- United States

- /

- Biotech

- /

- NasdaqGM:SGMT

Top Penny Stocks To Watch In April 2025

Reviewed by Simply Wall St

As the U.S. stock market experiences a surge, driven by positive earnings reports and anticipation of tariff news, investors are paying close attention to potential opportunities across various sectors. For those willing to explore beyond established giants, penny stocks—often representing smaller or newer companies—remain an intriguing option. Despite being considered somewhat outdated, these stocks can still offer significant growth potential when backed by strong financials and sound fundamentals. In this article, we highlight three penny stocks that stand out for their balance sheet strength and potential for impressive returns.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Safe Bulkers (NYSE:SB) | $3.33 | $336.55M | ✅ 4 ⚠️ 3 View Analysis > |

| Tuya (NYSE:TUYA) | $2.18 | $1.18B | ✅ 3 ⚠️ 3 View Analysis > |

| Smith Micro Software (NasdaqCM:SMSI) | $1.04 | $18.66M | ✅ 4 ⚠️ 4 View Analysis > |

| Kiora Pharmaceuticals (NasdaqCM:KPRX) | $3.12 | $9.06M | ✅ 4 ⚠️ 1 View Analysis > |

| Flexible Solutions International (NYSEAM:FSI) | $3.81 | $47.68M | ✅ 4 ⚠️ 2 View Analysis > |

| TETRA Technologies (NYSE:TTI) | $2.47 | $321.72M | ✅ 5 ⚠️ 2 View Analysis > |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.62 | $78.56M | ✅ 3 ⚠️ 1 View Analysis > |

| BAB (OTCPK:BABB) | $0.80 | $5.74M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (NasdaqGS:LCUT) | $3.71 | $82.45M | ✅ 3 ⚠️ 2 View Analysis > |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.726 | $64.59M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 766 stocks from our US Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Origin Materials (NasdaqCM:ORGN)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Origin Materials, Inc. operates as a carbon-negative materials company with a market cap of $102.24 million.

Operations: The company generates revenue from its Specialty Chemicals segment, totaling $31.28 million.

Market Cap: $102.24M

Origin Materials, Inc., with a market cap of US$102.24 million, is navigating challenges typical of penny stocks. Despite generating US$31.28 million in revenue from its Specialty Chemicals segment, the company remains unprofitable and has seen increased losses over five years. Its stock faces potential delisting from Nasdaq due to a prolonged sub-US$1 bid price, with an October 2025 deadline to regain compliance. On the positive side, Origin's short-term assets significantly exceed liabilities, and it has reduced its debt-to-equity ratio substantially over five years. Future growth is anticipated with new production lines and expected revenue increases in 2026.

- Click here and access our complete financial health analysis report to understand the dynamics of Origin Materials.

- Gain insights into Origin Materials' outlook and expected performance with our report on the company's earnings estimates.

Sagimet Biosciences (NasdaqGM:SGMT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Sagimet Biosciences Inc. is a clinical-stage biopharmaceutical company focused on developing novel therapeutics known as fatty acid synthase (FASN) inhibitors to treat diseases arising from dysfunctional metabolic pathways, with a market cap of $82.10 million.

Operations: Sagimet Biosciences Inc. has not reported any revenue segments as it is a clinical-stage biopharmaceutical company focused on developing FASN inhibitors for metabolic diseases.

Market Cap: $82.1M

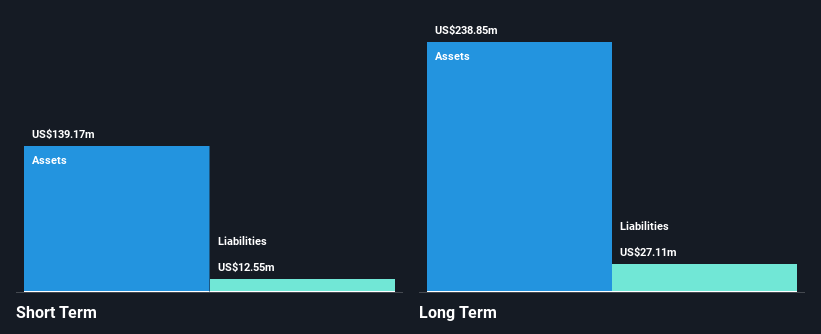

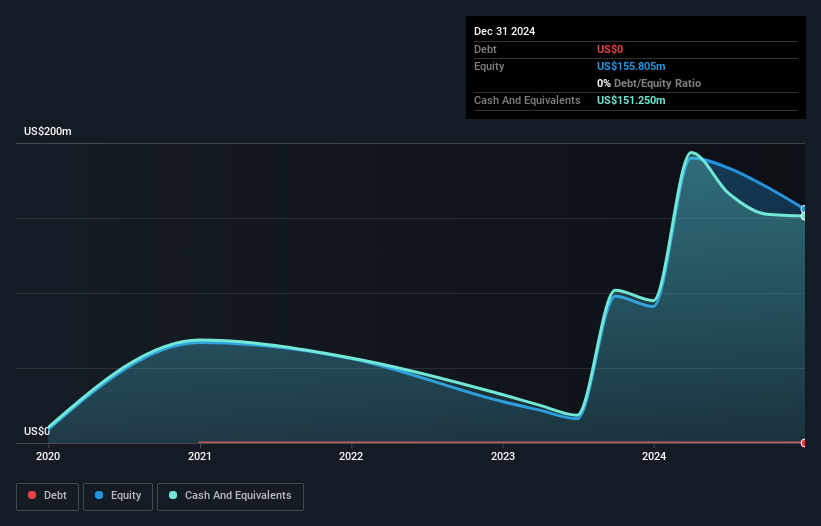

Sagimet Biosciences Inc., with a market cap of US$82.10 million, is a pre-revenue clinical-stage biopharmaceutical company focused on FASN inhibitors for metabolic diseases. Despite its unprofitability and increasing losses, Sagimet's financial position remains stable with short-term assets of US$152.8 million far exceeding liabilities and no debt over the past five years. Recent developments include FDA clearance for an Investigational New Drug application for TVB-3567, targeting acne treatment—a significant commercial opportunity if successful. However, the company's share price has been highly volatile recently, reflecting typical penny stock challenges in the biotech sector.

- Jump into the full analysis health report here for a deeper understanding of Sagimet Biosciences.

- Learn about Sagimet Biosciences' future growth trajectory here.

Protalix BioTherapeutics (NYSEAM:PLX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Protalix BioTherapeutics, Inc. is a biopharmaceutical company focused on developing, producing, and commercializing recombinant therapeutic proteins using its ProCellEx plant cell-based protein expression system, with a market cap of $205.23 million.

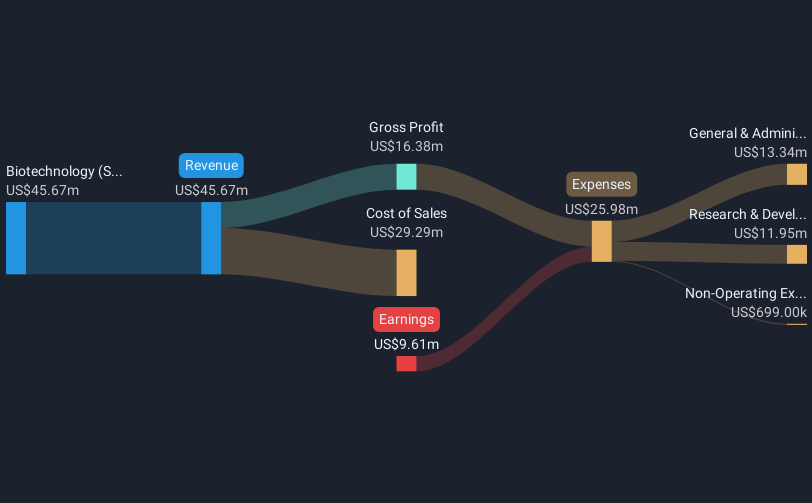

Operations: Protalix BioTherapeutics generates revenue of $53.40 million from its Biotechnology (Startups) segment.

Market Cap: $205.23M

Protalix BioTherapeutics, with a market cap of US$205.23 million, has experienced a challenging year with revenues declining to US$53.4 million from the previous year's US$65.49 million, and net income decreasing to US$2.93 million from US$8.31 million. Despite these setbacks, the company remains debt-free and maintains strong short-term assets of $60.1M against liabilities totaling $30.2M, showcasing financial stability typical for penny stocks in the biotech sector. The management team is seasoned with an average tenure exceeding five years, providing experienced leadership as they navigate industry volatility and pursue growth opportunities through their plant cell-based protein expression system.

- Navigate through the intricacies of Protalix BioTherapeutics with our comprehensive balance sheet health report here.

- Review our growth performance report to gain insights into Protalix BioTherapeutics' future.

Turning Ideas Into Actions

- Click here to access our complete index of 766 US Penny Stocks.

- Seeking Other Investments? The end of cancer? These 23 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:SGMT

Sagimet Biosciences

A clinical-stage biopharmaceutical company, develops novel therapeutics called fatty acid synthase (FASN) inhibitors for the treatment of diseases that result from dysfunctional metabolic pathways in the United States.

Flawless balance sheet slight.

Market Insights

Community Narratives