- United States

- /

- Metals and Mining

- /

- NasdaqGS:KALU

Is Dividend Sustainability Uncertainty Shaping the Investment Case for Kaiser Aluminum (KALU)?

Reviewed by Simply Wall St

- Kaiser Aluminum Corporation's Board of Directors has declared a quarterly cash dividend of US$0.77 per share, payable on August 15, 2025 to shareholders of record as of July 25, 2025.

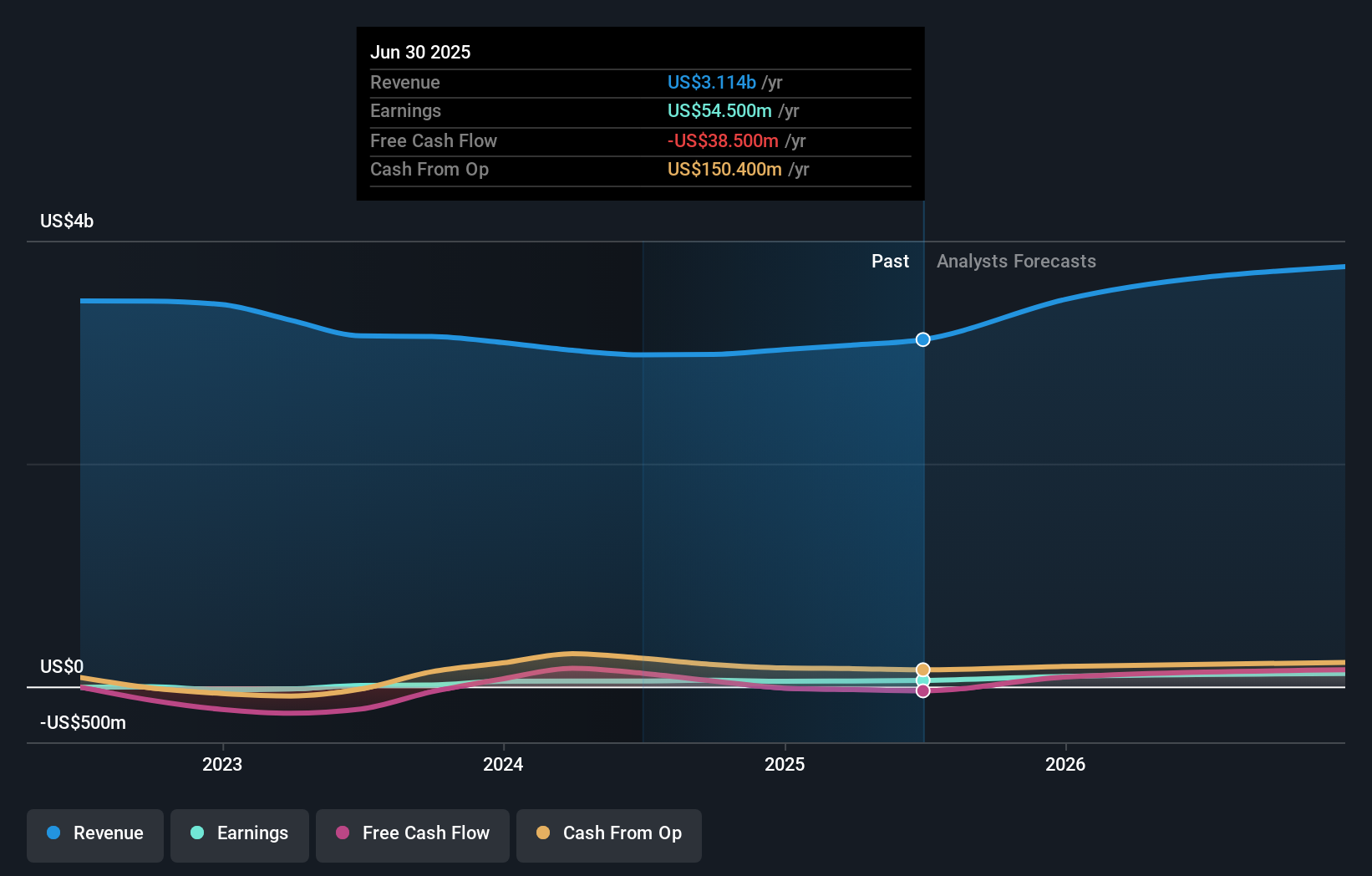

- While the company has a history of dividend increases, current earnings per share trends and payout ratios suggest mounting pressure on the sustainability of future payments.

- We'll explore how uncertainty about Kaiser Aluminum's ability to cover its high dividend payout shapes its investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is Kaiser Aluminum's Investment Narrative?

To be a shareholder in Kaiser Aluminum right now, you need conviction in both the company's ability to manage through industry cycles and its capacity to restore stronger profit margins as revenue recovers. The recent dividend announcement keeps Kaiser’s history of consistent payments visible, but the sustainability of these dividends is coming under question as the payout ratio edges above 100%. Short term, this move is more reassuring than disruptive: it signals confidence from management, and recent price strength reflects a positive reaction. Still, the most important catalysts remain stabilization of end-market demand and protecting margins against rising costs, while the biggest risks are earnings pressure and the potential for dividend cuts if profits lag. The news does heighten awareness around those risks, but for now it’s not a material change to near-term outlook or thesis, unless profit improvement stalls. Yet beneath the recent rally, dividend coverage risk remains an issue investors should not overlook.

Kaiser Aluminum's shares have been on the rise but are still potentially undervalued by 46%. Find out what it's worth.Exploring Other Perspectives

Build Your Own Kaiser Aluminum Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kaiser Aluminum research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Kaiser Aluminum research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kaiser Aluminum's overall financial health at a glance.

No Opportunity In Kaiser Aluminum?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Outshine the giants: these 19 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kaiser Aluminum might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:KALU

Kaiser Aluminum

Manufactures and sells semi-fabricated specialty aluminum mill products.

Proven track record and fair value.

Similar Companies

Market Insights

Community Narratives