- United States

- /

- Packaging

- /

- NasdaqGS:PTVE

Shareholders in Pactiv Evergreen (NASDAQ:PTVE) have lost 23%, as stock drops 5.3% this past week

Investors can approximate the average market return by buying an index fund. But if you buy individual stocks, you can do both better or worse than that. For example, the Pactiv Evergreen Inc. (NASDAQ:PTVE) share price is down 25% in the last year. That falls noticeably short of the market return of around 8.1%. Pactiv Evergreen hasn't been listed for long, so although we're wary of recent listings that perform poorly, it may still prove itself with time. The falls have accelerated recently, with the share price down 11% in the last three months. However, one could argue that the price has been influenced by the general market, which is down 5.9% in the same timeframe.

After losing 5.3% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

See our latest analysis for Pactiv Evergreen

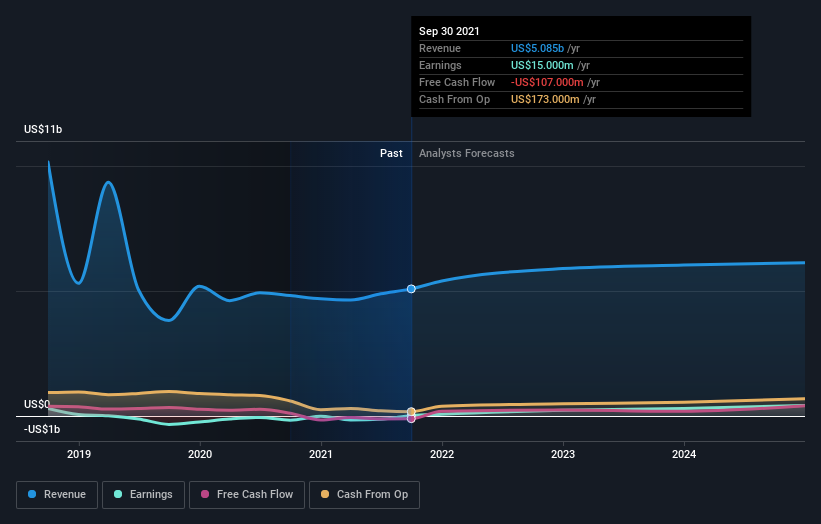

Given that Pactiv Evergreen only made minimal earnings in the last twelve months, we'll focus on revenue to gauge its business development. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. It would be hard to believe in a more profitable future without growing revenues.

In the last year Pactiv Evergreen saw its revenue grow by 5.6%. While that may seem decent it isn't great considering the company is still making a loss. Given this fairly low revenue growth (and lack of profits), it's not particularly surprising to see the stock down 25% in a year. It's important not to lose sight of the fact that profitless companies must grow. But if you buy a loss making company then you could become a loss making investor.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. If you are thinking of buying or selling Pactiv Evergreen stock, you should check out this free report showing analyst profit forecasts.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. As it happens, Pactiv Evergreen's TSR for the last 1 year was -23%, which exceeds the share price return mentioned earlier. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

Given that the market gained 8.1% in the last year, Pactiv Evergreen shareholders might be miffed that they lost 23% (even including dividends). While the aim is to do better than that, it's worth recalling that even great long-term investments sometimes underperform for a year or more. With the stock down 11% over the last three months, the market doesn't seem to believe that the company has solved all its problems. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 4 warning signs with Pactiv Evergreen (at least 1 which is potentially serious) , and understanding them should be part of your investment process.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:PTVE

Pactiv Evergreen

Manufactures and distributes fresh foodservice and food merchandising products, and fresh beverage cartons in the United States, rest of North America, and internationally.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives