- United States

- /

- Chemicals

- /

- NasdaqGS:LIN

Is Cramer’s Critique and New Credit Line Altering The Investment Case For Linde (LIN)?

Reviewed by Sasha Jovanovic

- Recently, Jim Cramer criticized Linde plc’s lack of public response to its recent share price weakness, even as he reiterated that it remains a high‑quality industrial gas business serving healthcare, energy, manufacturing and other sectors.

- At the same time, Linde secured a US$1.50 billion unsecured 364‑day revolving credit facility, underscoring its focus on maintaining liquidity and financial flexibility amid heightened market scrutiny.

- Next, we’ll examine how Cramer’s public criticism of Linde’s silence during recent share weakness might influence the company’s investment narrative.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Linde Investment Narrative Recap

To own Linde, you generally need to believe that industrial gases will remain essential across healthcare, energy and manufacturing, and that the company can sustain solid profitability despite cyclical volume pressure. Recent share price weakness and Jim Cramer’s criticism appear more sentiment driven than business driven, so they do not materially change the main near term catalyst, which is industrial demand recovery, or the key risk, which is prolonged economic softness in Europe and parts of Asia.

The new US$1.50 billion unsecured 364 day revolving credit facility is the most relevant update here, because it directly addresses liquidity and financial flexibility at a time when the market is questioning the stock’s recent slide. While this facility does not change the underlying earnings drivers, it gives Linde additional room to manage through any extended period of weaker base volumes or delayed project ramp ups without being forced into less favorable funding options.

However, even for a business of Linde’s scale, investors should be aware that prolonged economic weakness in key industrial regions could...

Read the full narrative on Linde (it's free!)

Linde's narrative projects $38.9 billion revenue and $9.1 billion earnings by 2028.

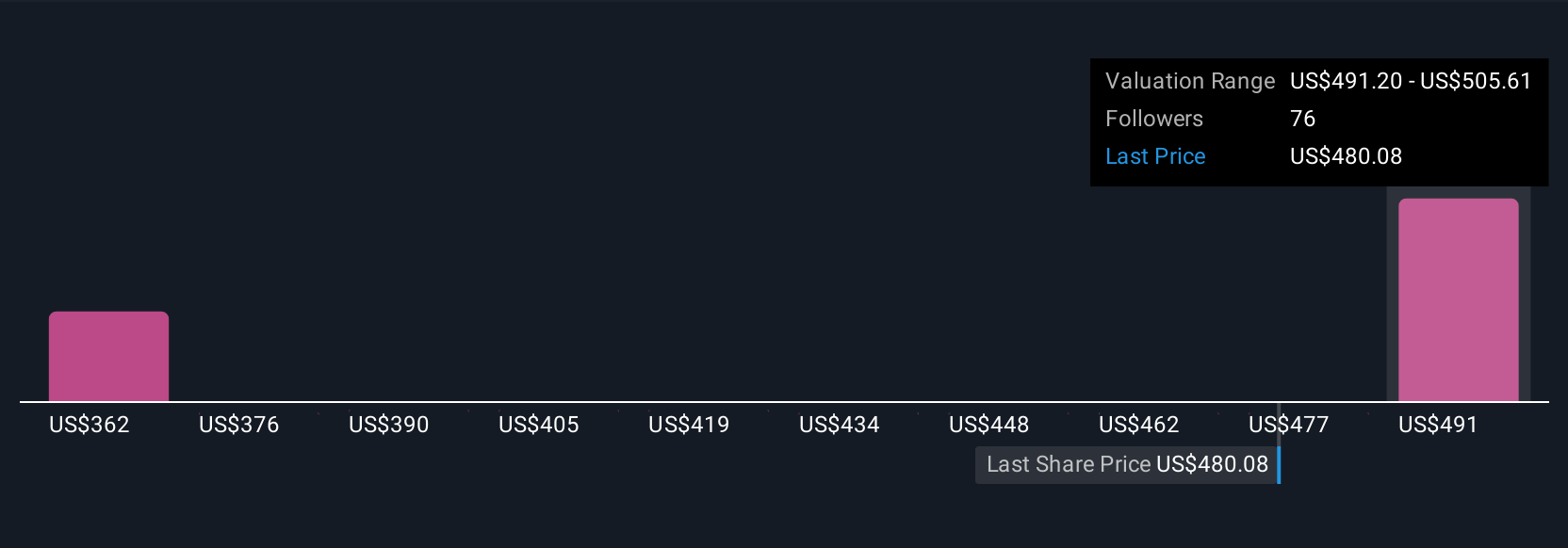

Uncover how Linde's forecasts yield a $505.61 fair value, a 27% upside to its current price.

Exploring Other Perspectives

Six fair value estimates from the Simply Wall St Community span about US$311 to just over US$506 per share, showing how far opinions can stretch. When you place that against the risk of structurally weaker industrial demand in Europe, it underlines why many investors prefer to compare several independent views before deciding how Linde fits into their portfolio.

Explore 6 other fair value estimates on Linde - why the stock might be worth as much as 27% more than the current price!

Build Your Own Linde Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Linde research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Linde research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Linde's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LIN

Linde

Operates as an industrial gas company in the United States, China, Germany, the United Kingdom, Australia, Mexico, Brazil, and internationally.

Proven track record average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Halyk Bank of Kazakhstan will see revenue grow 11% as their future PE reaches 3.2x soon

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026