- United States

- /

- Chemicals

- /

- NasdaqGS:LIN

Linde (LIN) Expands U.S. Space Footprint With New Industrial Gas Facilities

Reviewed by Simply Wall St

Linde (LIN) recently announced a series of ambitious expansions to bolster its role in the space industry, including new agreements to supply industrial gases for rocket launches and facility expansions in Florida and Texas. These developments, part of the company's legacy in space exploration, align with positive market trends where major indices like the S&P 500 reached record highs. However, markets have recently retreated slightly amid a deluge of earnings. Linde's 3.48% price increase the past quarter reflects these expansions positively contributing amidst mixed broader market movement, accentuated by strong corporate performances countered by tariff concerns.

Be aware that Linde is showing 2 possible red flags in our investment analysis.

Linde's recent expansion into the space industry could bolster its narrative of securing future stability through strategic investments and contracts. By supplying industrial gases for rockets, Linde is poised to tap into a high-growth sector that may align with its existing strengths in clean energy and productivity improvements. These developments could enhance Linde's revenue models and operational efficiencies, potentially driving growth despite broader economic uncertainties.

Over the past five years, Linde's total shareholder return of 104.32% indicates strong performance. In contrast, recent one-year data reveals Linde outperformed the US Chemicals industry, rendering a positive outlook amidst varied market dynamics. However, the broader market returned 13.7%, a performance Linde did not match, suggesting room for improvement as the company recalibrates its strategy.

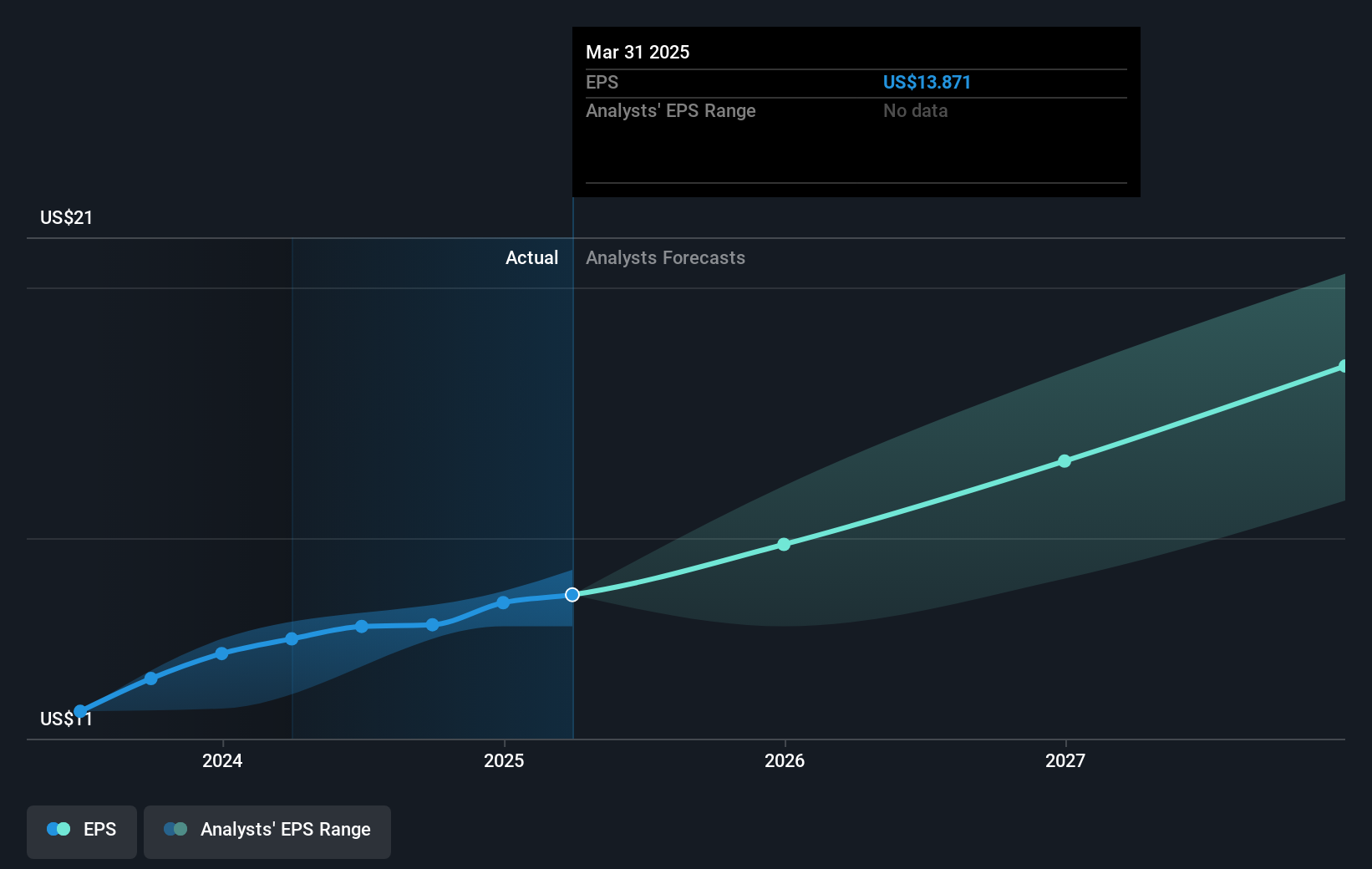

The company's efforts in the space sector and advancements in clean energy might positively impact revenue and earnings forecasts by offering new growth avenues. With current earnings at US$6.61 billion and projected to reach US$8.7 billion by May 2028, these ventures could provide added stability to the forecasts. As of today, Linde's share price of US$470.43 remains below the analyst price target of about US$497.45. This 5.74% discount suggests potential upside if the company continues on its current trajectory, although reliance on long-term contracts means strategic execution remains key.

Learn about Linde's historical performance here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LIN

Linde

Operates as an industrial gas company in the United States, China, Germany, the United Kingdom, Australia, Mexico, Brazil, and internationally.

Proven track record second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives