- United States

- /

- Metals and Mining

- /

- NasdaqGS:RGLD

Can Royal Gold’s 44% 2025 Rally Continue After Surging Gold Prices?

Reviewed by Bailey Pemberton

- Wondering whether Royal Gold is still a smart buy, or if its impressive run is losing steam? You are not alone. Wherever the share price goes next, understanding its value is crucial.

- Royal Gold’s stock has jumped 11.6% in the last week, is up 43.8% year-to-date, and has delivered a strong 40.0% gain over the past year. Momentum like this always sparks questions about what is driving the performance and how much is already priced in.

- Much of this recent surge followed news that gold prices have remained resilient amid global market uncertainty, with renewed interest from institutional investors and central banks. Royal Gold’s growing royalty portfolio and positive sector sentiment have kept investor optimism high, despite shifts in broader commodities markets.

- According to our valuation checks, the company scores a 3 out of 6 on our value scale, which suggests there are good points as well as some caution flags. Next, we will dig into how this score is determined. Stick around to discover a more insightful way to judge value beyond just the numbers.

Find out why Royal Gold's 40.0% return over the last year is lagging behind its peers.

Approach 1: Royal Gold Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates the value of a company by projecting its future cash flows and then discounting these amounts back to today's dollars. This approach is widely used to assess whether a stock is currently trading at a fair price based on its long-term earning power.

For Royal Gold, the current Free Cash Flow (FCF) stands at approximately $13.1 million, reflecting the company’s ability to generate cash from its royalty and streaming business. Over the next decade, analysts and extrapolated forecasts suggest strong growth and expect FCF to reach about $1.2 billion by 2028, with ongoing expansion thereafter. Notably, analysts provide estimates for the next five years. Further projections are modeled using established assumptions.

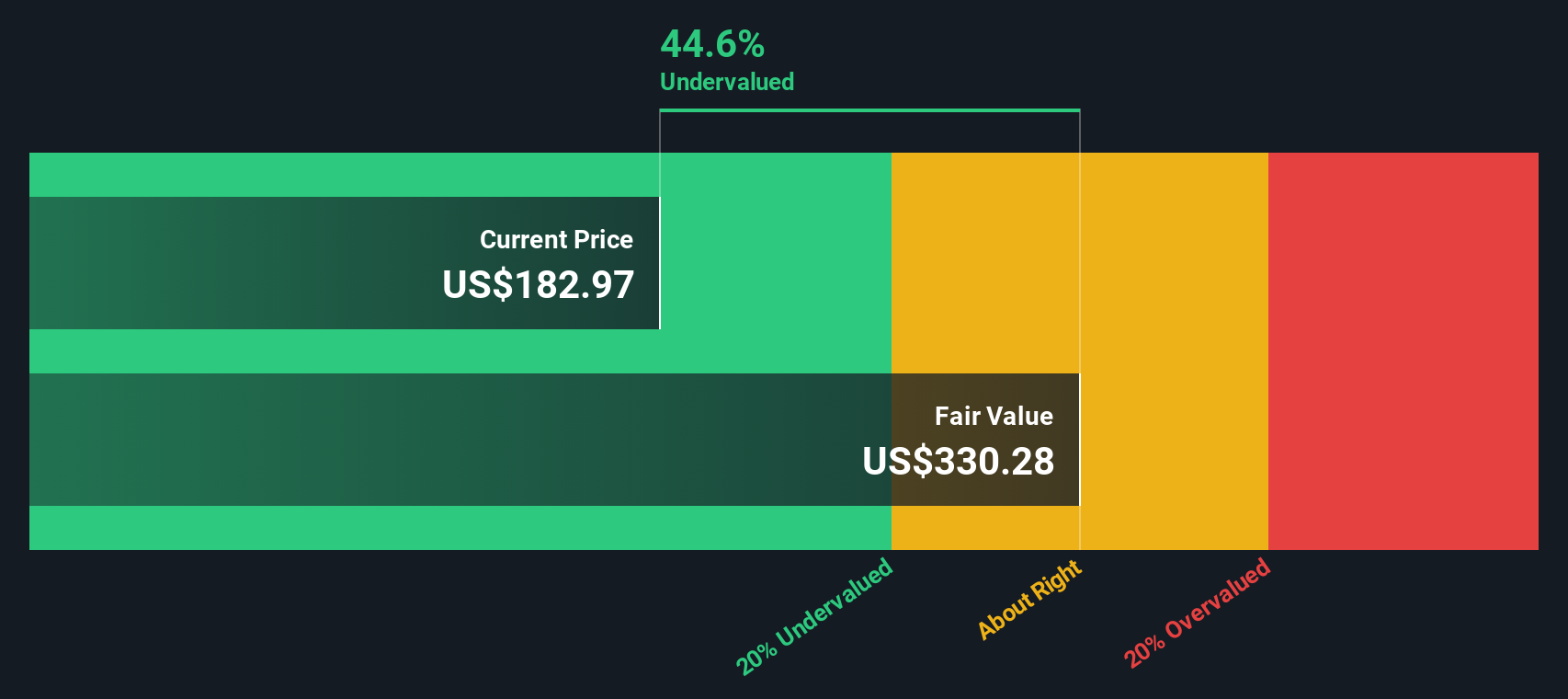

Using the DCF method, Royal Gold’s estimated intrinsic value is $287.35 per share. This suggests the stock is currently trading at a 32.7% discount to its projected value, indicating it could be undervalued at today’s prices.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Royal Gold is undervalued by 32.7%. Track this in your watchlist or portfolio, or discover 865 more undervalued stocks based on cash flows.

Approach 2: Royal Gold Price vs Earnings

For profitable companies like Royal Gold, the Price-to-Earnings (PE) ratio is a widely used and straightforward way to evaluate valuation. The PE ratio tells investors how much they are paying for each dollar of earnings, making it an effective metric for companies with regular profitability and relatively stable earnings.

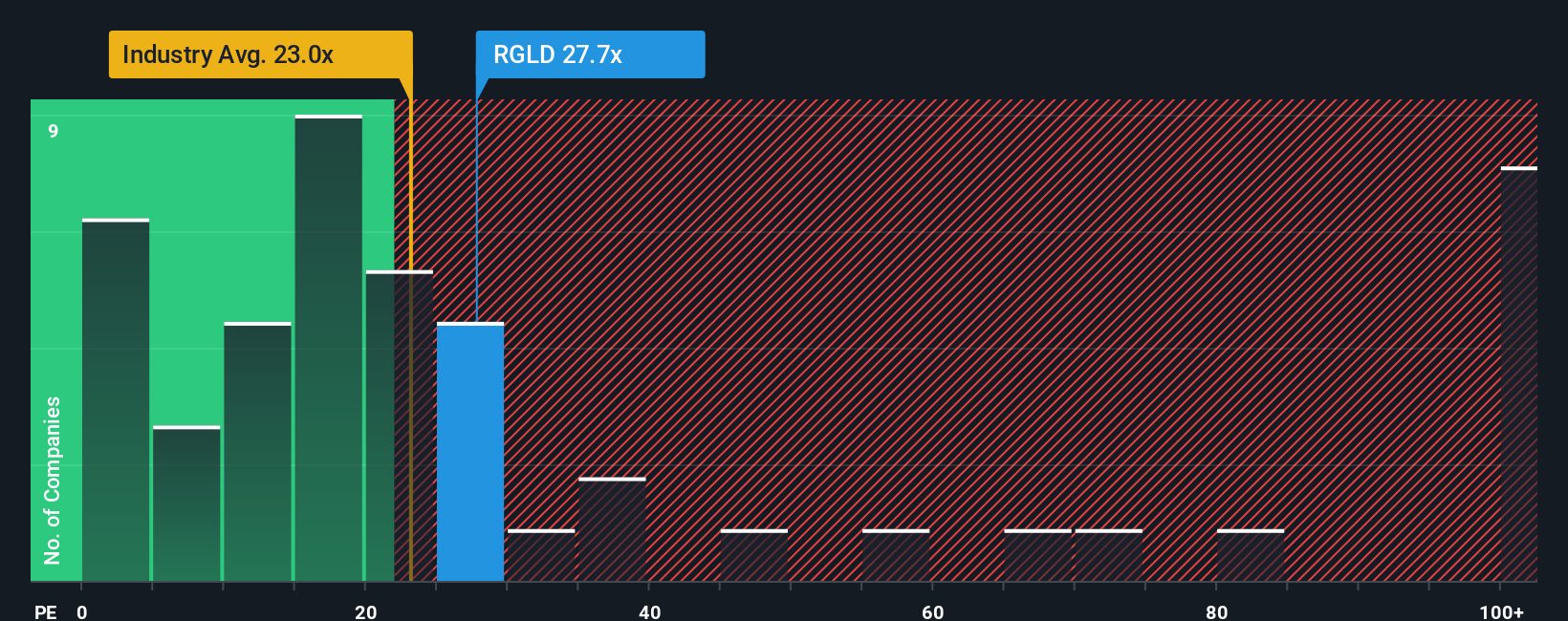

When considering if a company's PE ratio is fair, it's important to remember that higher growth expectations and lower risk typically justify a higher PE, while slower growth or greater uncertainty push the fair number lower. Royal Gold currently trades at a PE of 34x. For context, the Metals and Mining industry sits at an average of 23.9x, and Royal Gold’s peer group averages around 19.1x.

Simply Wall St also calculates a proprietary “Fair Ratio.” This measure does not just look at what peers or the industry are paying but goes further by factoring in Royal Gold’s earnings growth, its risk profile, profit margins, market capitalization, and specific industry dynamics. For Royal Gold, the Fair Ratio is 26.0x. This means the stock is trading above what we would expect given all these factors combined, even after considering strong growth expectations.

Comparing the current PE of 34x to the Fair Ratio of 26.0x suggests that Royal Gold’s stock price is ahead of what its fundamentals strictly warrant, based on this comprehensive, company-specific assessment.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1370 companies where insiders are betting big on explosive growth.

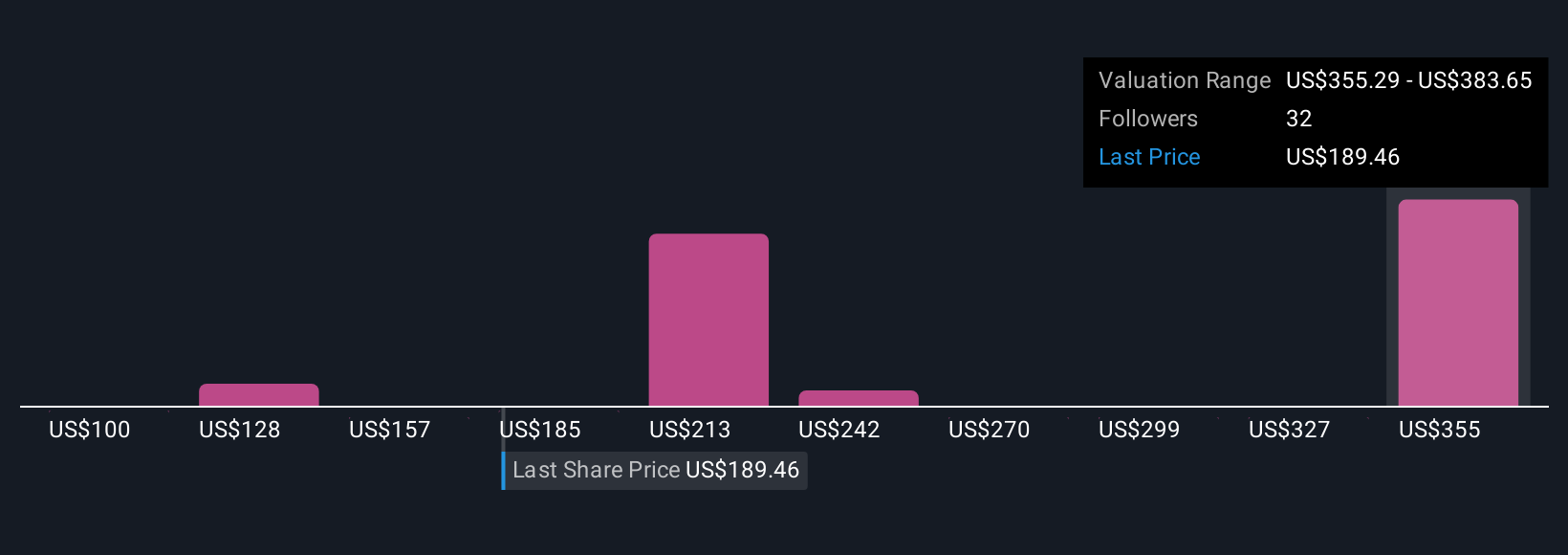

Upgrade Your Decision Making: Choose your Royal Gold Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a powerful yet simple approach that takes you beyond numbers and ratios. A Narrative is your personalized investment story about Royal Gold, where you outline what you believe about its future revenues, earnings, margins, and risks, then link that outlook directly to a fair value calculation.

Unlike static ratios or market averages, Narratives help investors tie together insights about a company’s strategy, industry, and catalysts with realistic financial forecasts. This creates a clear picture of what Royal Gold should be worth and the reasons behind that assessment. This approach is easy to use, built into Simply Wall St’s Community page, and trusted by millions of investors.

With Narratives, you can instantly compare your fair value to Royal Gold’s current share price and decide whether to buy, sell, or hold. Narratives also update in real-time as news emerges or earnings are released, ensuring your view adapts alongside the market.

For example, some investors might see Royal Gold’s strategic acquisitions and robust growth as supporting a bullish fair value of $237 per share, while others focus on commodity risk and assign a more conservative target like $182. This demonstrates how Narratives capture every perspective, so you can invest with confidence in your own logic.

Do you think there's more to the story for Royal Gold? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:RGLD

Royal Gold

Acquires and manages precious metal streams, royalties, and related interests.

High growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives