- United States

- /

- Metals and Mining

- /

- NasdaqGS:KALU

Kaiser Aluminum (KALU): Evaluating Current Valuation Following Strong Q3 Earnings Growth

Reviewed by Simply Wall St

Kaiser Aluminum (KALU) released its third quarter results, showing a solid jump in both sales and net income compared to last year. This marks a meaningful improvement and is catching the attention of investors weighing the stock.

See our latest analysis for Kaiser Aluminum.

After a year marked by steady improvement, Kaiser Aluminum’s share price has gained 10.85% since January and its total shareholder return over the past twelve months stands at an impressive 20.41%. Positive earnings momentum, a recently extended $575 million credit facility, and another quarterly dividend highlight management’s confidence. These factors are contributing to growing investor optimism despite occasional pullbacks.

If strong financials like these have you curious about what else is out there, it might be the perfect moment to discover fast growing stocks with high insider ownership

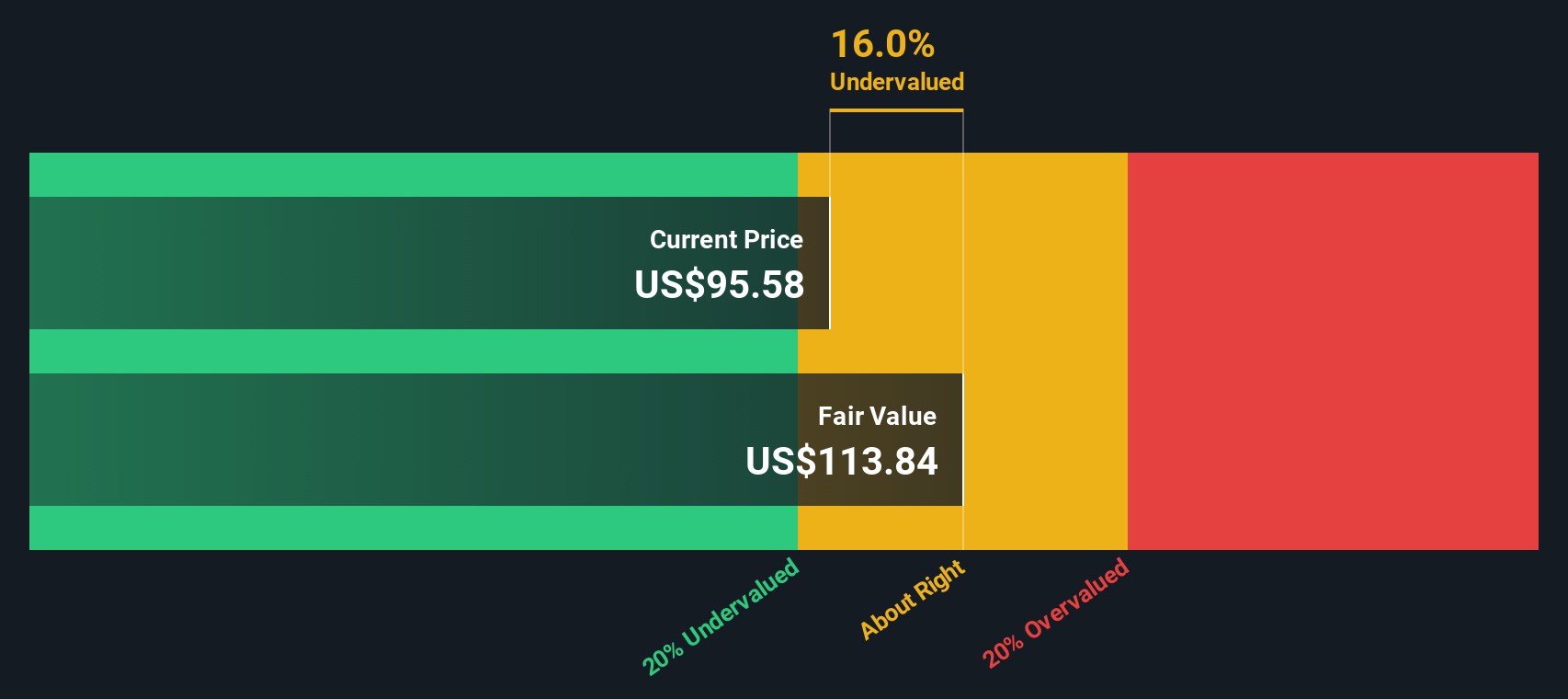

With the share price hovering just below analyst targets and impressive earnings growth fueling optimism, investors must now ask whether Kaiser Aluminum is still trading at a discount or if the market has already priced in its future potential.

Price-to-Earnings of 22.9x: Is it justified?

Kaiser Aluminum's stock trades at a price-to-earnings (P/E) ratio of 22.9x, which is lower than both its peer average of 28.7x and the broader US Metals and Mining industry average of 25.5x. This suggests that, at the last close of $77.90, the market is assigning a discount to KALU's earnings compared to industry benchmarks.

The P/E ratio is a common metric used by investors to determine how much they are paying for each dollar of earnings. For a company like Kaiser Aluminum, which has demonstrated recent earnings and revenue growth, the market appears to be underpricing its profit potential relative to peers.

Additionally, Kaiser Aluminum’s P/E is currently below our estimate of its fair price-to-earnings ratio of 25.6x. This may indicate further upside if sentiment improves or if earnings continue to beat expectations. The market could shift toward this level if current trends persist.

Explore the SWS fair ratio for Kaiser Aluminum

Result: Price-to-Earnings of 22.9x (UNDERVALUED)

However, sluggish short-term returns and recent market pullbacks could signal caution if industry headwinds or slowing growth emerge in the coming quarters.

Find out about the key risks to this Kaiser Aluminum narrative.

Another View: Discounted Cash Flow Perspective

While the price-to-earnings ratio portrays Kaiser Aluminum as attractively valued compared to peers and industry, our DCF model suggests an even larger disconnect. Currently, shares trade 37.4% below our estimated fair value based on cash flow projections, indicating significant undervaluation. This raises the question of whether there is overlooked upside, or if the market’s caution is justified.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Kaiser Aluminum for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Kaiser Aluminum Narrative

Keep in mind, if you have a different perspective or prefer your own approach, you can dive into the numbers and craft your own narrative in just a few minutes with Do it your way.

A great starting point for your Kaiser Aluminum research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Uncover opportunities most investors overlook by searching for stocks handpicked for strong growth, future trends, and stable dividend payouts, all in a few clicks.

- Start building wealth by tapping into stable cash returns. Check out these 17 dividend stocks with yields > 3% with yields over 3%.

- Get ahead of the curve on machine learning and robotics by relying on these 26 AI penny stocks shaping tomorrow’s innovations.

- Find overlooked value by reviewing these 871 undervalued stocks based on cash flows based on their true cash flow potential right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kaiser Aluminum might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:KALU

Kaiser Aluminum

Manufactures and sells semi-fabricated specialty aluminum mill products.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives