- United States

- /

- Metals and Mining

- /

- NasdaqGS:RGLD

Assessing Royal Gold’s Recent 49% Jump Amid Gold Price Optimism and Valuation Questions

Reviewed by Bailey Pemberton

- Wondering if Royal Gold is truly worth its current price? You are not alone, and we are about to break down the numbers to help you cut through the noise.

- The stock has caught serious attention lately, rising 6.7% in the past week and up 49.4% year-to-date. This signals that investors are seeing big potential, or possibly increasing risks.

- Royal Gold recently landed in the news due to industry optimism around gold prices and positive sentiment from sector upgrades. Both have played key roles in its recent share price surge. Other headlines have spotlighted the company's strategic investments and expansion of royalty interests, which have helped fuel investor confidence.

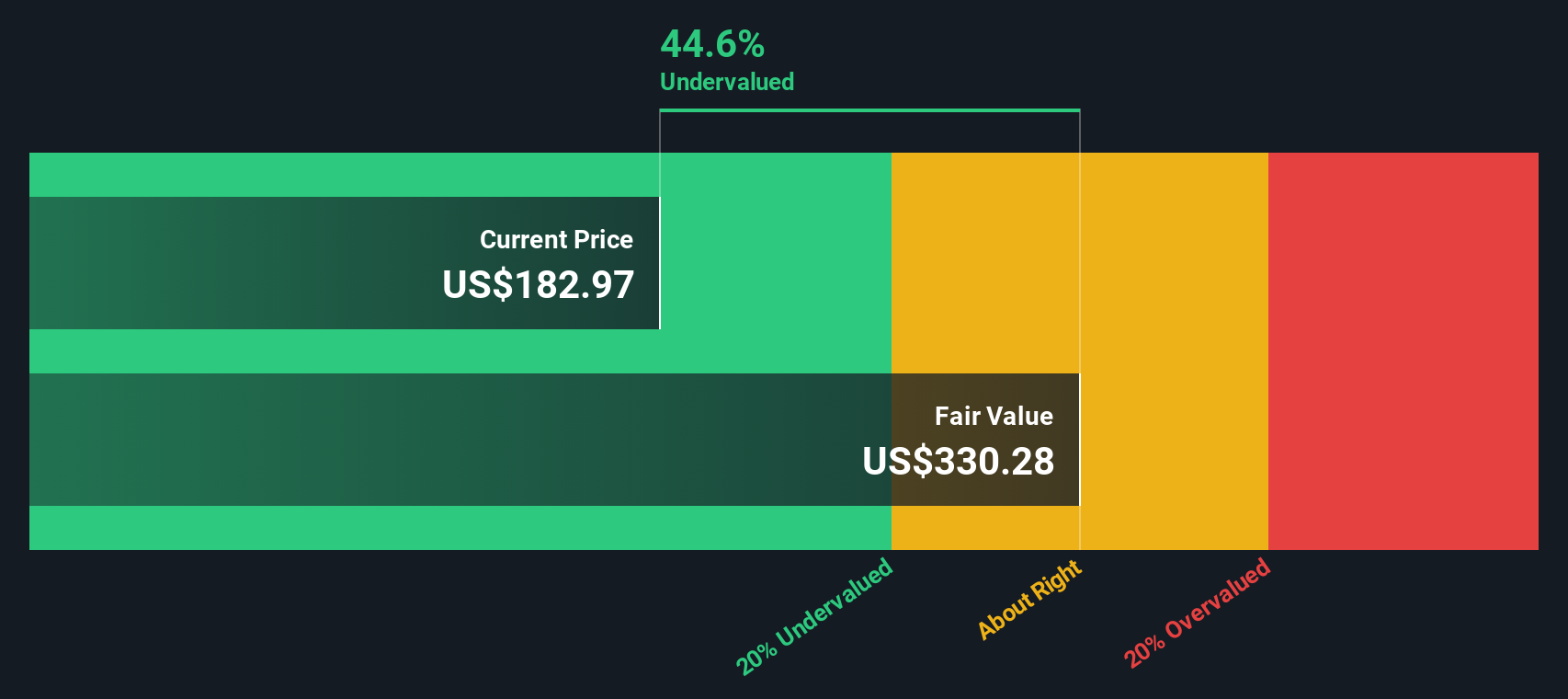

- Looking at its valuation, Royal Gold scores 2 out of 6 on our value checks, suggesting it is undervalued in only a couple of key areas. Yet traditional valuation techniques sometimes miss what really matters, as we will reveal later in the article.

Royal Gold scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Royal Gold Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by forecasting its future cash flows and discounting them back to today’s dollars. In other words, it helps investors figure out what a business might be worth if you added up all the profits it is expected to generate in the years ahead, then adjusted for the time value of money.

For Royal Gold, the latest available Free Cash Flow is $13.09 million. Analysts project that by 2029, Free Cash Flow will increase to $1.07 billion, with forecasts (and further extrapolations by Simply Wall St) showing continued growth through 2035. The estimates for each of the next ten years show both a steady increase and strong confidence in Royal Gold's ability to generate cash in the future.

Based on the DCF model, the estimated fair value for Royal Gold stands at $224.45 per share. Compared to the company’s recent trading price, this suggests the stock is undervalued by 10.4%. This margin indicates an opportunity for investors who believe in the accuracy of these forecasts and the underlying business strengths.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Royal Gold is undervalued by 10.4%. Track this in your watchlist or portfolio, or discover 926 more undervalued stocks based on cash flows.

Approach 2: Royal Gold Price vs Earnings

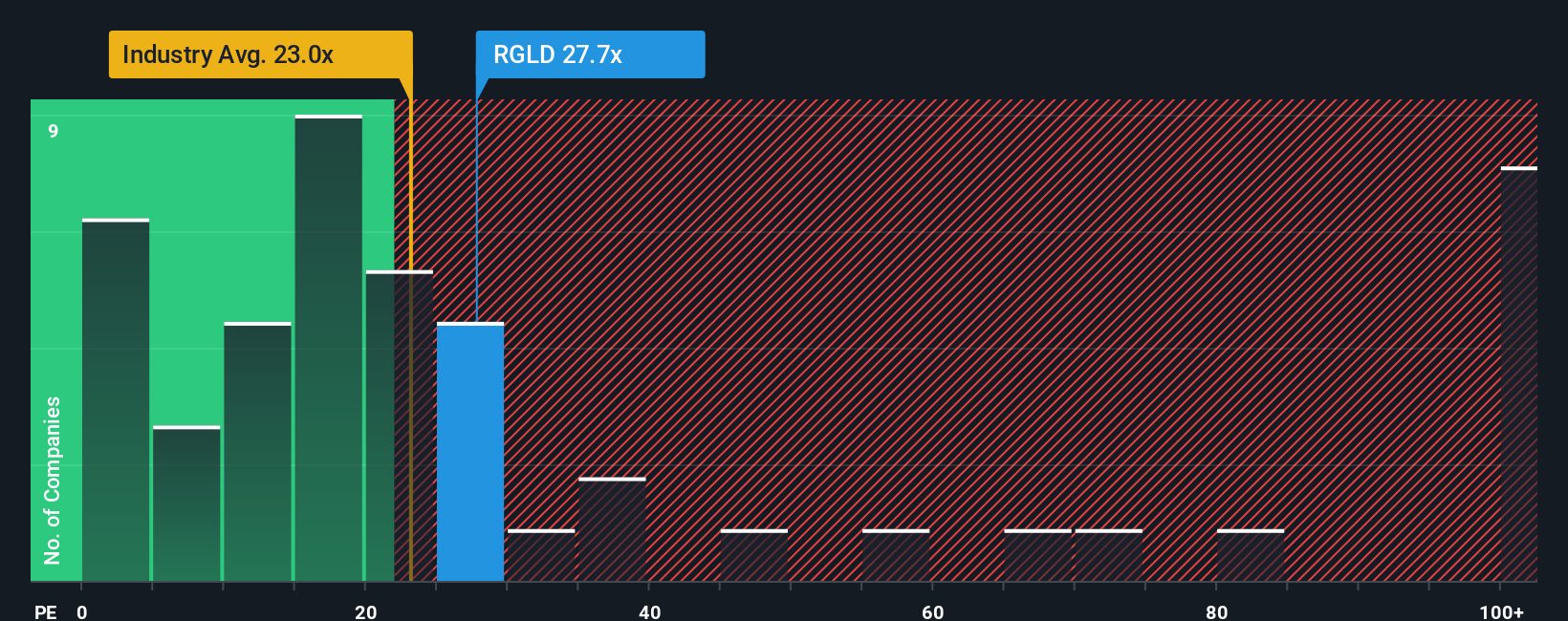

The Price-to-Earnings (PE) ratio is a widely used metric for valuing profitable companies like Royal Gold. It provides a snapshot of how much investors are willing to pay for each dollar of the company's earnings. This makes it especially useful when a business is consistently generating profits, as it directly ties the share price to company performance.

Growth expectations and risk play a big role in determining what a "normal" or "fair" PE ratio should be. Companies with stronger growth prospects or lower risk profiles often command higher PE multiples. Industries with more uncertainty or slower growth generally see lower multiples.

Currently, Royal Gold trades at a PE ratio of 35.3x. That is much higher than both the Metals and Mining industry average of 22.1x and the peer group average of 21.2x. This suggests the market sees Royal Gold as a premium pick within its sector.

Simply Wall St offers a more comprehensive perspective by calculating the "Fair Ratio," in this case, a fair PE of 25.2x. Instead of simply comparing with industry or peer averages, the Fair Ratio incorporates factors like Royal Gold's earnings growth, profit margins, market capitalization, and unique risk profile specific to the sector. This results in a more tailored and accurate valuation benchmark.

Compared to the Fair Ratio of 25.2x, Royal Gold's actual PE ratio of 35.3x suggests the stock may be overvalued relative to its risk and growth outlook.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1433 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Royal Gold Narrative

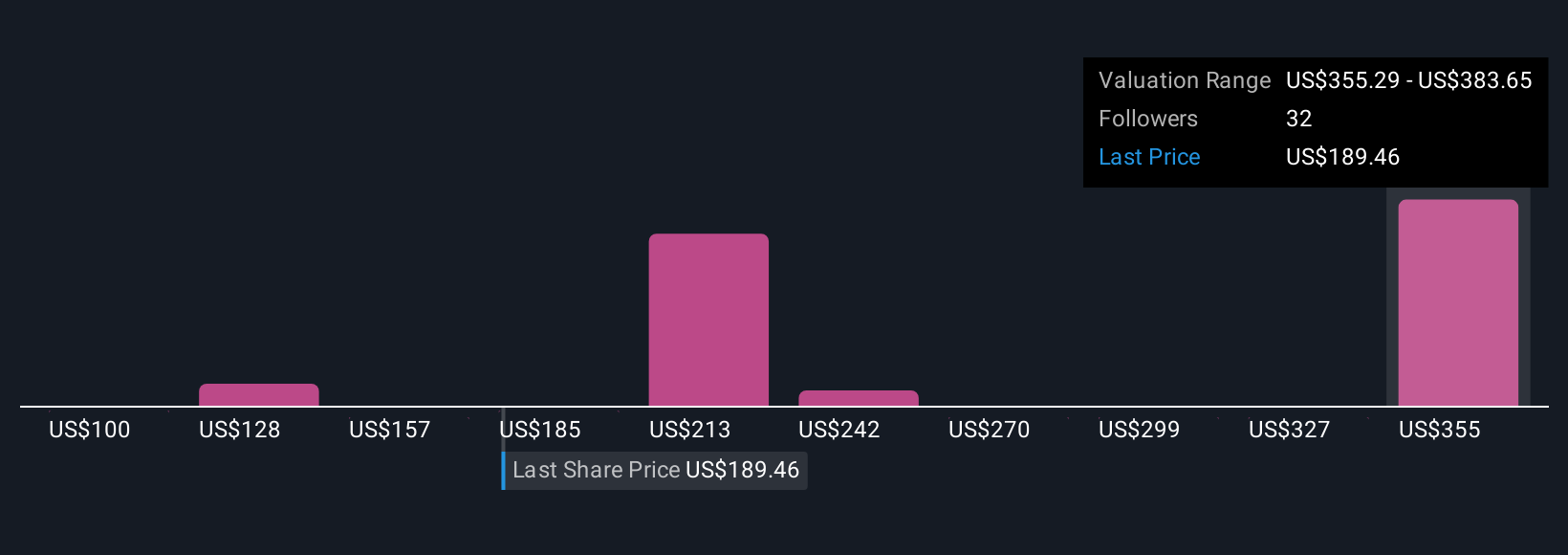

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. Narratives are your personal investing story. They connect your perspective on a company to its numbers by allowing you to set your own assumptions about future revenue, earnings, margins, and what Royal Gold should be worth.

With Narratives, you do not just look at static numbers. You link the business's story, a financial forecast, and a fair value, all tailored to how you see the company's future. On Simply Wall St's Community page, millions of investors use Narratives as an easy and accessible tool to bring more context and confidence to their decisions.

Narratives help you decide when to buy or sell by making it simple to compare your fair value with the current price, so your investment actions become more intentional and data-driven.

Because Narratives are updated dynamically as new information, news, or earnings come in, your story (and your fair value) automatically keep pace with market reality.

For example, one investor might forecast strong earnings growth, expecting Royal Gold to reach a fair value of $248.18 per share, while another, more cautious Narrative places fair value at $182.00. This illustrates how different perspectives, all grounded in transparent assumptions, can shape smarter and more personal investment decisions.

Do you think there's more to the story for Royal Gold? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:RGLD

Royal Gold

Acquires and manages precious metal streams, royalties, and related interests.

High growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success