- United States

- /

- Packaging

- /

- NasdaqCM:ORBS

A Fresh Valuation Look at Eightco Holdings (ORBS) After Strategic Digital Asset Shift and Leadership Overhaul

Reviewed by Simply Wall St

You might have already heard: there’s a lot happening at Eightco Holdings (ORBS) right now, and if you’re thinking about what it means for your portfolio, you’re not alone. In just a matter of days, Eightco announced a shift in strategy that has grabbed Wall Street’s attention. The company raised major funds through a private placement and equity offering, intending to use the proceeds to acquire Worldcoin as its main treasury reserve asset. Adding to the pivot, Dan Ives, a recognizable name in technology and AI circles, was just named Chairman of the Board. This suggests the company is serious about its new direction.

This flurry of events has not gone unnoticed by the market. Eightco Holdings stock has surged more than 3,000% in response, and trading activity has skyrocketed as both retail and institutional investors react to the prospect of digital asset exposure and headline leadership. Over the past year, the stock showed more measured gains, but recent momentum has overshadowed previous market moves and redefined risk and opportunity for existing and potential shareholders. New institutional investors like BitMine Immersion Technologies coming in on the deal have only fueled speculation that this is more than a short-term spike.

With shares rocketing higher and a radically different business behind the ticker, the critical question now is whether Eightco Holdings is genuinely undervalued after this transformation, or if the market is already factoring in all of the anticipated future growth.

Price-to-Sales Ratio of 1.1x: Is it justified?

Eightco Holdings currently trades at a price-to-sales (P/S) ratio of 1.1x, which is higher than the US Packaging industry average of 0.9x. Based on this metric, the company appears somewhat expensive relative to industry peers.

The price-to-sales ratio measures how much investors are willing to pay per dollar of sales. This can be especially useful for companies that are not yet profitable. In sectors like packaging, where profit margins may be cyclical or volatile, this multiple gives investors a quick comparison point for valuation.

Because Eightco's P/S ratio exceeds the industry average, investors may be paying a premium for anticipated growth or positive developments that are not yet reflected in current revenue or earnings. However, compared to the broader peer group, it still trades at a lower multiple. This suggests there is some relative value if the business transformation pays off.

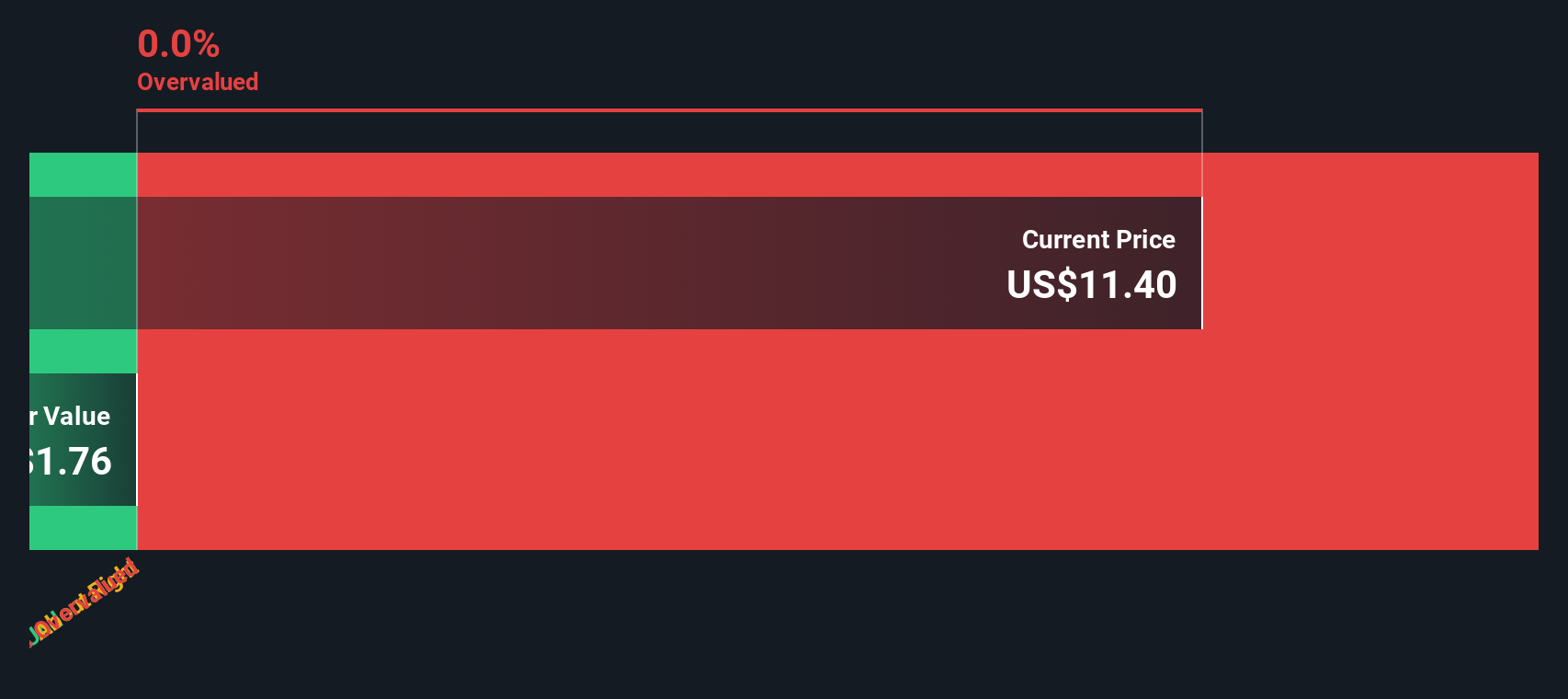

Result: Fair Value of $15.62 (OVERVALUED)

See our latest analysis for Eightco Holdings.However, ongoing losses and uncertain revenue growth could quickly challenge the bullish story if Eightco fails to deliver on its ambitious new plans.

Find out about the key risks to this Eightco Holdings narrative.Another View: What Does the SWS DCF Model Reveal?

While the price-to-sales ratio suggests Eightco shares are not cheap compared to the industry, our DCF model takes a deeper look at the company’s future cash flows. There is insufficient data for a fair value estimate, leaving the first valuation open to question. Does the lack of DCF clarity signal hidden opportunity, or more risk ahead?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Eightco Holdings Narrative

If you think the story plays out differently or want to dig into the numbers on your own, you can build your own view in just a few minutes. Do it your way.

A great starting point for your Eightco Holdings research is our analysis highlighting 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Take your investing one step further and make sure you’re not overlooking tomorrow’s up-and-comers, breakthrough technologies, or untapped opportunities. The right tools can help you spot hidden gems before the crowd does.

- Uncover overlooked opportunities in the market by checking out penny stocks with strong financials. penny stocks with strong financials can help you spot rising stars early.

- Supercharge your watchlist with AI-driven companies by exploring AI penny stocks leading advancements in artificial intelligence across industries.

- Maximize your value strategy and find stocks trading below their true worth via undervalued stocks based on cash flows for businesses that stand out for their strong cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eightco Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:ORBS

Eightco Holdings

Provides inventory management and corrugated custom packaging solutions in North America and Europe.

Low risk with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives