- United States

- /

- Chemicals

- /

- NasdaqGS:LIN

Linde (LIN) Valuation in Focus as Leadership Transition Plans Announced

Reviewed by Kshitija Bhandaru

Linde (LIN) announced that CEO Sanjiv Lamba will assume the additional role of Chairman of the Board in early 2026. Steve Angel is preparing to retire after a long tenure.

See our latest analysis for Linde.

Leadership changes at the top often create waves, but Linde’s steady approach and robust contract backlog have helped maintain confidence. While the stock has seen a modest dip of nearly 1% over the past month, its 1-year total shareholder return remains positive. This highlights resilience and long-term growth potential as momentum holds steady.

Curious about what else is gaining traction? Now is a good moment to broaden your perspective and discover fast growing stocks with high insider ownership

Despite a proven track record and steady financials, Linde’s valuation sits just below analyst targets. Is this a timely entry point for long-term investors, or has the market already factored in future growth?

Most Popular Narrative: 8% Undervalued

Linde’s most followed narrative sees more upside, with an estimated fair value of $511 compared to the last close at $469.48. The numbers suggest momentum is underpinned by strong fundamental drivers and ambitious future targets.

Linde's project backlog has doubled over the last 4 years, anchored by long-term, fixed-fee contracts supporting U.S. clean energy and electronics infrastructure. Management expects this robust pipeline to remain at record levels, positioning the company for steady multi-year revenue and earnings growth.

Want to know the growth blueprint behind this high valuation? The key element of this narrative is record-breaking earnings and a future profit multiple usually associated with tech leaders. Interested in which bold financial projections support that price target? Dive deeper to see the surprising numbers that drive this fair value calculation.

Result: Fair Value of $511 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, global economic softness and overcapacity pressures in key markets could quickly challenge growth assumptions and impact Linde’s ambitious margin outlook.

Find out about the key risks to this Linde narrative.

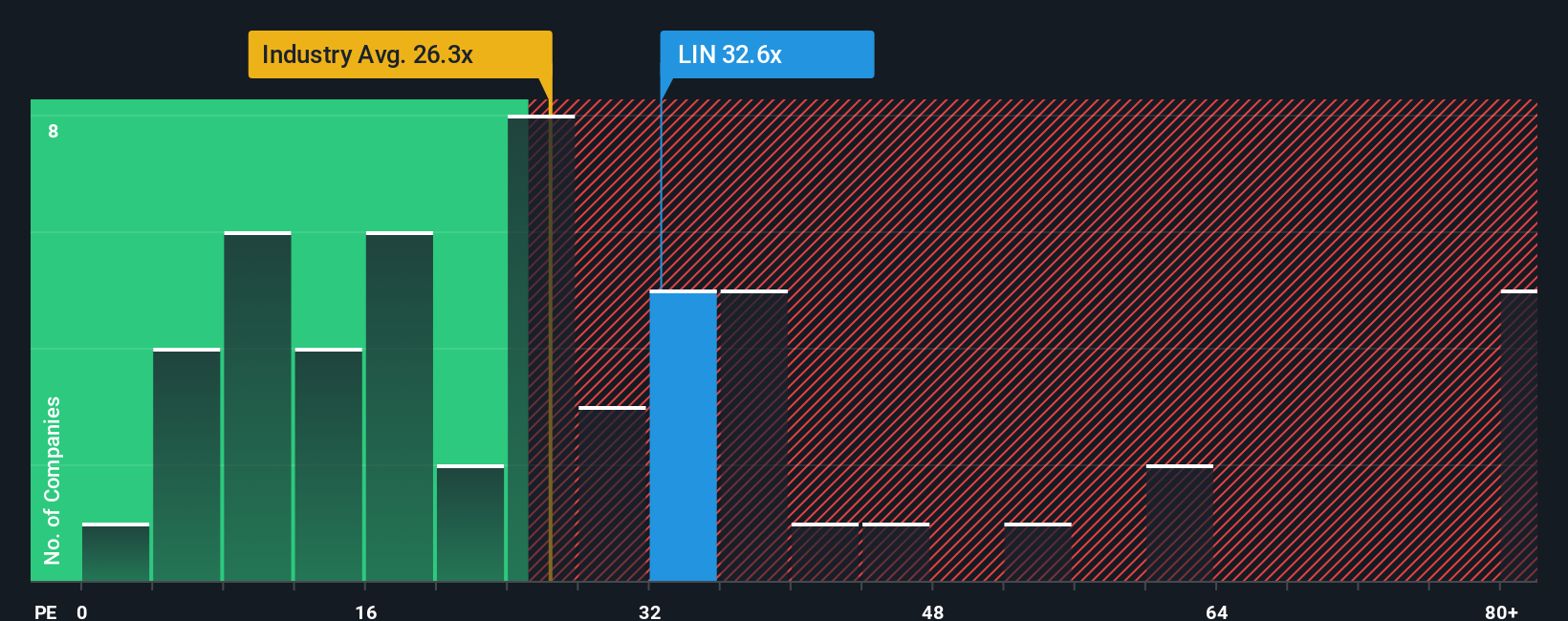

Another View: Multiples Comparison Raises Questions

While the consensus price target points to potential upside, Linde’s current price-to-earnings ratio of 32.8 is above both its industry peer average (26.7) and the estimated fair ratio of 26. In practical terms, this premium could signal limited upside and increased risk if expectations slip. Are investors paying too much for certainty?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Linde for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Linde Narrative

If you see things differently or want to do a little digging of your own, crafting a personalized take takes just a few minutes. Do it your way.

A great starting point for your Linde research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors always broaden their horizons. Don’t wait to see the next trend in your rearview mirror. Use these powerful tools now and give your portfolio an edge:

- Tap into tomorrow’s growth by tracking these 910 undervalued stocks based on cash flows that offer potential upside based on strong cash flows and favorable long-term outlooks.

- Boost your passive income by seeking out these 19 dividend stocks with yields > 3% with attractive yields above 3%, ensuring your investments work harder for you.

- Ride the innovation wave by targeting these 24 AI penny stocks tackling artificial intelligence breakthroughs that could reshape entire industries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LIN

Linde

Operates as an industrial gas company in the United States, China, Germany, the United Kingdom, Australia, Mexico, Brazil, and internationally.

Proven track record second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives