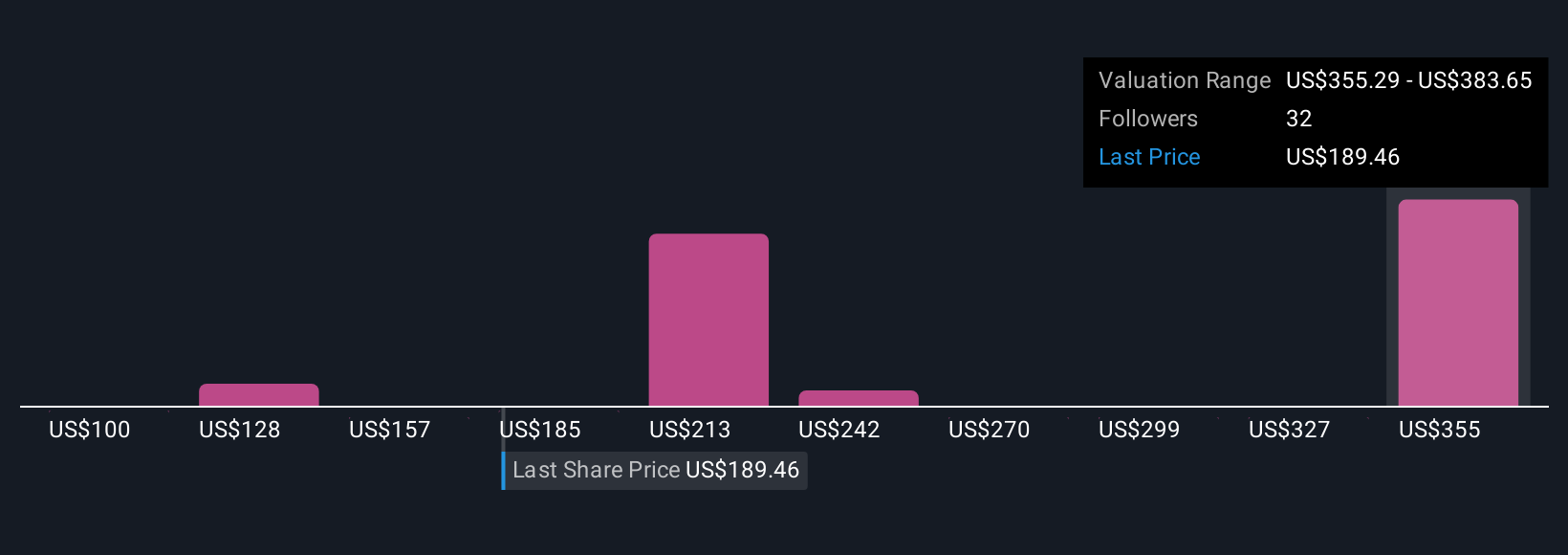

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. This dynamic method brings your investment perspective to life and grounds your decision in more than just numbers. A Narrative is your unique story about Royal Gold: you set your expectations for future revenue, margin, and growth, and connect these ideas directly to a fair value estimate.

This approach links your view of the company’s opportunities and risks with a financial forecast, then instantly calculates what you believe Royal Gold is worth right now. On Simply Wall St’s Community page, millions of investors use Narratives to frame their buy or sell decisions, quickly seeing if their fair value is above or below the current share price.

Narratives update automatically when new data, news, or company results arrive, so your analysis adapts as the story evolves. For example, one investor’s Narrative might be very bullish, outlining strong earnings growth from new projects and targeting a fair value of $237, while another might take a cautious view on operational risks and set their fair value at $182. This lets you compare your logic to others, stress-test your beliefs, and decide when the price and the story align for you.

Do you think there's more to the story for Royal Gold? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:RGLD

Royal Gold

Acquires and manages precious metal streams, royalties, and related interests.

Flawless balance sheet with high growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives