- United States

- /

- Metals and Mining

- /

- NasdaqGS:RGLD

Does First Quantum’s $1 Billion Gold Stream Transform Royal Gold’s (RGLD) Long-Term Investment Story?

Reviewed by Sasha Jovanovic

- First Quantum announced in late October that it had secured a US$1 billion non-debt gold stream arrangement with Royal Gold and completed the Kansanshi S3 Expansion project, as part of efforts to strengthen its balance sheet and progress key priorities for 2025.

- This gold stream deal significantly expands Royal Gold’s asset base and reinforces its exposure to gold, positioning the company to benefit from any future increase in gold prices.

- We'll examine how the new US$1 billion gold stream arrangement with First Quantum may alter Royal Gold’s long-term investment profile.

These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Royal Gold Investment Narrative Recap

To be a Royal Gold shareholder, you need to believe that demand for gold will remain robust and that the company’s diversified portfolio of royalty and streaming assets will deliver consistent cash flow, largely immune to the operational risks faced by mine operators. The US$1 billion gold stream deal with First Quantum expands Royal Gold’s asset base, reinforcing its gold exposure; however, it does not fundamentally alter the near-term catalyst of integrating Sandstorm Gold and Horizon Copper portfolios, nor does it mitigate the ongoing risk of operational setbacks at key producing assets.

Among recent announcements, the planned acquisitions requiring increased use of Royal Gold’s revolving credit facility stand out as most relevant. As these deals close, investors will closely watch whether anticipated benefits from portfolio diversification and cost synergies are realized, especially since higher leverage could pressure net margins if integration or asset performance lags behind expectations.

However, even with growing streams, investors should also be aware that increasing competition for new royalty deals may...

Read the full narrative on Royal Gold (it's free!)

Royal Gold's narrative projects $1.4 billion revenue and $877.9 million earnings by 2028. This requires 21.4% yearly revenue growth and a $428.4 million earnings increase from $449.5 million.

Uncover how Royal Gold's forecasts yield a $238.62 fair value, a 37% upside to its current price.

Exploring Other Perspectives

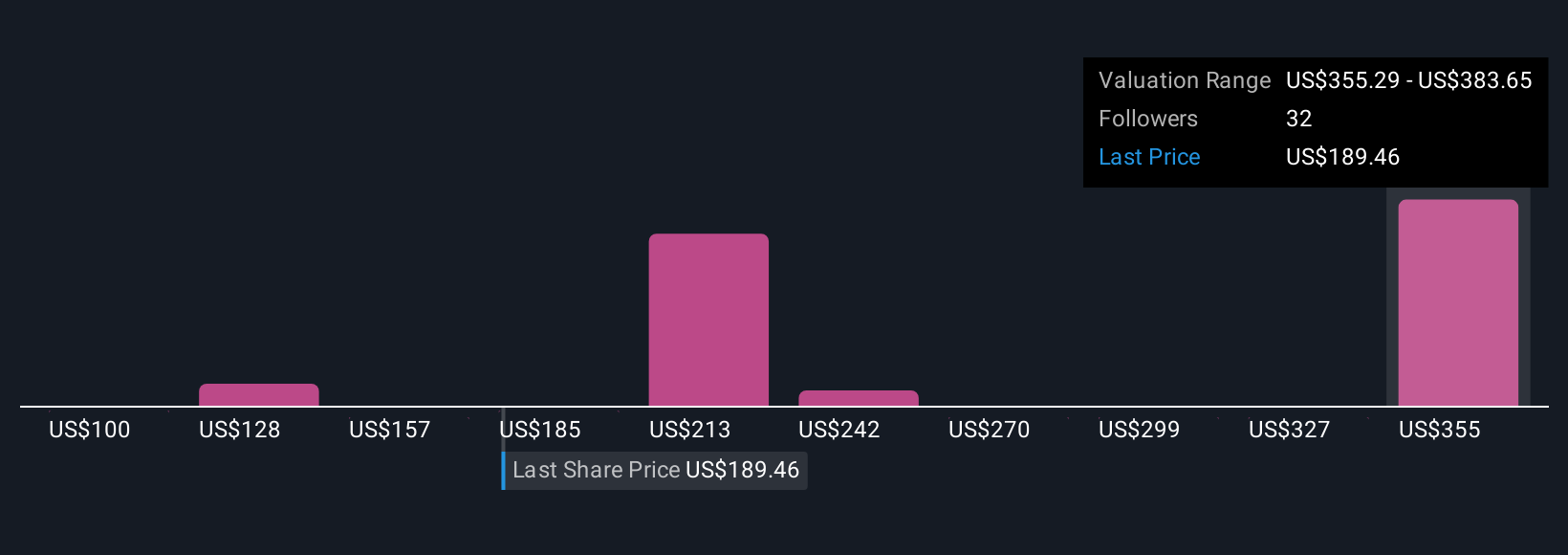

Ten members of the Simply Wall St Community estimate Royal Gold’s fair value between US$143.73 and US$266.61 per share. While investor views vary, many are focused on the outcome of portfolio integration and how this could shape cash flow quality in the years ahead; consider these insights as you explore alternative opinions.

Explore 10 other fair value estimates on Royal Gold - why the stock might be worth as much as 53% more than the current price!

Build Your Own Royal Gold Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Royal Gold research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Royal Gold research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Royal Gold's overall financial health at a glance.

Seeking Other Investments?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:RGLD

Royal Gold

Acquires and manages precious metal streams, royalties, and related interests.

Flawless balance sheet with high growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives