- United States

- /

- Metals and Mining

- /

- NasdaqGS:FRD

There's Reason For Concern Over Friedman Industries, Incorporated's (NASDAQ:FRD) Massive 46% Price Jump

Friedman Industries, Incorporated (NASDAQ:FRD) shares have had a really impressive month, gaining 46% after a shaky period beforehand. Looking back a bit further, it's encouraging to see the stock is up 47% in the last year.

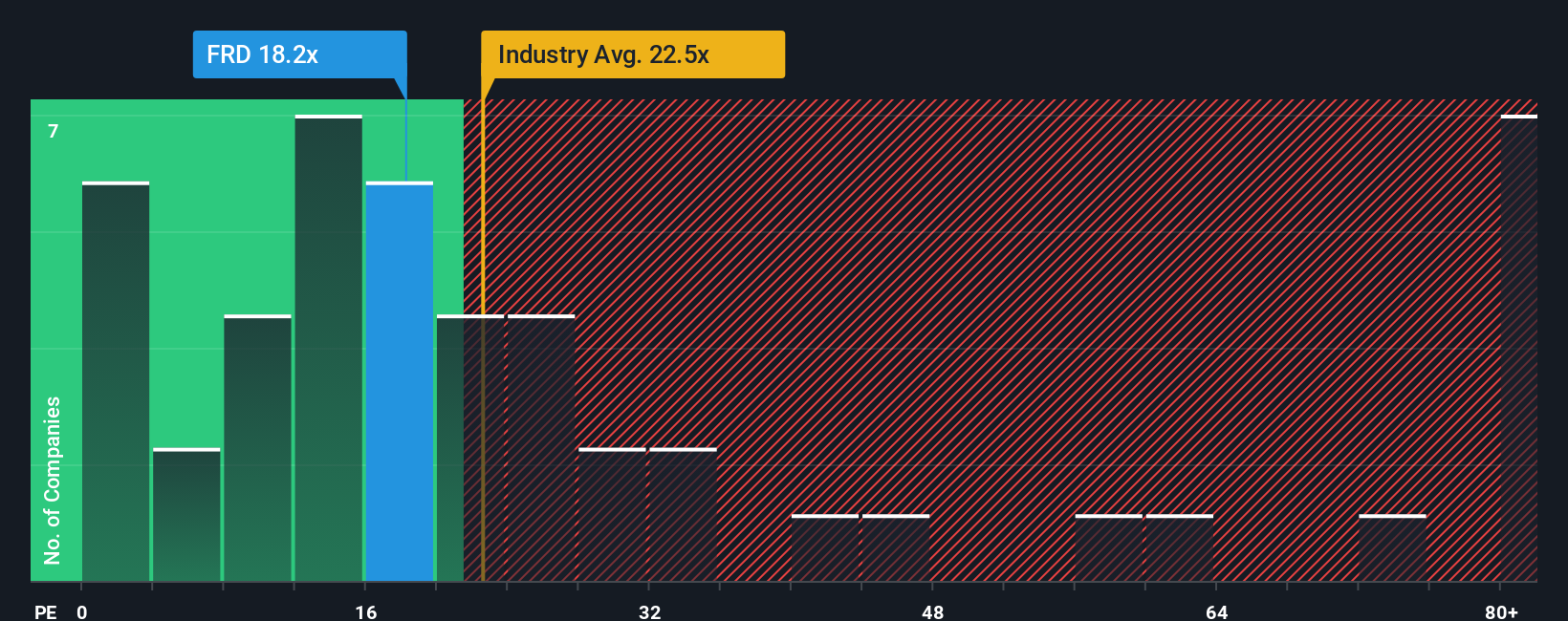

In spite of the firm bounce in price, there still wouldn't be many who think Friedman Industries' price-to-earnings (or "P/E") ratio of 18.2x is worth a mention when the median P/E in the United States is similar at about 19x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

For instance, Friedman Industries' receding earnings in recent times would have to be some food for thought. One possibility is that the P/E is moderate because investors think the company might still do enough to be in line with the broader market in the near future. If not, then existing shareholders may be a little nervous about the viability of the share price.

View our latest analysis for Friedman Industries

What Are Growth Metrics Telling Us About The P/E?

The only time you'd be comfortable seeing a P/E like Friedman Industries' is when the company's growth is tracking the market closely.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 29%. As a result, earnings from three years ago have also fallen 41% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Weighing that medium-term earnings trajectory against the broader market's one-year forecast for expansion of 15% shows it's an unpleasant look.

In light of this, it's somewhat alarming that Friedman Industries' P/E sits in line with the majority of other companies. Apparently many investors in the company are way less bearish than recent times would indicate and aren't willing to let go of their stock right now. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh on the share price eventually.

The Final Word

Friedman Industries' stock has a lot of momentum behind it lately, which has brought its P/E level with the market. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Friedman Industries currently trades on a higher than expected P/E since its recent earnings have been in decline over the medium-term. When we see earnings heading backwards and underperforming the market forecasts, we suspect the share price is at risk of declining, sending the moderate P/E lower. Unless the recent medium-term conditions improve, it's challenging to accept these prices as being reasonable.

Many other vital risk factors can be found on the company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Friedman Industries with six simple checks.

If these risks are making you reconsider your opinion on Friedman Industries, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:FRD

Friedman Industries

Engages in the manufacture and processing of steel products in the United States.

Solid track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives