- United States

- /

- Chemicals

- /

- NasdaqGS:LIN

Did a New Supply Hub Along I-75 Just Strengthen Linde’s (LIN) Growth Narrative?

Reviewed by Sasha Jovanovic

- Linde recently began supplying industrial gases from a new air separation unit to customers across key regions in eastern Tennessee, northern Alabama, and Georgia, supporting growth along the I-75 corridor.

- This facility expansion is expected to enhance Linde's operational reach and ensure more reliable service to a broadening base of end markets in the Southeastern U.S.

- We’ll consider how this expansion of Linde’s supply network may reinforce the company’s long-term growth outlook in its investment narrative.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Linde Investment Narrative Recap

At its core, the investment case for Linde rests on the company's ability to convert its global scale, project backlog, and network density into steady, long-term growth, especially through expansion in resilient U.S. markets and clean energy. Linde’s new air separation unit in the Southeast supports this outlook by strengthening supply reliability and reach, though the biggest near-term catalyst remains the upcoming Q3 results, while the primary risk continues to be persistent industrial weakness in Europe; this expansion does not materially shift either dynamic just yet.

Among recent announcements, Linde’s fresh long-term agreements to support U.S. space launches and clean hydrogen projects highlight the company’s pivot toward robust growth sectors. These deals connect directly to the broader catalyst of securing high-margin, multi-year contracts that could balance out headwinds from older, cyclical end markets and reinforce the margin story investors are watching.

On the other hand, a prolonged slowdown in European industry could still challenge returns if base volumes remain weak there, so investors should…

Read the full narrative on Linde (it's free!)

Linde's outlook projects $38.9 billion in revenue and $9.1 billion in earnings by 2028. This assumes a 5.4% annual revenue growth rate and a $2.4 billion increase in earnings from the current $6.7 billion.

Uncover how Linde's forecasts yield a $511.00 fair value, a 15% upside to its current price.

Exploring Other Perspectives

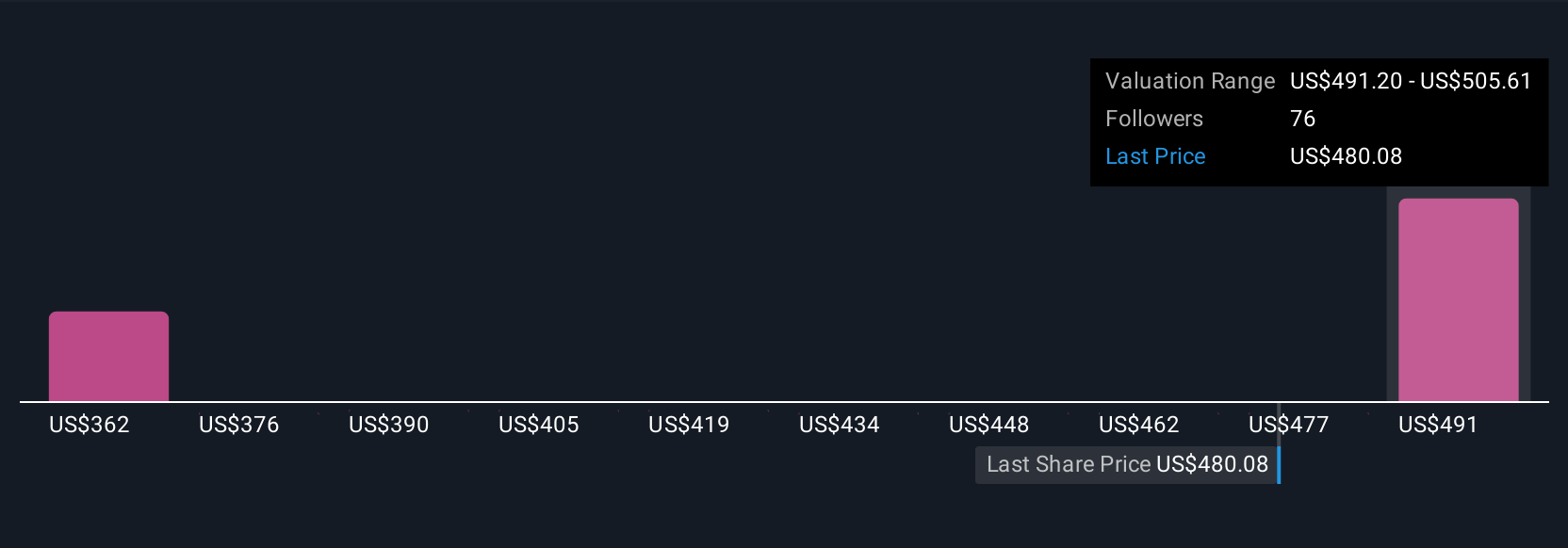

Five fair value estimates from the Simply Wall St Community range widely from US$353.86 to US$511 per share. This reflects diverse market views at a time when Linde’s new U.S. facility underpins longer-term optimism but persistent European economic risk is still top of mind, check out alternative analyses to see what others expect for the future.

Explore 5 other fair value estimates on Linde - why the stock might be worth as much as 15% more than the current price!

Build Your Own Linde Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Linde research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Linde research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Linde's overall financial health at a glance.

Curious About Other Options?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LIN

Linde

Operates as an industrial gas company in the United States, China, Germany, the United Kingdom, Australia, Mexico, Brazil, and internationally.

Proven track record second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives